Wondering how a cash-out refinance compares to a first lien HELOC?

As your mortgage matures, you’ll typically gain equity in your home. Home equity is your property’s value minus what you currently owe on your mortgage.

For example, let’s say you purchased your home for $300,000, and after a few years of making payments, you’ve lowered your mortgage balance to $200,000. Assuming your home is still worth $300,000, that means you’ve built up $100,000 worth of equity in your home.

Cash Out Refinance vs HELOC

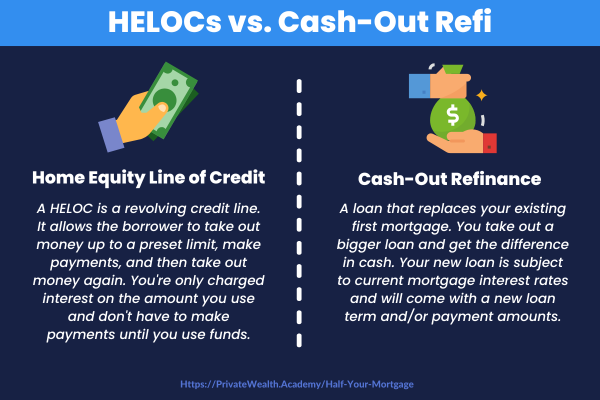

Both cash-out refinances and HELOCs capitalize on your home’s equity by allowing you to tap into a portion of it and use it like cash. But there are some key differences…

Cash-Out Refinance

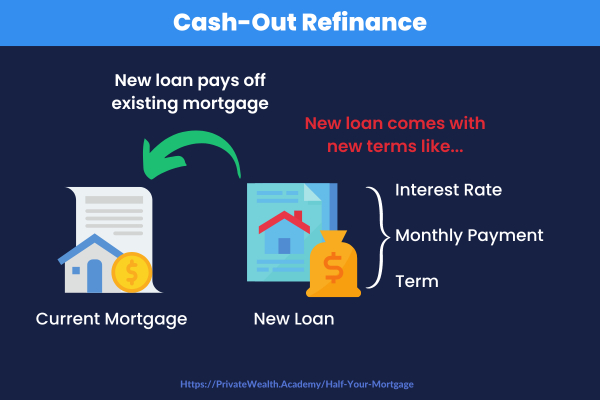

Similar to a second mortgage, in which one takes out a second loan with its own separate monthly payment – a cash-out refinancing loan is a new home loan used to pay off your existing mortgage.

Through this process, you take equity out of your home by refinancing to a higher loan amount (which could increase your DTI & monthly payment).

The process of a cash-out refinance is much like the process you went through for your primary mortgage. You’re simply using a new mortgage to pay for the original mortgage.

Here are the Basic Cash-Out Refinance Requirements:

Existing home equity: You need to have at least 20% equity in your home to capitalize on this type of refinance.

Credit score: 620+

DTI ratio: For conventional loans, you’ll need a debt-to-income (DTI) ratio of less than 50%. For FHA and VA loans, your ratio can be higher. Your DTI ratio is your total of all your monthly expenses divided by your monthly income

The three biggest downsides to cash-out refinances is that…

- Will generally increase your DTI ratio & monthly payments.

- You’ll have to pay closing costs again (2-5% of the loan amount.)

- Even though cash-out refinances typically have slightly lower interest rates than HELOCs – due to the fact that you’re forced to pay interest on the entire loan sum can really rack up the total amount of interest you’ll pay over the loan term.

You might not want to do a cash-out refinance if:

- You want to pay off your home as fast as possible.

- The closing costs are unreasonable.

- You want to save as much as possible.

- You don’t trust yourself to spend the money wisely.

- Cash-out refi rates are higher than your current mortgage rate or HELOC.

Home Equity Line Of Credit

A home equity line of credit (HELOC) can allow you to access 80-90% of your equity (in some cases up to 100%.) This type of home loan works as a revolving line of credit in which you can withdraw up to your loan limit, pay off the balance & repeat any time during the draw period (the first 10-15 years.)

Once your draw period ends, you can no longer withdraw funds.

The Basic HELOC Requirements:

Existing home equity: a minimum of 10% equity

Credit score: 680+ *Some lenders may accept lower scores down to 620.

DTI ratio: 43% or lower.

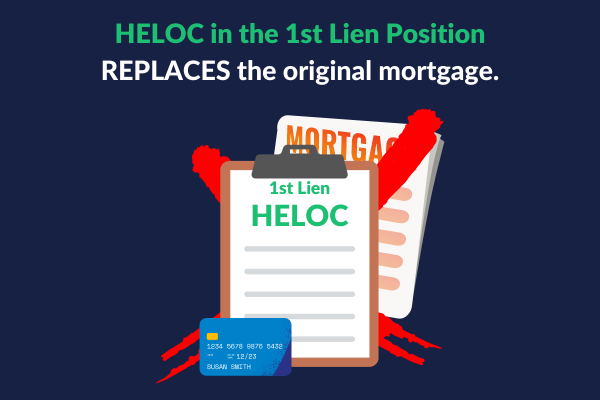

How A First Lien HELOC Works: A first lien HELOC works by replacing your existing mortgage. It takes over as first lien or first mortgage. But unlike a traditional mortgage, it also works similar to a home equity loan. You can also withdraw cash for the duration of the draw period without having to sell or refinance.

When deciding between a cash-out refi and a HELOC, here are some things to consider…

Unlike home equity loans – which come as a one-time, lump sum of cash – HELOCs offer flexibility because you can simply borrow the funds you need (and only pay interest on the amount you use.) Plus, you can withdraw funds for many years! Making HELOCs an affordable and popular option.

Don’t Forget Taxes

There are also tax implications of refinancing versus taking out a line of credit.

Because refinances are considered loans, you would not need to include the cash from your cash-out refinance as income when filing your taxes.

Also depending on what your cash is used for, the interest may or may not be tax deductible.

We like to help you mitigate risk whenever possible that’s why we recommend…

Even if speed isn’t what you’re looking for, the repayment flexibility that a HELOC offers including the ability to only pay interest on the amount used – is hard to beat…

If a cash-out refinance isn’t the best or most affordable option for you…

The Half Your Mortgage program will help you save tens to hundreds of thousands of dollars over the course of the loan & maximize your cash-flow by teaching you how to properly utilize a home equity line of credit.

In case you didn’t know: this program was developed with the help of real-life HELOC loan originators. So you can be sure the information is accurate, up to date and comprehensive.

As an HYM student you’ll get access to our exclusive HELOC knowledge, video training, a detailed written guide, access to our proprietary calculators,

you’ll learn how to secure a HELOC with all the right features, teach you the proven techniques to pay off the loan in the fastest time, along with a curated list of lenders in your State(created just for you) to help you get the best terms, one-on-one support, and much more.

Click the link below to get access today & learn everything you need to know about HELOCs to get approved and start using your home equity like cash.

Learn More About the Half Your Mortgage Program

Instead of wondering if a HELOC is right for you…

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call now.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.