Looking for ways to reduce income tax this year?

We know taxes suck – and if you haven’t learned how to remove your income tax liability yet (or still owe taxes from last year) you’re probably looking for the best ways to keep those taxes as LOW AS POSSIBLE this year.

We’re here to help!

Today we’re going to give you 20 tax deductions you may be eligible to claim…

1. Child Tax Credit

The child tax credit (CTC) will reset to at $2,000 per child in 2022 and 2023. Families must have at least $3,000 in earned income to claim any portion of the credit and can receive a refund worth 15 percent of earnings above $3,000, up to $1,500 per child.

Additional Child Tax Credit (ACTC) – If the amount of your Child Tax Credit is greater than the amount of income tax you owe, you may be able to claim the Additional Child Tax Credit (ACTC). The ACTC is equal to the lesser of the un-allowed Child Tax Credit, or 15% of your earned income that is more than $3,000.

Eligible dependents include:

- Child

- Stepchild

- Foster child

- Sibling

- Step-sibling

- Half-sibling

- Grandchild

- Niece/nephew

- Adopted child

The IRS has already announced that it will have to hold/delay refund payments for people claiming the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) due to additional anti-fraud safeguards/reviews under newly enacted laws (PATH Act).

2. Reinvested Dividends

This isn’t really a tax deduction, but it is a subtraction that can save you a lot of money. And it’s one that many taxpayers miss. If, like most investors, you have mutual fund and stock dividends automatically reinvested in extra shares, remember that each reinvestment increases your “tax basis” in the stock or mutual fund. That, in turn, reduces the amount of taxable capital gain (or increases the tax-saving loss) when you sell your shares.

Forgetting to include the reinvested dividends in your cost basis—which you subtract from the proceeds of sale to determine your gain—means also overpaying your taxes. TurboTax Premier and Home & Business tax preparation solutions include a tool—Cost Basis Lookup—that will figure your basis for you and make sure you get credit for all your reinvested dividends.

3. Earned Income Tax Credit

The earned income tax credit reduces the amount of taxes owed for low- to moderate-income workers and also families. The IRS typically notifies households that might qualify for EITC, but if you aren’t contacted by the time you sit down to do your taxes, you can check eligibility with the EITC Assistant.

4. Lifetime Learning Credit

The lifetime learning credit, or LLC, applies to higher education candidates. To claim it, you, your spouse or also a dependent must be footing the bill for qualifying higher education costs.

Like many tax credits and also deductions, the Lifetime Learning credit phases out for higher-income taxpayers. As of 2022, the LLTC phases out between $80,000 and $90,000 of modified adjusted gross income for single taxpayers. With an MAGI of $90,000 or higher, you can’t claim any credit as a single taxpayer.

5. American Opportunity Tax Credit

The American opportunity tax credit, or AOTC, is exclusively for first-time college students for their first four years of college or other higher education, which makes it different from the LLC (above). If you’re pursuing a degree and haven’t had a felony drug conviction, you could qualify if you meet income thresholds.

The American Opportunity Tax Credit is also a tax credit to help pay for education expenses paid for the first four years of education completed after high school. You can also get a maximum annual credit of $2,500 per eligible student and 40% or $1,000 could be refunded if you owe no tax.

6. Child and Dependent Care Credit

If you care for a child or another dependent in your household, you may be able to receive up to $3,000 of qualifying expenses (for a maximum credit of $1,050) for one child or dependent, or. up to $6,000 of qualifying (for a maximum credit of $2,100) for two or more children or dependents.

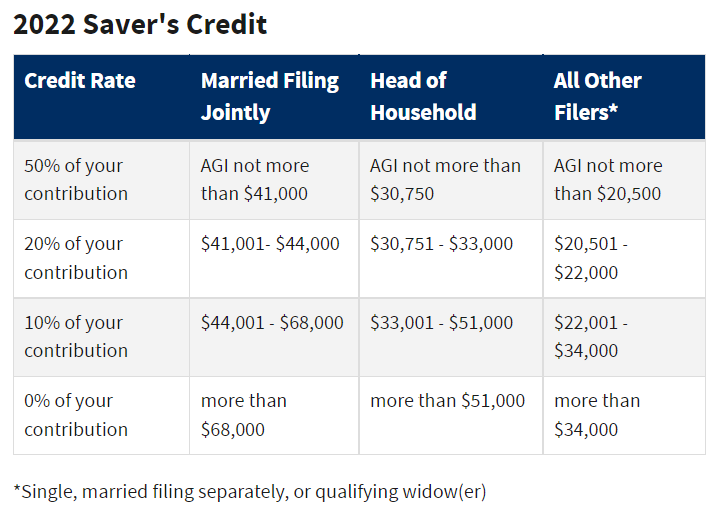

7. Saver’s Credit

If you make contributions to an individual retirement account or employer-sponsored retirement plan, such as a 401(k), you may qualify for the saver’s credit. You must be at least 18 years of age, you can’t be a full-time student and no one else can claim you as a dependent on their tax return. The amount of the credit depends on your AGI, but can be between 50%, 20% or 10% (the maximum you could receive is $1,000 if filing alone or $2,000 if filing jointly).

