Curious what the benefits of a HELOC are?

There’s a lot of ’em but before we get into that…

Do you know what the term ‘mortgage’ really means?

It seems very apt that the one bill we cannot miss paying without major consequence. The word ‘mortgage’ literally means “death pledge” in old French and Latin. Isn’t that interesting?

And it is a death pledge. First of all, a mortgage takes 2-3 DECADES to pay off. Second, a single missed payment can result in you losing ALL your equity you’ve paid into the home. Third, most peoples homes are a ‘negative asset’ because they pay 200% of the home’s value.

This is why the Home Equity Line of Credit (HELOC) is a phenomenal solution for homeowners.

While the ability to pay off your home in 5-7 years is pretty awesome…

What if a HELOC could do even more for you?

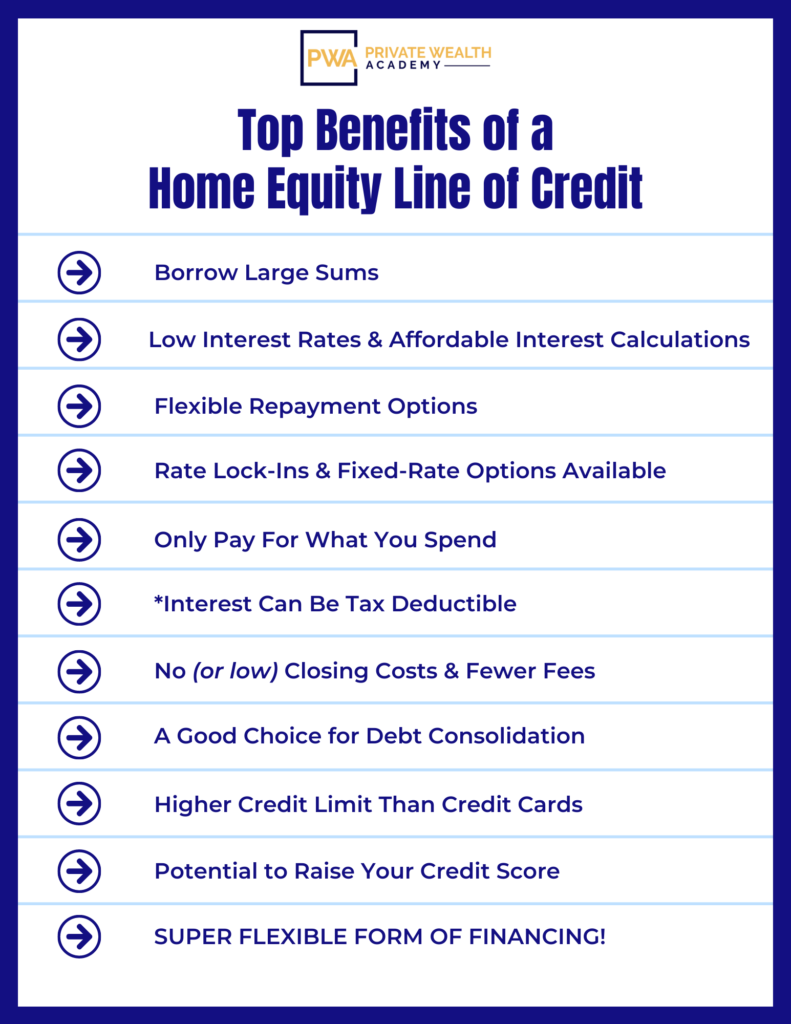

Through all of Carlton’s research, there were multiple HELOC benefits he found. For sake of time, here’s the top 12 BENEFITS of a HELOC:

Benefits of a HELOC

#1: Borrow Large Sums

You can typically borrow up to 80-85% of your home’s value, minus outstanding mortgage payments. (Some lenders allow up to 95-100%.)

#2: Low Interest Rates

HELOCs typically come with lower interest rates than other forms of financing (and often include very low introductory rates that generally stay in effect for the first 6 to 12 months.)

