There are very specific advantages of living life as an irrevocable trustee in everything one does.

That’s life as a trustee of a private Express Irrevocable Trust.

The following is an excerpt from Carlton Weiss’ Concise Trustee Handbook – ‘Trustee in Commerce: Body Armor for Commercial Warfare’

Life As An Irrevocable Trustee

Place a simple barrier between the “sovereign”, “secured party” or “citizen” and commerce.

Throw out the fragile crown of sovereignty & give

the man bulletproof trustee amour.

He now does things on behalf of a trust. Problem solved.

He needs to eat, but does he buy directly from the store with his own Federal Reserve Notes or silver dimes?

No. He buys on behalf of the trust. And works out a private contract with the trust. This enables him to eat the trust’s food and offset his trustee compensation.

He sees an advantage to owning a ranch in a certain jurisdiction. But, does he make an offer to purchase in his own name and thereby acquire personal ownership of the property?

No. He draws up an Offer to Purchase (or Offer to Buy if the trust has the gold on hand). The trust acquires the property and the beneficiaries of that trust benefit from his wise decision.

He can then contract privately with the trust as to how he may use the property, offsetting his compensation if that use involves anything outside of his duties as trustee.

Let’s say he needs to travel to the state to do the deal.

He’s an irrevocable trustee, so he gets into a trust-owned vehicle with a certified copy of the manufacturer’s certificate of origin and bill of sale and his trustee identification, and he travels to that state on official trust business.

Whatever contract he works out with the trust regarding offsetting things along the way with his trustee compensation is a private contract thatactually is protected under Article 1, Section 10.

Benefits of Being an Irrevocable Trustee

There are no questions as to the validity of such a blatant trust relationship.

Besides, Who’s asking? Another trust? Like the U.S.A.?

The Constitution for the United States of America creates an Express Trust under the Common Law, as did the Articles of Confederation, to act as a limited governing entity.

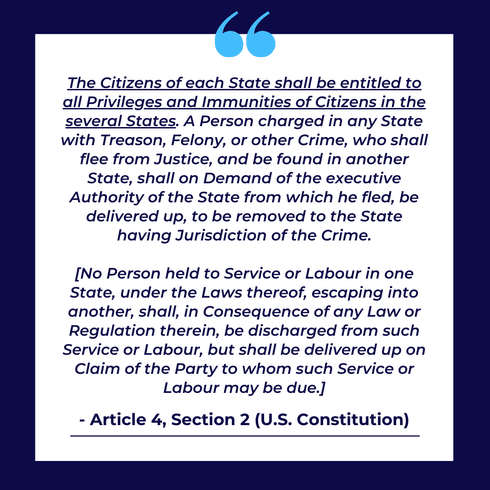

Article 4, Section 2 provides a clear protection to the trustees of such trusts to do business on behalf of the trust while not being subjected to foreign business entity laws.

THIS PROTECTION IS REAL

If the host state tried to stop you, the trust could actually sue and the state would likely settle out of court. The state constitutions do the same for each individual territory.

Anytime one of these entities has questions for an Express Trust under the Common Law, they are also asking an equal to show deference not legally required.

Article 1, Section 10 and Article 4, Section 2 can therefore be invoked anytime one of these entities looks as though it might impair the obligations one has to the trust or block the ability to administer trust affairs in a certain state as trustee.

YOU’VE GOT THE POWER!

There is no fear of even being prosecuted: after all, how many constitutional courts does one see these days?

However, it takes you to invoke constitutional jurisdiction. That’s power!

The extent of the protection may not have dawned on you yet, so allow me to point out that your benefits & obligations to the trust are as extensive as everything you do in your daily life.

A trustee in commerce eats, drinks and sleeps wearing his trustee amour. His clothes, his toothbrush and even his trousers are trust property.

When he has Federal Reserve Notes or dollar bills, they are in the trust’s possession by virtue of his trusteeship— never in his personal possession.

It’s a lot simpler than some would expect.

A simple document binder to hold the trustee identification, authorization papers, the trust’s debit cards and Federal Reserve Notes is all that is ever in your possession.

Possession is nine-tenths of the law, but at the same time it is only nine-tenths. There is one-tenth remaining for situations such as this.

The document binder has the trust’s name and a private property notice embroidered on the outside to designate ownership. The notice also names the trustee authorized to have the document binder in his possession.

At that point, everything within the document binder belongs to the trust. It may be in your possession as trustee, however the contents are in the trust’s possession to the extent of nine-tenths of the law.

They are in your personal possession only one-tenth by virtue of physically being on you. You are absolved of any liability associated with having the debit card or, even worse, Federal Reserve Notes. So, for all intents and purposes you have not reduced yourself to a merchant.

What good is it to be the sovereign, secured party creditor or regular individual when your status is practically useless in everyday commerce?

On the other hand, the trustee sleeps well every night because one can’t give up what they doesn’t have(and doesn’t need to have).

An irrevocable trustee owns nothing. Yet, is able to “control” it all (through the trust document).

Learn More About The Bulletproof Trust

As long as one maintains strict separation, paying close attention to the nuances in possession & ownership…

You’ll avoid commingling of trust property & will never diminish the protection.

They were without legally enforceable rights. They had no protections. What they couldn’t do for themselves would not get done, and there was no sense of justice toward them.

As a result, they were easily conquered over time and became today’s 14th Amendment citizens (have only privileges-not rights): beneficiaries in mind and spirit.

However, whose jurisdiction are you under if you don’t accept any benefits?Are you beginning to see now why trustees in commerce are in a league of their own?

Isn’t it time you finally free yourself from the slave system with Bulletproof Trust Secrets? (You’ll also get a FREE copy of Carlton Weiss’ Concise Trustee Handbook).

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.