8. Adoption Tax Credit

There are also benefits available for expenses related to adoption. The adoption tax credit covers adoption fees, court costs, attorney fees, traveling expenses and other expenses that are directly related to adoption.

For adoptions finalized in 2022, there is also a federal adoption tax credit of up to $14,890 per child. The 2022 adoption tax credit is NOT refundable, which means taxpayers can only use the credit if they have federal income tax liability.

9. Medical and Dental Expenses

Even with insurance, you might have to pay for medical expenses out of pocket. You can deduct these expenses for you, your spouse or any of your dependents, as long as the total amount exceeds 7.5% of your AGI.

Possible expenses include:

- Fees to doctors, dentists, specialists, mental health professionals and even nontraditional medical practitioners

- Hospital care, residential nursing home care and acupuncture treatments.

- Treatment for alcohol, drug addiction, smoking-cessation programs and prescription drugs for nicotine withdrawal and related addiction needs.

- Payments for insulin, eyeglasses, contact lenses, hearing aids, crutches, wheelchairs, guide dogs and other service animals

- Funeral expenses, over-the-counter medications and most cosmetic surgery can’t be deducted.

10. Residential Energy Credit

For the energy-efficient homeowner, you could also claim a residential energy credit. You can claim a tax credit for 10% of the cost of “qualified energy efficiency improvements” and 100% of “residential energy property costs”.

This credit is worth a maximum of $500 for all years combined, from 2006 to its expiration. Of that combined $500 limit…

- A maximum of $200 can be for windows.

- The maximum tax credit for a furnace circulating fan is $50.

- The maximum credit for a furnace or boiler is $150.

- The maximum credit for any other single residential energy property cost is $300.

The credit includes:

- Energy-efficient windows and doors

- Roofs

- Insulation

- Energy-efficient heating and AC systems

- Water heaters

- Biomass stoves

- Qualifying solar electric property and solar water heaters

11. Student Loan Interest Deduction

Student loan interest is interest you (or your spouse) paid during the year on a qualified student loan. It includes both required and voluntarily pre-paid interest payments. You may deduct the amount of interest you actually paid during the year or up to $2,500 (whichever is less).

12. Health Savings Account Contribution

If you also have a health savings account, contributions made to your HSA are not subject to federal income tax. You can also claim a tax deduction for making contributions to your HSA.

Contribution limits vary by your high-deductible health plan, your age and the date you become eligible. Consumers can also contribute up to the annual maximum amount as determined by the IRS. Maximum contribution amounts for 2022 are $3,650 for self-only and $7,300 for families. The annual “catch-up” contribution amount for individuals age 55 or older will remain $1,000.

13. Charitable Contribution Deductions

Charitable contributions are one of the most common ways to get a tax deduction. You can deduct contributions of money or property you donated to qualified organizations, but you’ll need to itemize your deductions.

In most cases, you can deduct up to 100% of your AGI, but there are some cases where you might be limited to 20% or 30%.

14. Self-Employment Tax Deduction

Self-employment tax is also not the same as income tax… Self-employment tax refers to the Medicare and Social Security taxes for self-employed people. This includes freelancers, independent contractors, and small-business owners.

In 2022, the first $147,000 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, Social Security tax, or railroad retirement (tier 1) tax.The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings.

Employers and also employees share the self-employment tax. Each pays 7.65%. People who are fully self-employed pay both parts themselves. An additional 0.9% Medicare tax rate applies if income is above a certain threshold amount.

So, if you have $100,000 in self-employment income and your spouse has $160,000 in employee wages, you’ll have to pay the additional Medicare tax of 0.9% on the $10,000 by which your joint income exceeds the $250,000 threshold.

Paying extra taxes to be your own boss is no fun. The good news is that the self-employment tax will cost you less than you might think because you get to deduct half of your self-employment tax from your net income when calculating your income tax. The Internal Revenue Service (IRS) treats the employer portion of the self-employment tax as a business expense and allows you to deduct it accordingly.

It is important to note that the self-employment tax refers to Social Security and Medicare taxes, similar to Federal Insurance Contributions Act (FICA) tax paid by an employer. When a taxpayer takes a deduction of one-half of the self-employment tax, it is only a deduction for the calculation of that taxpayer’s income tax. It does not reduce the net earnings from self-employment or reduce the self-employment tax itself.

