Thinking about selling your home?

Wondering if having a HELOC will change those plans?

The good news is…

You can still sell your home if you have a HELOC.

First-lien (or even second-lien).

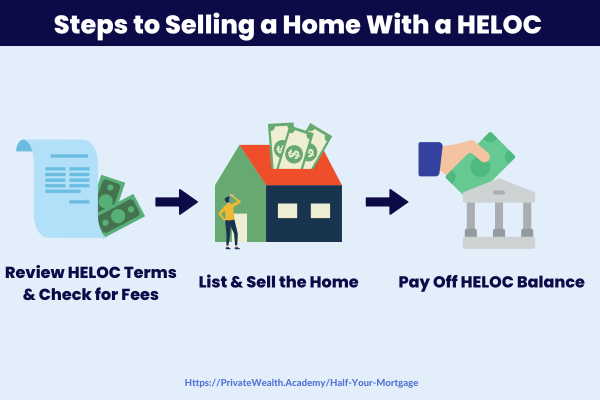

In many cases, selling property that has a home equity loan attached also shouldn’t create any issues. Typically, the HELOC is paid off at closing. This means also using the proceeds from the sale to pay off the home equity loan in full. This will also reduce the interest payments you would otherwise make over the life of the loan.

There are two things to avoid to ensure all goes smoothly…

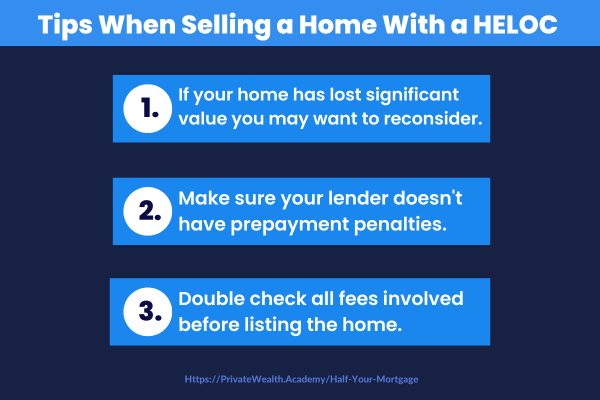

One issue may arise if your home has lost value (~50% or more) since you took out your home loan. In some cases, this can mean that the sale proceeds aren’t enough to pay back the loan. Some lenders are flexible in cases like these and will also waive their claim to the whole amount of the loan. This is called a short sale. In some cases, however, you will have to find another source of money to repay the remaining amount.

A second complication can arise if your lender imposes early repayment penalties on your equity loan. Because these loans are often designed to be long-term commitments, you are also liable to pay penalties.

As long as the lender doesn’t have any prepayment penalties or you keep the loan open for at least 2-3 years before selling, you shouldn’t have an issue.

Are There Fees for Selling a House With a HELOC?

Sometimes. Some home equity loans & HELOCs have early repayment penalties that will apply if you sell your house to pay off the loan. Make sure you contact your lender before you list the home to check if this applies to your loan.

Whether you’re a real estate investor, found your dream home or simply need to sell your current property – you can rest assured that having a HELOC won’t stop you from selling.

If you’re ready to turn your equity into cash – the Half Your Mortgage program will help make the process as simple & easy as possible.

We’ll show you how to… find your amount of borrowable equity,

calculate your debt to income ratio, lower your DTI, what to do in the event you get denied, calculate how much you’ll be spending on interest & payments. PLUS…

You’ll also get access to our custom HELOC calculators, a list of state-specific lenders, a bank questionnaire so you can ensure you’re getting a HELOC with all the right criteria (and most affordable rates.)

Of course you’ll also learn the most important part – the right exit strategy.

By following the time-tested HELOC Hyperdrive strategy found in

Half Your Mortgage you can pay off your home in 5-7 years on average – with the ability to pay it off in as little as 3 years.

If you’re ready to get started improving your cash flow by and saving tens to hundreds of thousands of dollars…

Click the link below to make the best use of your equity so you can maximize your cash-flow and finally have the financial leverage you need.

Learn More About the Half Your Mortgage Program

Got questions? Or just want to speak with a team member first?

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.