#3: Flexible Repayment Options. HELOCs often provide flexibility in terms of how you pay them off. The timeline for your HELOC can vary depending on how much you want to borrow and the lender but HELOCs generally last up to 30 years.

#4: There are Fixed-Rate Options.

Contrary to popular belief, HELOCs can come with fixed-rate options – it all depends on the lender. However, even variable rate HELOCs usually offer the ability to lock-in rates or convert a portion to a fixed rate.

#5: Only Pay For What You Spend.

Another advantage of HELOCs is that you can use funds as you need them. Where conventional mortgages, home equity loans and even personal loans require you to take out a lump sum.

You can withdraw HELOC funds as needed, only paying interest on the amount borrowed (making it more affordable.) If you wind up using less cash, you’ll have a smaller monthly payment.

#6: Interest Can Be Tax Deductible

According to the IRS, interest on home equity lines of credit are deductible if the borrowed funds are used to buy, build, or substantially improve the taxpayer’s home that secures the loan. The loan must be secured by the tax-payer’s main home or second home (qualified residence), and meet other requirements.

#7: Typically There’s No Closing Costs

HELOCs often don’t come with “closing costs” but when they do, they’re typically covered by the lender (or up to a certain amount.) Generally speaking any closing costs with HELOCs tend to be far less than mortgages.

#8: No Fees For Cash Draws

Most HELOC lenders don’t have fees for using your line of credit.

#9: Can Be a Good Choice for Debt Consolidation

HELOCs still tend to have lower interest rates and lower initial costs than credit cards or personal loans, which makes them attractive for debt consolidation or ongoing projects with higher costs.

#10: Higher Credit Limit Than Credit Cards

The credit limit amount a borrower can receive through a HELOC is also largely determined by the amount of equity the borrower has in their home, credit score, and other factors. However, qualified borrowers with ample equity may be able to get approved for amounts up to $1,000,000 (sometimes up to

$2 Million if you live in a high-cost state like California.)

#11: Potential to Raise Your Credit Score

Two of the most important components of your credit score are your payment history and the different types of credit you have. Adding a HELOC to your credit portfolio and making on-time and regular monthly payments (which is a must) can boost your credit history since it shows a streak of good financial habits. Plus, we’ll show you a little-known way to INSTANTLY boost your credit score in a matter of DAYS just by making a simple phone call.

#12: SUPER FLEXIBLE FINANCING

One reason HELOCs are so popular is that the money can be used in any way with no restrictions. This is also one of the main advantages of HELOC loans. However, we do believe there is a right & wrong way to use HELOCs. Just like any form of financing, you need to borrow responsibly.

Oh AND… as you’ll learn in the days to come, a HELOC is easier to qualify for than a mortgage!

Honestly, this is just scratching the surface… However, if you’re a real estate investor, the benefits of a HELOC would be DOUBLE THIS LIST!

Aren’t you ready to stop paying DOUBLE the interest and learn how to half your mortgage?

We’ve created the Half Your Mortgage program to help you go through the entire process of securing a HELOC (and lock-in the most affordable rates.)

We’ll show you the right type of HELOC to go after, the exact criteria to look for, how to prepare your finances, how to calculate the interest(so you know how much you’ll be able to save), and get access to our proprietary calculators to make the math easy-peasy.

You’ll even receive your very own list of state-specific HELOC lenders, a questionnaire list so you know what to ask lenders and so much more!

Click the link below to learn everything you need to know about securing an affordable first lien HELOC so you can transform your equity into cash.

Learn More About the Half Your Mortgage Program

The Half Your Mortgage program can do some amazing things, but you don’t have to take our word for it – just listen to Melody’s experience and how much she was able to save!

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing.) We’ll run over the numbers with you using our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE!

We’ve got SO MUCH MORE to share with you about what’s possible with a Home Equity Line of Credit. Tomorrow we’ll go into more detail about what makes a HELOC a smarter alternative to 30 year mortgage.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.