Remember, you’re paying the first 7.65% whether you are self-employed or work for someone else. And when you work for someone else, you’re indirectly paying the employer portion because that’s money that your employer can’t afford to add to your salary.

15. Common Business Deductions

Other common business deductions include: Internet, phone, home office, business insurance, rent, health insurance premiums, meals, business travel, vehicle use for business purposes, interest on business loans, startup costs (you can deduct up to $5,000 in business startup costs in the first year of active trade or business), advertising costs, retirement plan contributions, education, specialized magazines, journals, and also books directly related to your business are tax deductible as supplies and materials.

Office supplies, credit card processing fees, tax preparation fees, and repairs and maintenance for business property and equipment are also deductible. There are more deductions available than those listed here, but these are some of the biggest ones.

16. State Tax You Paid Last Spring

Did you owe taxes when you filed your 2021 state tax return in 2022? Then remember to include that amount with your state tax itemized deduction on your 2022 return, along with state income taxes withheld from your paychecks or paid via quarterly estimated payments.

17. State Sales Taxes

This write-off makes sense primarily for those who live in states that do not impose an income tax – Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. You also must choose between deducting state and local income taxes or state and local sales taxes. For most citizens of income-taxing-states, the state and local income tax deduction is usually the better deal.

18. Health Insurance Premiums

Medical expenses can also blow any budget, and the IRS is sympathetic to the cost of insurance premiums—at least in some cases. Deductible medical expenses have to exceed 7.5% of your adjusted gross income (AGI) to be claimed as an itemized deduction for 2022. However, if you’re self-employed and responsible for your own health insurance coverage, you might be able to deduct 100% of your premium cost. That also gets taken off your adjusted gross income rather than as an itemized deduction.

19. Jury Pay Paid to Employer

Some employers continue to pay employees’ full salary while they are doing their civic duty, but ask that they turn over their jury fees to the company. Also, the only problem is that you have to report those fees as taxable income. If you give the money to your employer you can deduct the amount so you aren’t taxed on money that simply passes through your hands.

20. Refinancing Mortgage Points

When you buy a house, you often get to deduct points paid to obtain your mortgage all at one time. When you refinance a mortgage, however, you have to deduct the points over the life of the new loan. That means you can deduct 1/30th of the points a year if it’s a 30-year mortgage—that’s $33 a year for each $1,000 of points you paid. Doesn’t seem like much, but why throw it away?

Also, in the year you pay off the loan—because you sell the house or refinance again—you get to deduct all the points not yet deducted, unless you refinance with the same lender.

Remember, anytime you’re also not sure whether a cost is a legitimate business expense, ask yourself, “Is this an ordinary and necessary expense in my line of work?”

This is the same question that the IRS will ask when examining your deductions if you are ever audited. If the answer is ‘no’, then don’t take the deduction.

You could also spend time finding a dozen ways to reduce income tax…

OR also learn to legally remove your tax liability…

The unfortunate thing is – even with all these deductions, you may find that you STILL owe money…

While the IRS laughs straight to the bank – don’t you wish there was an easy way to LEGALLY remove your income tax liability?

There is!

Let us show you the little-known redemption method that allows one to by-pass income tax liability LEGALLY.

This is what Elite Tax Secrets is all about!

This is NOT about withholding taxes, Social Security taxes or Medicare taxes…Or evading or protesting taxes – we’re NOT tax protesters – NO!…

We’ll show you how to reduce your income tax liability – LEGALLY!

(Tax evasion is ILLEGAL – Tax avoidance is perfectly legal)

And what if this little-known redemption method could continue to reduce your tax liability every year from now on?

It can!

The best part is…

The process is FREE & legal to do

It’s easy to learn

It’s FAST to do

It can remove up to 100% of your income tax liability!

The law protects you from being prosecuted from attempting to put this into action so you’ve truly got nothing to lose by giving this method a shot.

April 18th will be here before you know it…

NOW is the absolute best time to get Elite Tax Secrets and learn how to reduce your income tax liability FOREVER!

This is THE #1 simplest, easiest, FASTEST method to reduce your income tax liability down to ZERO.

Unlike other methods to avoid taxes, this method doesn’t involve any special business structures, NO sneaky ways of transferring funds, NO foreign or off-shore accounts and NO confusing paperwork.

It’s as easy as writing a check!

Even if you never use the OTHER METHODS shown inside the program…

this ONE tax secret alone is worth MUCH MORE than the cost of the ENTIRE program!

The only question now is – what will you do with all that money you’ll save in taxes year after year?

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.