Got questions about your business credit profile & getting approvals?

We hope you’ve been finding our short posts helpful so far. We know there’s a lot to learn…

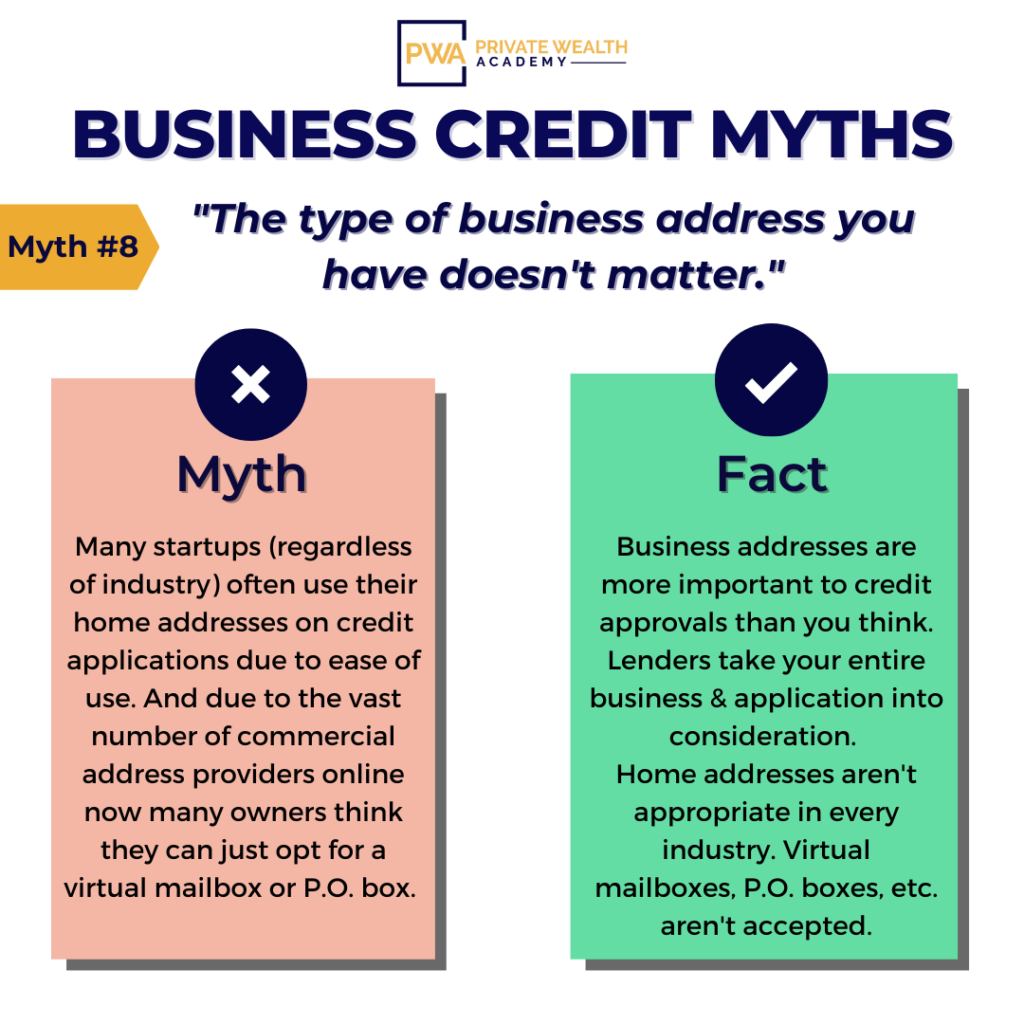

There’s one thing you want to avoid if you want to get approvals…

And that’s using the wrong kind of business address…

In fact your company address can have surprising affects on your business credit profile and approvals overall.

Did you know that most lenders can see the details of your business credit profile including the address and what zone it’s in?

That’s why it’s important to never use these types of addresses…

P.O. (post office) mailbox, virtual mailboxes, addresses marked as PMB (Personal Mail Boxes) or postal annex for your primary business address

Some virtual offices MAY be okay but…

Lenders will be able to see what kind of address it is and some prefer not to lend to virtual offices (especially with higher amounts of financing). In either case…

Be sure to Google the address and if it’s a UPS, FedEx Store, etc.

If it is – avoid it at all costs.

Why?

Because these types of addresses can get you flagged with banks.

And at the very least, you’ll get denied for your credit offer.

We recommend using a shared office or paying to rent a spare office mailbox.

In most cases you can simply use your home address. *Unless your industry deems it inappropriate like a trucking company for example.

The good news is, nowadays home offices are accepted by the majority of banks.

So if you’re deciding between a virtual office and a home address – a home address is generally the better way to go.

And it’s not just because more people are working from home now…

It’s because there are MANY consultants, therapists, realtors, instructors and marketers that have home based businesses that make 7+ figures annually.

Business Credit Profile Tips

Today we’ll show you how having great business credit profile helps maintain and improve your company’s cash flow and helps to strengthen your company all around.

As an owner, I’m sure you like us understand that a lapse in cash flow can stop business growth in its tracks…

For example: let’s say that you’ve maxed out your current credit and you don’t have a way to pay for ads – so your advertising campaign gets interrupted which could potentially stop all revenue from coming in. Then you’re stuck having to find a way to pay back your current debts AND find a way to restart cash flow coming into your business…

Or say that you’re in the startup phases of your company and you have a lot of business expenses to account for but limited funding. You want to get your business off the ground without staying in the red for too long but you don’t want to go to outside investors or have enough capital to make it happen – what then?

Having a strong business credit profile can prevent all that

The most obvious benefit of having good corporate credit is the ability to have backup funds if/when cash flow gets tight. There are other ways having strong credit improves your business cash flow such as:

- Providing the funds you need for necessities like utilities, operating costs & travel

- Assists with startup costs like office space, equipment, inventory and the like

- Allows you to grow faster with the ability to hire more staff members & employees

- Ensures you can pay your bills on time & prevents any service or supplier interruptions

- Helps your money go further with corporate credit card rewards or cash-back perks

- Can help provide more funds for things like advertising to further increase internal cash flow

- *By increasing your company’s cash flow your bank rating (and thus corporate credit scores) will also improve leading to a stronger credit profile

Besides that, borrowing money can actually help build your company’s credit score (did you know that?)

Invest

Many people are tempted to simply “collect credit” but that isn’t going to do much to help you. For one thing, it isn’t helping to put more money back into your pocket, which is what credit is meant to help you do – invest.

Another thing is, it can be hard to boost your credit score without spending some of that credit & acquiring additional credit lines to establish history.

This is because lenders want to see that when you do have debt, you know how to appropriately manage the funds and make payments on time. Establishing a business credit profile is all about creating a track record to give lenders a reason to trust you to show that you can borrow and repay responsibly.

Aren’t you ready to establish an excellent business credit profile & improve your company’s cash flow?

Learn More About Corporate Credit Secrets

Worried you won’t meet certain lender requirements? We’ll be talking about that in an upcoming post when we share one of the BIGGEST secrets in the ENTIRE business credit industry. Keep an eye out for that!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.