Looking for a HELOC strategy to pay off home(s) in less than 10 years?

Wondering if home equity lines of credit (HELOCs) are available in other countries like Canada or Mexico?

Good question.

Yes – HELOCs are available in the US, Canada and other countries.

So what’s the HELOC strategy to pay off home(s) in Canada?

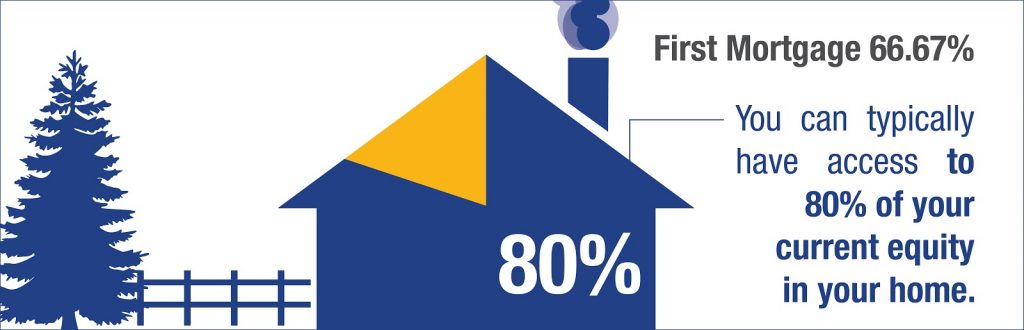

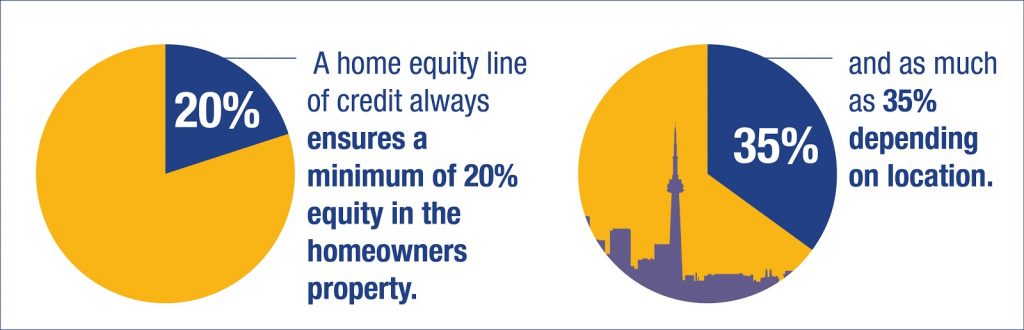

In Canada, you may borrow up to 66% of your home’s value with a HELOC. This differs greatly from American borrowers that may borrow up to 80% (or more) of the home’s appraised value.

However…Canadians have the option to use re-advanceable lines of credit or secondary lines of credit to circumvent this issue.

What’s the HELOC strategy to pay off home(s) in Mexico? You’re probably wondering.

They may also come with a fixed payment option which allows you to get a slightly lower interest rate.

The conventional lines of credit available at larger banks in Canada, offer interest only payments.

Your credit profile, income, debt-to-value ratio, and value of your home are all factors. These determine the rates the lender will offer.

Borrowers are only charged when funds are withdrawn from the HELOC. If you have a HELOC with a credit limit of $100,000 and you spend $45,000, interest will begin to accrue on the $45,000 the moment it is spent.

As you pay down the balance, you pay less interest and as you borrow more, you pay more. In other words, HELOCs are usually free if you don’t use your line of credit. In some cases they may come with a small ($50) annual fee.

