Wondering if a HELOC can be refinanced?

That’s a great question. After all, financial situations can change over time.

The ability to withdraw funds from your HELOC ends after the draw period (typically 10-15 years). As you near the end of the draw period, that’s the time to start assess if you need to refinance the loan.

The repayment phase of a HELOC is where you must begin making fully amortized interest and principal payments each month. This can last anywhere between 10-20 years and can increase your monthly payment amount (if one has only been making interest payments.)

The reason we advise against interest-only payments is because…

After 10-15 years, larger monthly payments can come as a shock when you have to start repaying the principal. Considering payments will be two to three times the amount one was used to paying during the draw period – and even higher if interest rates have risen. However…

There’s two pieces of good news…

First, if you follow our proven strategy inside the Half Your Mortgage program, you will have been making principal + interest payments from the start & should have the entire loan paid off before the repayment period begins.

Can You Refinance a HELOC?

Yes, you can always refinance your HELOC if you need to.

If you think you won’t be able to manage the payments, or if you have some additional projects you’d like to fund, you can refinance your HELOC.

Refinancing your HELOC can help you lower your monthly payment or reduce the interest rate. You can often get a better deal by refinancing if your credit score has improved recently or if choose variable rates.

Even if the new interest rate is higher than that of your original loan, this might be the best option for you because it can give you the extra time you need to use and repay the funds.

There are several ways you can refinance your HELOC…

Options

1. Talk to Your Lender – Some offer home equity assistance programs and will adjust your interest rate, loan period or monthly payments if you don’t think you will be able to keep up with payments. If you have a good relationship with your lender, there’s a good chance they’ll work with you. HELOC modifications aren’t super-common, but there’s a possibility since they don’t want to lose your business.

Loan modifications are a solution for those struggling to make payments or those with an “underwater mortgage” (An underwater mortgage is a home purchase loan with a higher principal than the market value of the home. This situation can occur when property values are falling), or for those that don’t have enough income to cover a new loan payment.

Loan modification can prevent you from defaulting on the HELOC and ruining your credit score, as well as keep you from foreclosure.

Lenders aren’t required to modify your loan, so this option may or may not be available to you. The lender may require you to complete a three-month trial period showing that you can make the altered payments before your servicer officially modifies your loan. The lender may also report the loan modification to the credit bureaus causing your credit score to drop.

2. Open A New HELOC – Some lenders will let you open a new HELOC and roll some or all of the old one’s balance into it. You’ll have to pay interest on the balance, but you’ll be back in the draw period, meaning you can continue to withdraw and avoid principal payments. This can buy you some time and allow you to delay any payments toward principal for another ten years. The negative aspect to opening a new HELOC is that you are prolonging the debt and will eventually have to repay it. The longer you put it off, the more interest you’ll pay overtime.

3. Refinance Into A Home Equity Loan – You can use a home equity loan to pay off a HELOC. With a home equity loan, you may get up to 30 years to repay your balance. With a longer term, your monthly payments may be more manageable due to their stability.

However, home equity loans require you to pay interest on the entire loan sum and extending your loan means you will pay more in interest in the long run.

Another con to this method is that home equity loan rates are usually higher than HELOC rates. This means your rate won’t increase if market rates go up, but it also won’t decrease if they go down.

4. Refinance into a New Mortgage – If you find yourself running low on options, you can refinance both your HELOC and your new mortgage into a single loan.

If you can find a mortgage with a lower interest rate than you’re currently paying this could make sense.

This enables you to get the lowest fixed-interest rates available because first-mortgage rates tend to be lower than home equity loan rates since the first-mortgage lender is the first in line (“first to lien is the first in line”) in lien priority.

You’ll also have the security of fixed monthly payments and know your total borrowing costs up front. The downside to taking out a new first mortgage may mean paying significantly higher closing costs overall than you would pay when refinancing into a new HELOC or home equity loan. Keep in mind that refinancing a mortgage means paying closing costs and fees. Closing costs to refinance can total 2% to 5% of the loan amount. This should be strongly considered as a last resort to defaulting on your HELOC.

The biggest downside to refinancing is you’ll need to requalify.

In order to refinance your HELOC, you will have to qualify just as you would to refinance a first mortgage.

You will have to qualify based on your income, equity, and home value. In order to receive the best rates, you will need an exceptional credit score in the 700+ range. Borrowers with credit scores as low as 620 may qualify, but they will often pay more than twice the interest rate of someone with an excellent score.

Lenders will also look at your debt-to-income ratio (DTI). They want to see that your existing monthly debt payments plus the monthly payment on the loan for which you’re applying won’t total more than 43-50% of your income.

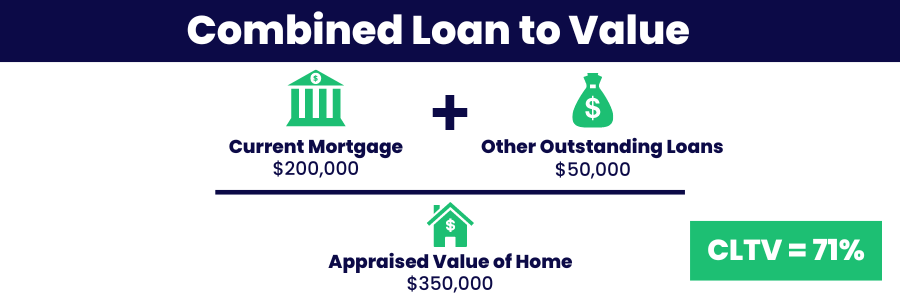

Lastly, you’ll need to have enough equity in your home after taking out the new loan to meet the lender’s guidelines for your combined loan-to-value (CLTV) ratio. That’s calculated by dividing the total amount you’ve borrowed against your home by the property’s fair market value.

If you are unable to qualify to refinance your HELOC, you have 2 more options…

Use a Personal Loan to Pay Off Your HELOC – This may be a good choice if you can get approved for a personal loan that is large enough to pay off your HELOC and you don’t plan on carrying a balance for long. Borrowers will need excellent credit to qualify for larger loan amounts with the best rates. A personal loan will give you a fixed monthly payment that you can predictably budget.

Cash-out Refinance – You may be able to use a cash-out refinance of your current mortgage to refinance your HELOC into your primary home loan. Cash-out refinancing is the process of taking out a new mortgage for more than you currently owe on your home and receiving the difference in cash. You can use that extra money to pay off some or all of your HELOC balance.

However, keep in mind that refinancing your mortgage means paying closing costs and fees. You also need to consider whether interest rates have risen substantially. If you refinance at a higher rate, you could wind up losing money and increasing the size of your monthly payment rather than saving money so this option should be a last resort.

The biggest takeaway from all of this is that you have options in the event you can no longer meet monthly payments. Because no one knows how their financial situation will look 20 or 30 years from now…

Our goal is to help you secure the most affordable HELOC that’s right for you and have you be able to pay it off in 10 years or less before the repayment period officially begins.

Inside the Half Your Mortgage program we’ll provide everything you need to find the right HELOC provider, lock-in the best rates & teach you our HELOC Hyperdrive Strategy to help you pay it off in as little as 3 years. Best of all…

You’ll also get High Credit Secrets as a FREE BONUS so you can boost your credit score to 100+ in less than 30 days! So even if you end up needing to refinance, at least your credit score won’t hold you back.

Click the link below to start saving money with you own HELOC.

Learn More About the Half Your Mortgage Program

Want to see how much a HELOC will save you before getting started?

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing.) Let’s start by running through the numbers together using our proprietary software. We’ll see how much you’ll be saving in interest & determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.