Wondering what other home financing options are available to you? Or what the difference is between mortgages, HELOANs, HELOCs & cash-refinancing?

Financing a home can be confusing so today we hope to clarify your options.

Conventional Mortgage

Mortgages or “conventional mortgages” is where a bank or credit union lends money to purchase a property.

Min. Credit Score: 680+

DTI: 43% or less

Down payment: 8-25% (typically the younger you are the lower the down payment requirement)

Interest Rate: Fixed or Variable (The borrower repays the amount of the loan plus interest over the length of the term.)

Loan Term: 30 years

Collateral: In the event of defaulting, the lender has legal recourse to foreclose on the home.

Unconventional mortgage options include: Federal Housing Administration (FHA) mortgages – allow borrowers to put as little as 3.5% down, as long as they pay mortgage insurance. While U.S. Department of Veterans Affairs (VA) loans, U.S. Department of Agriculture (USDA) loans require a 0% down payment but have other requirements.

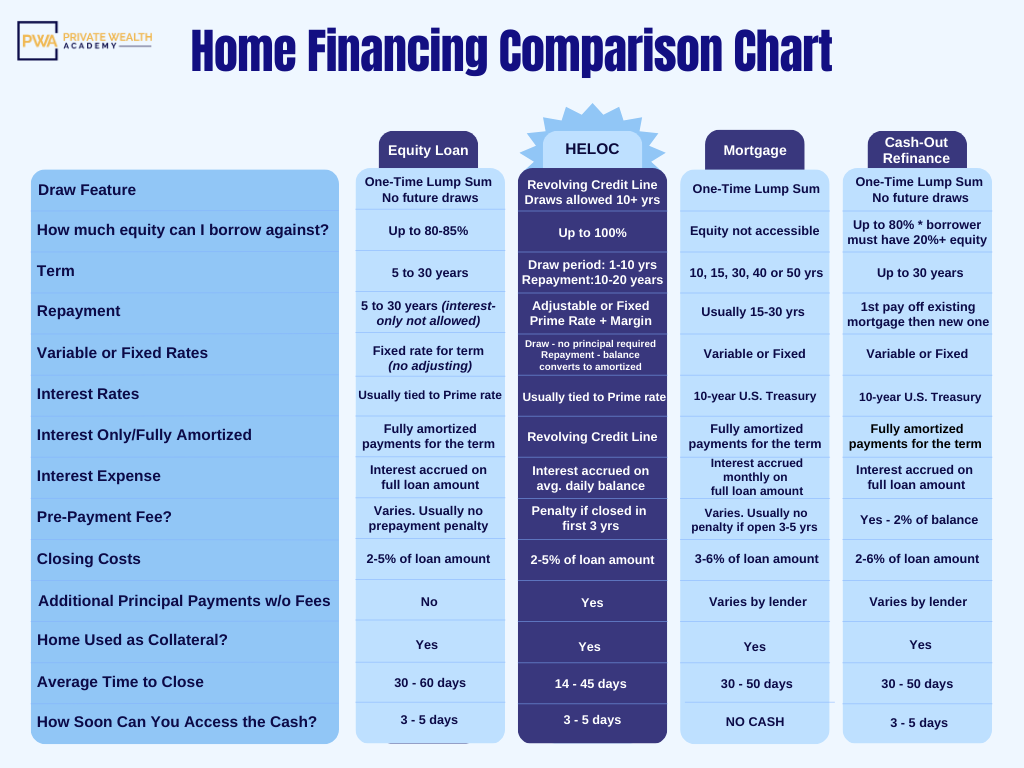

Curious how a HELOC compares to other loan-types?

Home Equity Loan (HEL)

While a HELOC is a type of home equity loan – there are key differences. The main difference is that a HEL gives you access to a lump sum of cash that you repay over a specified period of time and at a fixed interest rate.

The biggest downside to HELs is that you’re forced to pay interest on the entire lump sum, typically. So just like first mortgages, you’ll pay much more over the loan term.

Cash-Out Refinancing

A cash-out refinance is essentially a second mortgage. This will increase your monthly payment but you can choose to keep the same term length. You’re opening a new loan. Once you pay off your old mortgage, you begin to pay off your new one.

No matter how close you were to paying off your original mortgage, the extra cash you obtained with a cash-out is treated like a new loan. This also reduces your proceeds if you were to sell.

Reverse Mortgage

A reverse mortgage isn’t a home financing option everyone can qualify for. In fact, it’s only available if you’re 62 or older. This type of loan allows one to convert part of their home’s equity into cash. These loans are structured so that no monthly mortgage payments are required.

HELOC Strategy

Knowing the difference between a mortgage, home equity loans and HELOCs can save you hundreds of thousands of dollars, not to mention – YEARS of payments.

