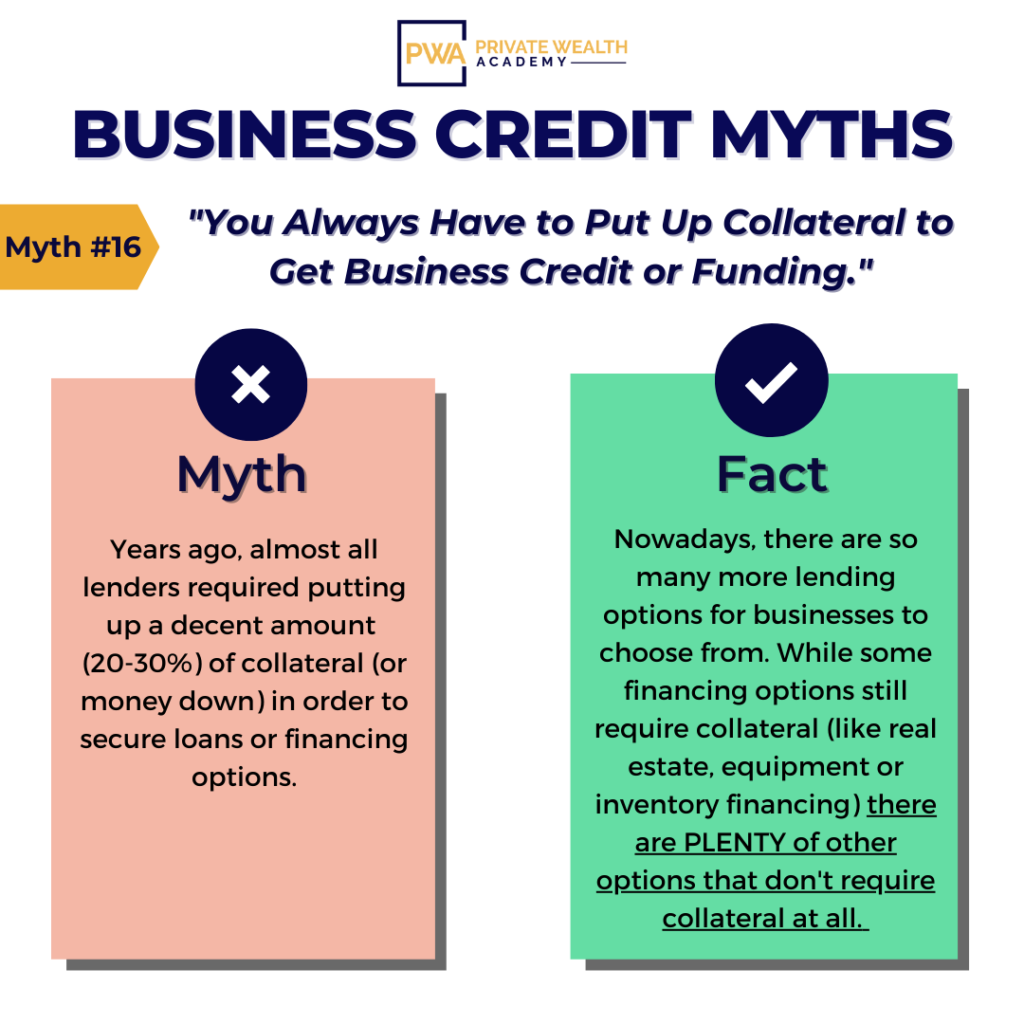

Have you been told you need to put up business collateral to get credit or funding for your company?

Many business owners are under the impression that lenders won’t issue a loan unless you put up collateral that’s worth at least 50% of the loan itself.

What that means is that if you’re looking to borrow $50,000, the business collateral or assets to secure it must have a cash value of at least $25,000.

This can lead to business owners making poor decisions — decisions that could tie their business to their personal assets.

For example: listing your home or car as collateral.

The good news is that’s not necessarily true.

THE TRUTH: Yes, some specific types of loans or financing may require business collateral (such as inventory or vehicle financing) but generally speaking – there are many other types of financing that don’t require any collateral.

In fact, it’s never a good idea to put up business collateral to secure loans or financing if you can avoid it.

When you put up your own collateral to secure a business loan or other funding, you’re putting your own personal assets at risk.

If you tie up your personal wealth to obtain a business loan, you’re putting your assets on the table for the bank to take if you can’t pay it back.

Considering the failure rate of businesses…

…and the fact that average financing terms can be 3-10 years…

…you may even be putting your business at risk in the process, too.

And if it’s business collateral or assets that you’re offering – just be sure it’s a manageable offer you can live with. For example: try to avoid any loans or financing options that want to put a general lien on the business assets. That means if the company fails, the lender can liquidate anything of value that’s left.

Inventory, equipment, fixtures, invoices/accounts receivable are better forms of business collateral to offer if necessary.

So, how can you secure money for your business without the tradeoff of collateral?

By having good cash flow & a solid corporate credit profile to rely on.

Your company’s credit is an extremely important part of the financial puzzle, and it can have a direct impact on whether or not your business succeeds both now and in the future.

When businesses can show a proven track record of on-time payments, a solid credit score, and meet other requirements of lenders, they can obtain money for their business without the need for their personal credit or collateral.

Another BIG the trick is that you don’t start by applying for credit with the big guys (like bank cards or loans). Doing so will almost guarantee a denial.

Rather, you build your way up with the smaller lenders and offers and then go after the big guys when the time is right.

When executed the right way, this strategy works every time.

You’ll be on track for all the funding you need to expand your business, hire new employees, and grow your profits.

The only way to get there is to know the process to follow.

And, that’s how we can help.

If you want a proven system to follow to become highly fundable and learn how to get $50,000-100,000 in corporate credit in 6 months or less…

Join The Corporate Credit Secrets Program

Remember, $50K-100K is just the beginning. If you want to learn how you can obtain virtually unlimited corporate credit without having to offer personal or business collateral, this course is exactly what you need.

When it comes to getting approved for high-limit unsecured credit there’s one thing you’ll need that most owners overlook. We’ll tell you everything you need to know in tomorrow’s email so keep an eye out!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.