So you’re looking to remove or cancel debt, right?

Well, unlike some methods we teach – the debt removal process is time-sensitive and requires you to ACT NOW. Today, we’ll answer a common question we often get asked.

What to Know When You Cancel Debt

Can I Send A Debt Validation Letter At Any Time?

According to the FDCPA, a letter requesting validation must be sent within 30 days of a debt collector’s initial communication.

An initial communication is usually the first debt collection letter which contains the 30-day notice found in § 1692g(a) of the FDCPA. *Even if they call you, they are supposed to notify you in writing within 5 days.

After that first contact, the 30-day count-down begins.

But don’t worry – stopping collections is as easy as starting the process and sending off your debt validation request letters.

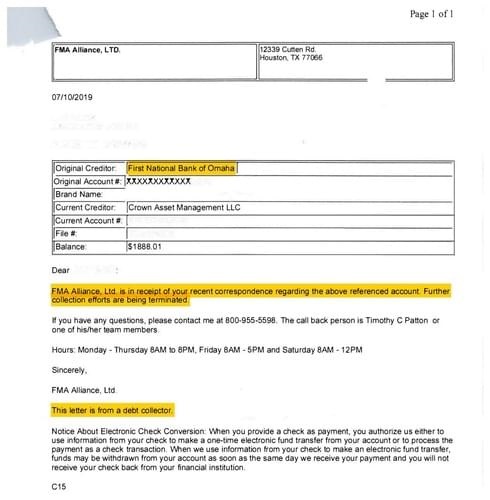

Once a debt collector receives a timely validation request, it must cease collection efforts until they validate the debt.

However, they cannot send more letters or phone calls demanding payment.

COLLECTIONS WILL BE STOPPED

In the event that it is reporting the debt to the credit reporting agencies, it cannot update the collection entry EXCEPT to report that the debt is disputed or deleted (which they must do)

Reporting the fact that the debt is disputed is a requirement in § 1692e(8) of the Act.

It’s Best to Cancel Debt ASAP

Have you received your first contact from collections?

If so, the clock is ticking…

Why postpone it? Learn how it works & send off your letters.

We’ve made the debt removal process simple & easy to follow.

Get started TODAY & put an end to collections FOR GOOD.

Learn More About Debt Removal Secrets

Wondering what happens if you miss the first 30-day window? Be sure to catch our post tomorrow giving you the next steps you’ll need to take.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.