Good Credit vs Bad Credit

Your credit score plays a pivotal role in almost every aspect of your life, from securing employment to renting an apartment. Let’s explore the profound difference between having good credit and bad credit.

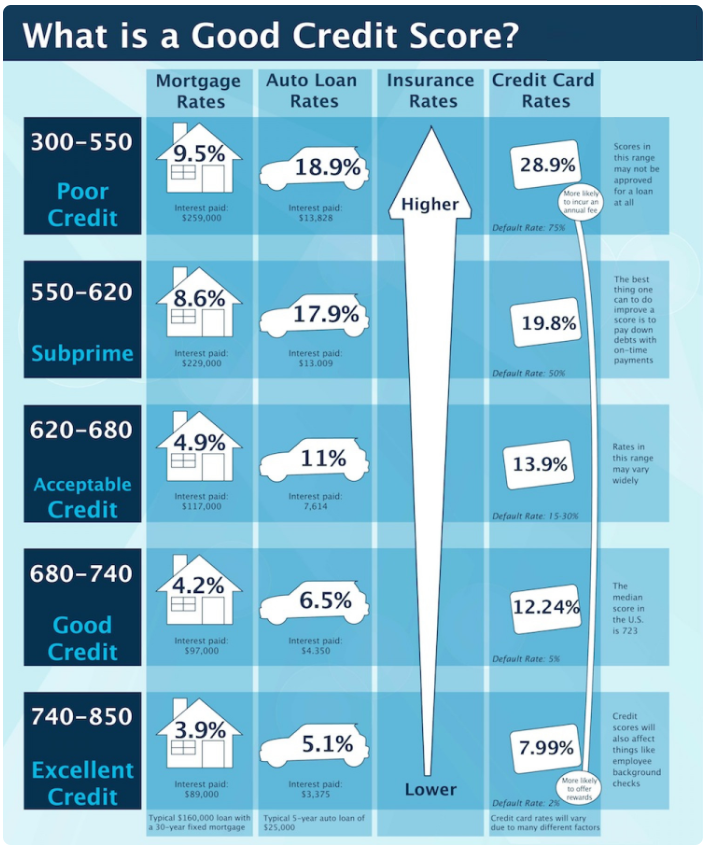

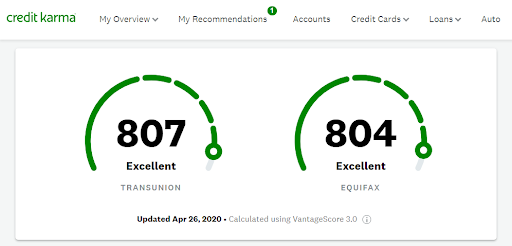

Having a high credit score opens doors to significant financial benefits, including:

- Mortgage Refinancing: Potential savings on your mortgage.

- Better Car Loans: Access to improved auto loan terms.

- Best Credit Card Rates: Enjoy lower interest rates on credit cards.

- Reduced Automobile Insurance: Lower insurance premiums.

- Increased Disposable Income: More funds for future financial goals like investing and saving.

As a result of bad credit, you may have to pay more for loans, be denied credit for big-ticket items like a new home or car, and even have trouble landing a job.

Opportunities with Good Credit vs Bad Credit

In the end, having good credit is all about convenience-the convenience of options, to make any choice we want to. Improving one’s credit opens up additional opportunities that may not have previously been available.

Better finances allow you the option to negotiate favorable contracts, save money by securing reduced interest rates, and accept the best credit card deals available. Having higher credit also allows you the options to make better decisions.

If you have good credit, you can choose from a wider range of credit card and loan possibilities and you don’t have to settle for whatever is available but rather can take your time finding what suits you best.

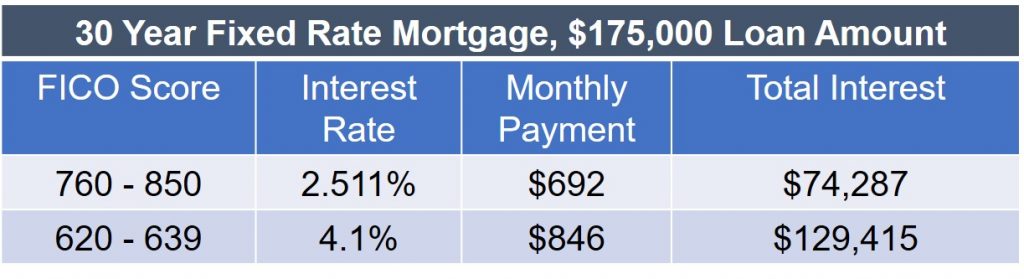

Credit scores are the biggest factor in a lender determining your risk level. In fact, your credit score determines what sort of roof you will be living under as housing is one of the biggest impacts of a person’s credit standing.

Housing With Good Credit vs Bad Credit

Whether you rent or buy is all determined by your credit. Your credit score dictates whether you are eligible to save 1% on your mortgage rate and remove thousands in payments.

Clearly knowing how to improve your credit score is one of the most important factors in securing affordable financing options.

The method in High Credit Secrets will immediately raise your credit rating and catapult you toward the highest tier of credit. We’ve done the research for you in determining what works and what doesn’t in credit building shaving years off of the process.

We detail the plan to exponentially improve your finances and offer the direction you need to dramatically enhance your credit score in a short period of time.

Take advantage of our proven technique and elevate your lifestyle by improving your finances with our 38 strategies. See the doors of possibility open in your life through High Credit Secrets.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.