Wondering how long it will take to establish a corporate credit score?

How long did it take you to build up your personal credit score?

For most people, the process of building an excellent consumer credit profile takes years.

What about your corporate credit score?

When it comes to your business credit profile and scores…

Chances are, you probably don’t have any yet…

The Nav American Dream Gap Survey, revealed of small business owners surveyed, 45% did not know there’s a separate business credit score, 72% did not know where to find their business credit score and 82% didn’t know how to interpret their score.

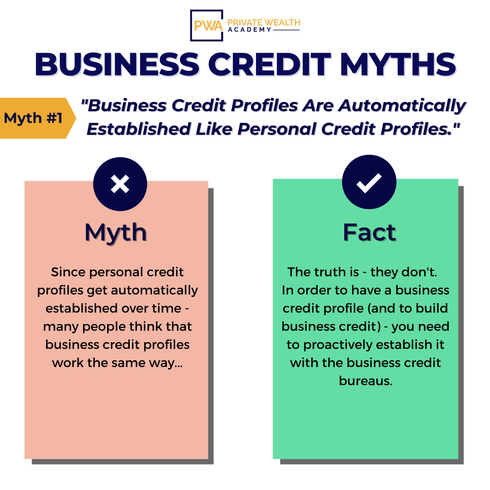

The reason most owners don’t know there’s a separate business score is because many believe it gets automatically established like consumer credit.

This is partially true and partially false.

NOTE: In the rare case that D&B or other business credit bureaus actually have information on your business, often the information isn’t entirely accurate or up-to-date which can cause credit approval issues later on.

When it comes to getting a corporate credit score, you need to actively establish it by…

- Getting registered with business credit bureaus

Typically, businesses aren’t automatically assigned a credit profile or score. In fact, there are businesses that have been running for 3+ years that have no company credit profile or scores.

That isn’t the best way to go about your business, though…

It’s incredibly important toget registered with business credit bureaus. (These bureaus are separate from the bureaus that issue your personal credit score.)

- Applying to creditors that report to the business credit bureaus

There are certain places that will approve your business for credit, even without an established credit score. The trick is to know which ones to target (which is something we can help with!) And of course making sure they report to the business credit bureaus. *Experian Business and Equifax Business both initiate your corporate credit profile once a creditor starts reporting payment history.

- Paying all your bills on time!

Just like your personal credit, it’s incredibly important to pay every bill for your business on time. The only way lenders will know you’re fundable is if you can produce a proven track record of responsible payments. *And the earlier you can pay your business bills – the better your score will be!

There are other steps to take as well but these are a great place to begin.

By actively making your corporate credit a priority you’ll be able to control the way credit bureaus, lenders, vendors, banks, investors and business partners treat your company.

If you truly want to create a strong credit profile with good corporate credit scores in the quickest time possible, you need to follow a proven plan.

That’s EXACTLY what Corporate Credit Secrets is.

If you’ve been seeking a proven method to become highly fundable and want to secure $50k-100k in credit for your company…

The Corporate Credit Secrets program is right for you.

Learn More About Corporate Credit Secrets

Think you can’t get funding for your business if you have bad personal credit? Lookout for tomorrow’s post where we’ll be de-bunking that myth and so much more.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.