Wondering if you can still get approved for business credit with bad credit?

What’s your personal credit score? 600? 700? 800?

Guess what, even if it were 600 or even 550 – you can STILL secure business credit with bad credit. (It might be a bit more difficult – but possible.)

And that’s great news – especially if you have bad credit.

Having bad personal credit can be a hurdle when it comes to applying for high limit credit cards or traditional loans.

No one likes to deal with denials.

But, while bad credit can limit the amount of money you can access personally, it doesn’t have to get in the way of your dreams and goals.

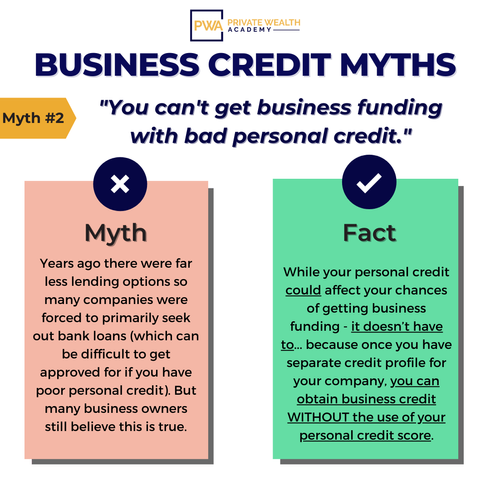

There’s a myth that you can’t get business credit with bad credit. While lots of business owners believe that, the good news is that it isn’t necessarily true.

While your personal credit can affect your chances of getting approved for business credit – it doesn’t have to…

You STILL have options available…

How to Get Business Credit with Bad Credit

Once you have established a separate credit profile for your company, it opens more doors to obtain credit for your company WITHOUT the use of your personal credit score.

So your company’s credit profile can be completely and totally independent of your personal credit (depending on how you apply for credit.)

By default creditors will ask to check your personal credit but there is a way around this.

The only way you can do this though, is to establish a company credit profile with a strong payment history that can get approved on its own (and it can be done FASTER than you may think).

With good credit scores, your company can take advantage of ALL types of funding, from vendor credit, to retail credit, fleet credit, company credit cards, low-interest loans and MORE.

Another way to get business credit with bad credit is by applying for specific credit offers that are designed for those with less than stellar credit.

Having a good company credit profile doesn’t just help get you more credit approvals, though. It also protects your personal finances from lawsuits, helps prevent commingling of funds, and allows you to secure MUCH higher credit limits than is possible with personal credit.

And, it’s not as difficult to get business credit as you might think.

By using our method, you can quickly build a solid corporate credit profile…

…that opens doors you could never imagine were possible.

Inside Corporate Credit Secrets we’ll show you how you can obtain $50k-100k+ in credit for your company in 6 months or less. Plus, we’ll even show you a few quick methods you can use to improve your personal credit too!

If you’ve tried building business credit or applying for business loans with bad credit in the past and failed – it’s not your fault.

There’s a lot of inaccurate information out there…

We’re here to give you a clear and proven roadmap to know exactly what lenders want to see and how to quickly become the highly fundable business they’re looking to approve.

Don’t let your current personal credit score get in the way of your goals, you can still get business credit with bad credit. Besides with the Corporate Credit Secrets program we’re going to help you achieve the best of both credit worlds!

Aren’t you ready to start improving your credit scores?

Learn More About The Corporate Credit Secrets Program

Is getting credit without a personal guarantee for real or all hype? Lookout for tomorrow’s post, we’ll reveal the truth behind that popular myth.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.