Have you been getting business credit denials? Or wonder what might cause a company to get denied?

Understanding the reason for business credit denials, may not be as simple as it is for personal credit. For one thing, there’s more information to verify for companies than for individuals. While this isn’t an exhaustive list, the following are common reasons one may be denied business credit…

10 Surprising Things That Can Cause Business Credit Denials:

1. Banks Can’t Verify Your Business Name

If you’re a sole proprietor applying for a business credit card, you can apply using your legal name (not recommended). But if you’re an LLC, corporation, or partnership, you’ll need to put your legal business name on the application.

The credit card issuer will verify this information with your state government.

As well as, f the business name on your application doesn’t match the name registered with the state, this could be a reason for business credit denials and the bank isn’t likely to approve your application.

*Mis-matched data is a MAJOR reason for business credit denials. If you’ve been having issues – check Lexis Nexis, ChexSystems and Innovis too. ALL information should be IDENTICAL across the board. Any differences like email address, address, phone number and business name can affect approvals.

2. Your Business Isn’t In Good Standing With the State Government

Most lenders require a business to be registered with the Secretary of State and some also require a Certificate of Good Standing as proof. This applies if you’ve registered a corporation, an LLC, or a partnership. This also means that your company’s paperwork is up-to-date and that you’ve paid all yearly renewal fees. Businesses that don’t aren’t in compliance with state regulations will experience business credit denials.

3. You Don’t Have an Employee Identification Number (EIN)

If you’re a corporation, LLC, or partnership, you are required to provide an EIN.

What Is an EIN?

An EIN is a unique number the Internal Revenue Service assigns to businesses in the United States for tax reporting purposes. This number also indicates that you’re a legit business owner. If you don’t provide an EIN on the credit card application, the bank can’t verify your business and may reject your application.

Why Sole Proprietorships Aren’t Recommended for Business Credit…

A corporation is a unique legal entity separate from the owner. Meaning it can establish it’s own credit profile and therefore will be able to secure credit in it’s own right. Plus, your personal credit score will be insulated from the actions of your company. Which wouldn’t be the case as a sole proprietorship.

4. The Bank Can’t Verify Your Business Phone Number

Business credit card applications also ask for a business phone number. This information also allows the issuing bank to get in contact with you. A non-listed telephone number, or having a different number attached to the business can hurt your approval chances and can lead to business credit denials. If you haven’t already, list your phone number with telephone directories, and make sure the number is accurate.

5. Your Business Doesn’t Have a Commercial Address

Home addresses used to be a HUGE No-No when applying for business credit but in this post-COVID area things are a bit different now… While you can apply and get approved with a home address (P.O. Boxes and virtual mailboxes are never allowed), having a separate business address is still the more favorable way to go typically leading to more approvals and higher credit limits since they’re seen as larger companies.

*We share a few more affordable options inside the Corporate Credit Secrets program. On the other hand, using a P.O. box, mail service address or virtual mailbox will lead to business credit denials.

6. You Haven’t Been in Business Long Enough

There are no hard or fast rules regarding how long you have to be in business to qualify for business credit (each lender & offer is different). Always be sure to check the requirements in fine print of the offer before applying. Otherwise, applying for an offer that you don’t meet the requirements for can cause business credit denials.

7. You Don’t Have a Business Credit

If you don’t have a business credit profile, you also might get rejected. However, you can establish a credit file through Dun and Bradstreet and business credit bureaus like Experian Business and Equifax Business.

To create a D&B profile, you’ll first need to register your business with Dun and Bradstreet and then request a D-U-N-S number. This serves as a Social Security number for your business. To build business credit with the bureaus, contact Experian and Equifax to set up a business profile. If you have an existing profile, make sure your information is accurate before applying for a credit offer.

8. You Have a Thin Credit Profile

This might be the case if you’re new to the credit world, and haven’t had enough time to build a strong credit score. At this point, banks can’t gauge your creditworthiness. So, you’ll have to build up your credit report before applying to certain credit offers.

*We’ve designed Corporate Credit Secrets to be startup-friendly so even if your business is brand new with no previous credit, we’ve got offers you can apply for right away.

9. You Have a Low Credit Score

Or maybe the problem isn’t lack of credit history, but rather a less-than-perfect credit score. Factors that decrease credit scores include paying bills late, applying for too much credit in a short span of time, and having high credit utilization. When applying for a business credit, banks don’t only check your business credit profile, many applications also ask for your Social Security number. This also gives them authorization to check your personal credit, too.

If your business and/or personal credit score is too low and doesn’t meet the bank’s minimum requirement, you’re likely to get denied.

10. You Didn’t Complete the Application or Provide Details

Leaving out pertinent details can also cause a rejection, so make sure you complete the application. Sometimes the bank will ask for further documentation such as revenue or bank statements, P&L sheets, etc. If you don’t include an entity status, or provide more information, the bank may deny your application.

Want step-by-step instructions so you can do all of this and more?

If you’ve been getting denied business credit – STOP THE VICIOUS CYCLE –

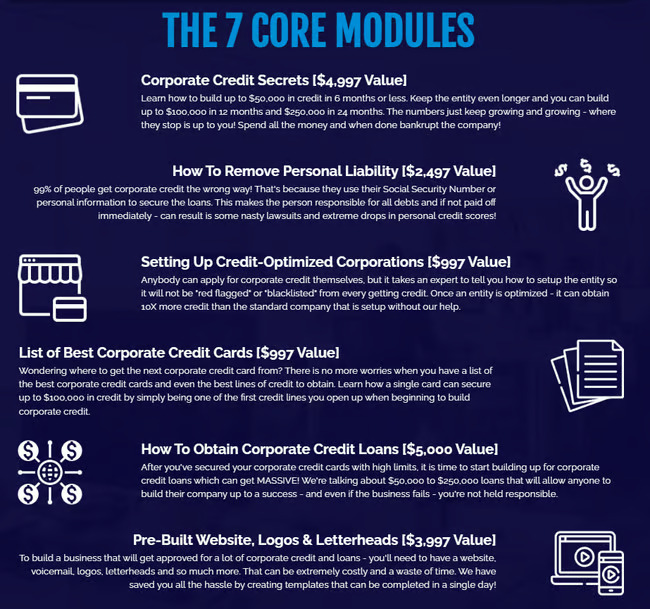

We can help… Join the Corporate Credit Secrets program

NO MORE TRIAL & ERROR! We’ve designed this program to help you understand what lenders are looking for and show you how to establish a business credit profile that makes it easy to get approved for credit quickly.

Learn More About Corporate Credit Secrets

Still not sure if corporate credit is worth your time? Don’t miss our post tomorrow where we share how 3 business owners secured $100K+ in credit!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.