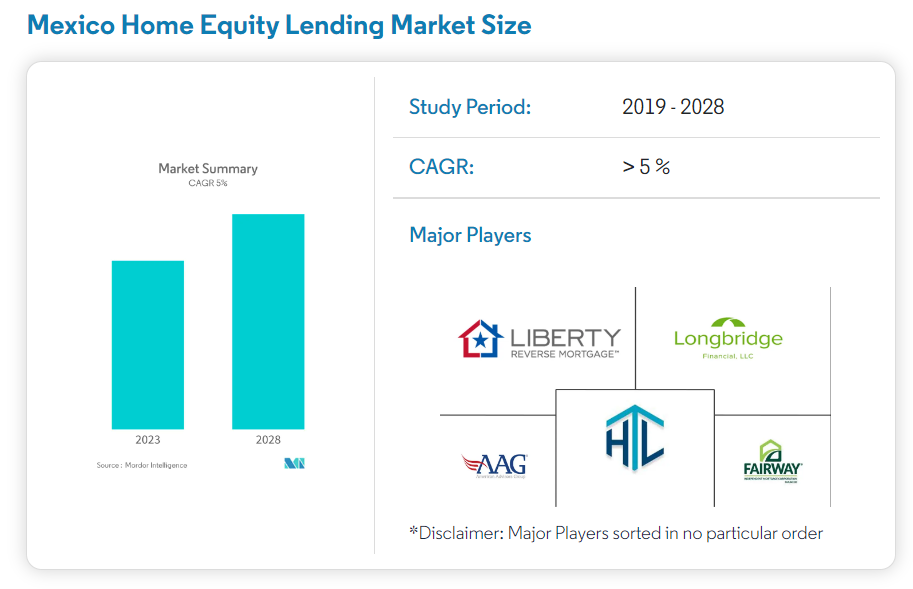

HELOCs are also available in Mexico, Australia, Brazil and the UK. But, the availability and terms of these loans will vary depending on the lender and your individual financial situation.

If you’re seeking a HELOC for a property in another country other than the United States, we recommend consulting with a loan officer, financial advisor and/or attorney to ensure that you understand the legal and tax implications of obtaining a home equity line of credit in that country, as well as any other factors that may impact your financial situation.

The HELOC is an ideal financial vehicle for homeowners that aren’t sure exactly how much they need. Or, for those just looking for some financial security in a volatile market. Many homeowners will take out a HELOC and also not necessarily use it right away. It can also be used as a source for emergency funds or to invest without actually drawing it down.

An excellent example of HELOC use would be for investors or owners to pay them down as quickly as possible, use extra cash on hand to pay down their debts, and then reborrow as necessary to try and minimize interest costs.

One thing’s for sure…

A HELOC can be a useful tool no matter where you are. A low-interest loan with flexible repayment terms is quickly available (usually within 30 days) if you have sufficient equity. This gives you immediate access to a large sum of money that will also not cost you until it’s withdrawn.

The biggest takeaway here, no matter where your property is located – when it comes to HELOCs, making principal + interest payments throughout the entire draw period will save you hundreds of thousands in interest and YEARS worth of payments.

If you want to learn how to secure the most affordable HELOC with the right terms for you – the Half Your Mortgage program is the perfect solution to make it happen.

We’ve done the hard part and also spent many months researching and putting this course together to help save you A LOT of time and money. We’ll show you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to shop for lenders, lock-in the best rates and so much more!

“Do You Provide Recommendations for HELOC Lenders in Other Countries?”

While we only provide lender recommendations within the United States, the Half Your Mortgage program can still be a valuable investment as it will teach you everything you need to know about HELOCs and give you a proven exit strategy to pay it off the loan in the fastest time possible!

No matter where in the world you’re looking to open your HELOC…

The Half Your Mortgage program will show you the right type of HELOC (and features) to use that will save you the MAXIMUM amount of money.

We’ll show you how to prepare your finances, boost your credit score,

calculate your debt-to-income ratio, the criteria your HELOC needs,

how to compare lenders, the questions to ask to ensure you’re getting the best rates, what to do in the event your application gets denied and more!

You’ll also get access to our proprietary calculators to make the math super-duper easy. And a list of state-specific lenders that will save you hours of research time.

If you want the BEST HELOC strategy to pay off home(s) in 7 Years or Less…

Our proven HELOC Hyperdrive Strategy that will show you how to pay off the loan in as little as 3 years.

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Book a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.