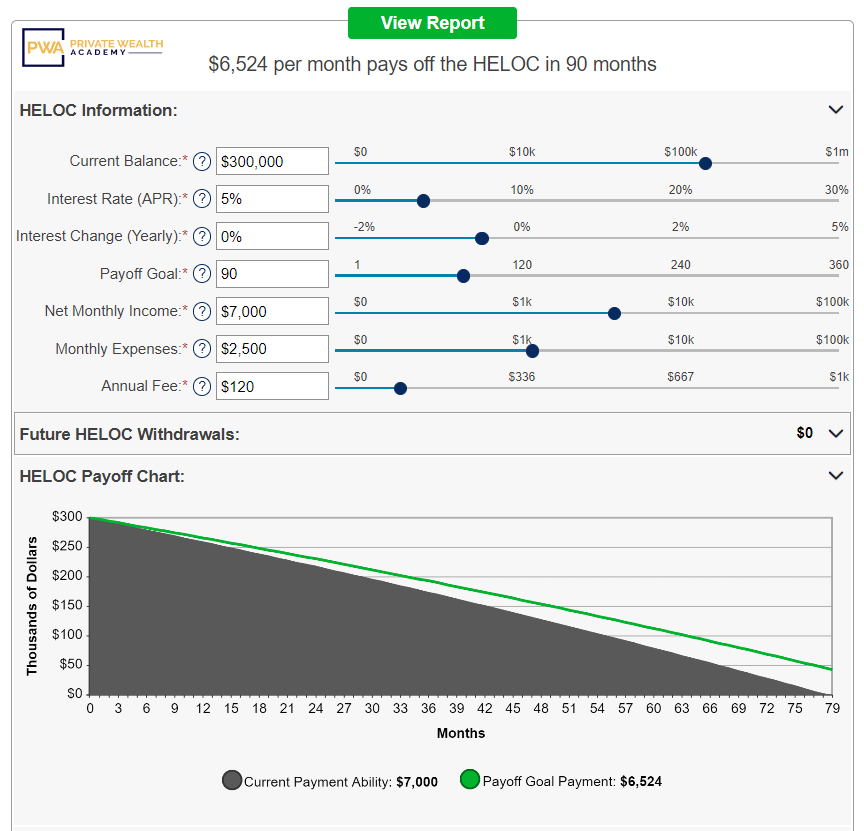

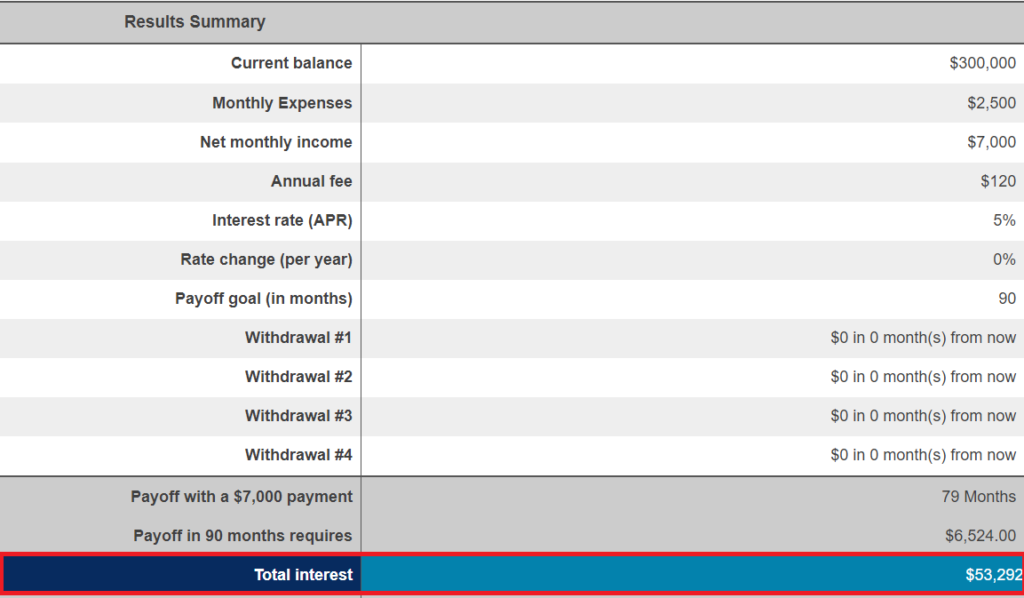

To demonstrate: Let’s say you have a $300K HELOC with a 5% interest rate and a net income of $7K per month, that’s a household income of about $120K a year. You can pay off the home in about 6.5 years, without changing your income!

Best of all, you’ll only pay $53,292 in interest compared to $288,424 on a traditional mortgage – a savings of $235,132! Pretty incredible, right?

You’re able to save the price of another home just by using a HELOC!

This is why it’s so crucial to know the advantages of a HELOC over both first and second mortgages. As the math above shows, a HELOC can save you a significant amount of money!

*To expand image size, click the arrow in the bottom right hand corner or right-click + Save As to download to your computer/phone.

A HELOC is more flexible (and more affordable) than other types of home financing because you can take out smaller amounts as you need them, whereas these other options are essentially a second mortgage.

Many people may think of a HELOC as a second loan or lien on their homes, which sits “behind” their first mortgage. However…

There’s a specific type of HELOC that allows you to REPLACE YOUR MORTGAGE (we’ll discuss this more in the coming days.)

This type of HELOC also allows you to access all your equity, not just the amount of a smaller second mortgage.

And unlike mortgages, which limit the amount a homeowner can pay each year and assess penalties if you exceed the maximum annual payment. With a HELOC, typicallythere are no penalties for paying it off early.

Meaning you can make principal payments whenever you like, reducing the interest you pay, making it one of the most alluring (and affordable) choices of all the home financing options.

And by borrowing only what you need (and only paying interest on the amount you use), you can reduce your interest rate.

All these features allow you to pay off the loan faster than any other form of financing and keep the amount of debt you incur as low as possible.

Are you beginning to see how a HELOC can completely change your financial situation?

A Home Equity Line of Credit can provide homeowners with more affordable rates and flexibility than other financing options. So no matter which way you slice it, the HELOC comes out on top.

Wondering how much you can borrow with a HELOC? We’ll talk more about that in tomorrow’s email. Until then, learn more about the Half Your Mortgage program.

We’ve created the Half Your Mortgage program to help you go through the entire process of securing a home equity line of credit (with the most affordable rates.) Click the link for access & get started today!

Learn More About the Half Your Mortgage Program

Not quite ready? You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing.) and learn what the savings will be for your exact situation.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.