If you’re retired, you might be wondering if you can still get a HELOC…

The good news is, yes, you can!

Out of the many goals we aspire to teach at Private Wealth Academy, two have always been at the top of our list – to preserve wealth and eliminate debt. While many can obtain these goals relatively quickly, not everyone is in a prime position financially when it’s time to retire.

How to Use a HELOC in Retirement

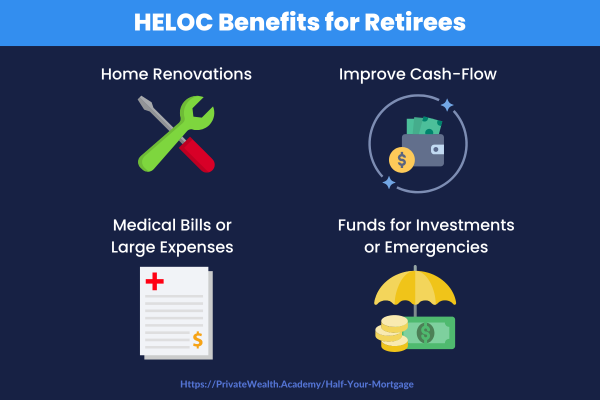

A home equity line of credit (HELOC) offers several advantages to retirees…

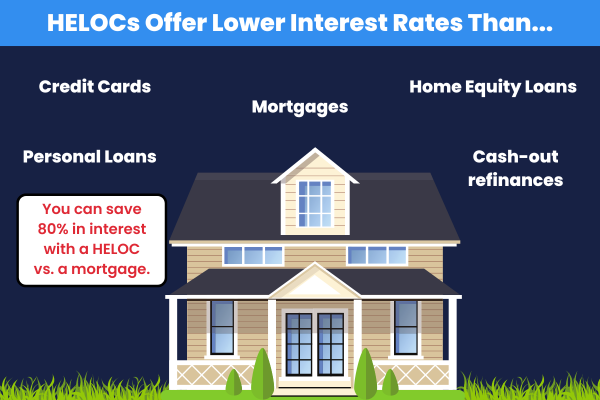

For one thing – a HELOC is one of the most affordable & flexible forms of financing you can have.

HELOCs offer the ability to save more in interest than mortgages, cash-out refinances, personal loans, credit cards and even traditional home equity loans. Making them the best credit weapon to use during retirement since it offers such amazing repayment flexibility.

This allows you to either pay the HELOC off gradually within its term limits, or you can use the strategy presented in Half Your Mortgage to pay it off in 5-7 years (on average.) The HELOC proves advantageous over other funding tools that don’t offer such congenial options.

Do you need to make repairs or modifications to your home to make it more senior-friendly? Like walk-in tubs, extra hand-rails, or wheel-chair ramps?

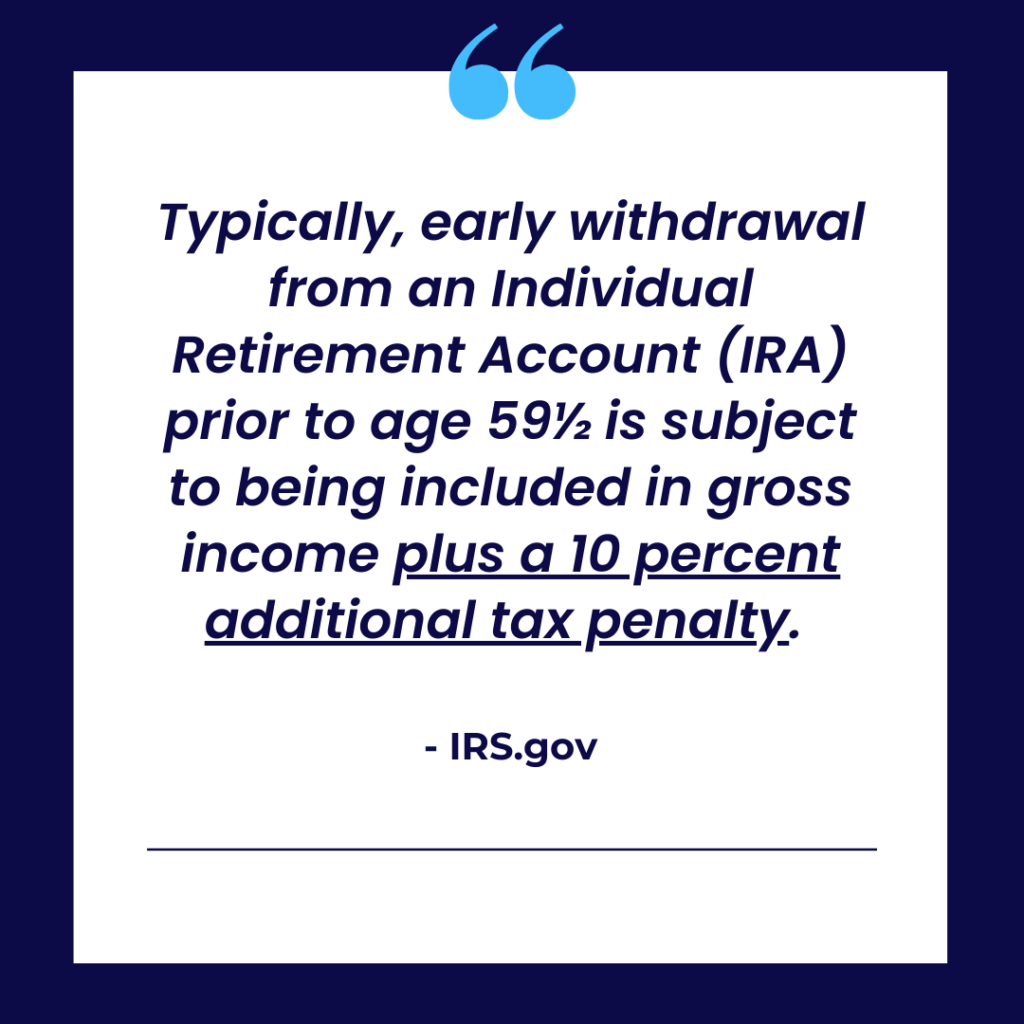

Many people retire with reserves in their IRA accounts but forget to factor in unexpected expenses that may crop up. That’s because…

If you take a large withdrawal one year to fund a big expense, it may push you into the next higher tax bracket. Not to mention early withdrawal fees.

For this reason, it may be smarter to use a HELOC to fund a large purchase, so you can use a HELOC to gradually repay the money rather than disrupt your portfolio.

By utilizing the HELOC, you can preserve any investments. As well as, increase the life expectancy of your portfolio and avoid incurring tax consequences from selling investments.

If you’re looking for a flexible funding source, the home equity line of credit (HELOC) is the perfect tool.

And it’s better than taking money out of your retirement account (since that usually comes with fees.)

The HELOC has proven to be an effective solution to increase cash flow during retirement. And, help you supplement income for those golden years.

Ready to get started?

The Half Your Mortgage program will show you how to lock-in a first lien HELOC with low interest rates, long draw periods (so you can withdraw funds for up to 10-15 years), flexible repayment options, daily sweep account so you pay the LEAST AMOUNT of interest possible and MUCH MORE!

Learn More About the Half Your Mortgage Program

Still not sure this is the right fit for you? Let us help you find out for sure!

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.