Can’t decide which bank to open your business checking account with?

We totally get it. There are also a lot of options out there…

Before you choose a business checking account…

Do you know the difference between a bank and a credit union?

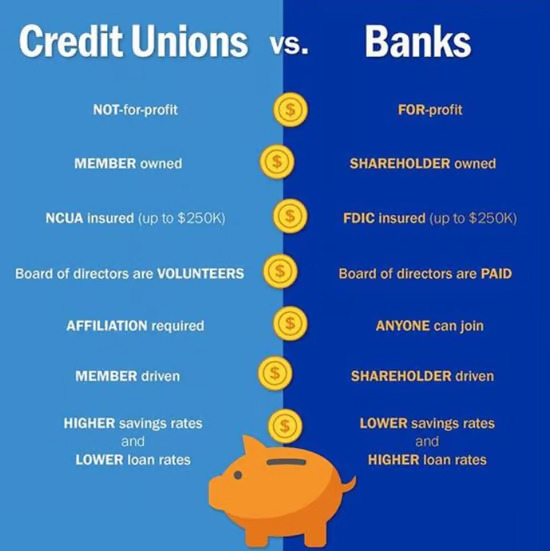

Banks are for-profit institutions. As well as, credit unions are categorized as nonprofits and also typically offer better rates and also lower fees. However, membership is typically required to become part of a credit union.

Here’s a few questions to decide which one may be best for you…

1. What Do You Need in Your Bank? What Features Are Available?

Do you need mobile deposits, the ability to quickly transfer funds between accounts, pay bills (individually or via an autopay function) or also the ability for instant credit approvals? Or perhaps you’ll be making lots of deposits or also other transactions, need invoicing or payroll services, or employee cards with set limits.

What Funding Features Do You Need in Your Bank?

While you are in the early stages of launching a business, you’ll probably want to open a business credit card for business purchases. You may want to establish a business line of credit (a source of funds you can access on an as-needed basis). Doing so will be slightly easier if these options are available from the bank where you have a business checking account.

While it’s best to have ONE MAIN business bank account that you primarily operate out of, the good news is, you can always open another bank account down the road in order to meet financing requirements.

***Inside our Corporate Credit Secrets program we give a breakdown of all the major national banks and their features as well as some invaluable tips for choosing the best local banks and credit unions for your business.

If cost is your number #1 priority also look closely at the account requirements…

2. How Important Is Location to You?

How close is the bank to your office, home, gym, etc? Consider how often you’ll be making trips to the bank…

Consider the nature of your business and also how often you will need to frequent the bank when making your decision.

3. What are the Fees & Requirements? Any Flexibility with the Fees?

Banks typically charge maintenance fees for a business checking account. Most banks waive these fees if you meet a certain minimum balance requirement each month.

It’s also common, for banks to charge a flat fee if you withdraw funds from other institutions’ ATMs. Some banks charge deposit fees if you exceed a set limit on the amount of money or number of deposits you can complete each day, week, or month.

Similarly, savings accounts have a minimum deposit or minimum balance requirements. Monthly maintenance fees may also apply, depending on the financial institution. However, some banks waive some or all of these if you satisfy other requirements – for example, your business checking account was opened at that institution, and the balance you keep in that checking account remains at or exceeds a set threshold.

4. Is There an Introductory Offer?

Many banks also promote introductory offers as a way to entice business owners to open a business account with their bank or credit union. Some offers also include bonus cash for making an initial deposit of a certain sum and maintaining the balance for a certain period of time (typically a few months). As well as, others offer lower fees to businesses opening new accounts.

5. Will an Online-Only Bank Be Able to Meet Your Needs?

While you may be attracted by the lower fees and convenience of an online business checking or savings account, stop to consider if you’re willing to accept the trade-offs.

6. Fund Protection & Insurance? Is the Bank Actually a Bank?

The Federal Deposit Insurance Corporation (FDIC) provides financial institutions with insurance for all types of deposits received there, including but not limited to checking and also savings account deposits. Ensure that the bank you choose is also FDIC-insured.

7. Are You Hoping to Apply for an SBA Loan?

If so, you may want to consider developing a relationship with an SBA lender. However, the SBA has specific preferred lenders in their respective states.

What Information Is Needed to Open a Business Bank Account?

Virtually all banks and/or credit unions will ask for the following:

- Your business’s legal name, as it appears on documents filed with your state and also the IRS. If your business is a sole proprietorship and its name differs from your own, you may need DBA (“Doing Business As”) registration.

- Your EIN, if your business is a corporation or an LLC. The bank wants this as proof that your business is legitimate.

- Your business address – the one you used to license your business.

- Your contact information, including your business’s phone number, email address and also website.

- Your driver’s license number.

- Other photo proof of identity, such as a passport.

- If your business is an LLC or corporation

The bank may also require you to provide:

- Your business’s partnership agreement, if you operate a partnership

- Your business’s articles of organization, if it’s an LLC

- Your business’s articles of incorporation, if it’s a corporation

- Your business license

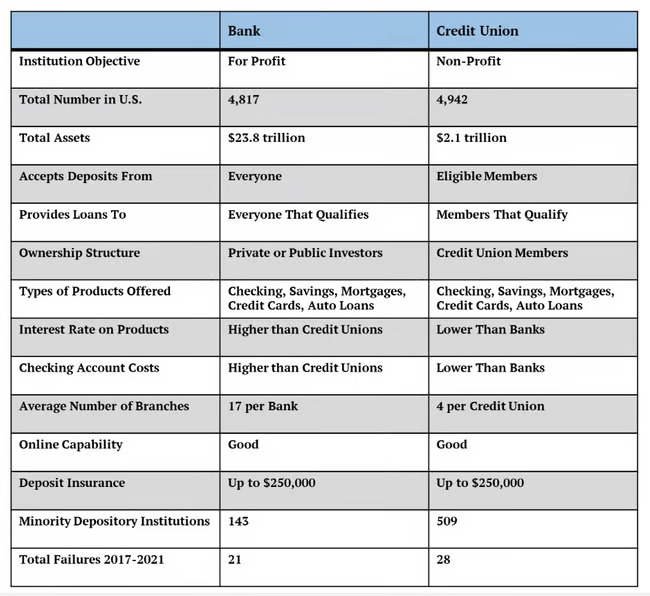

So Which Is Better – Big Banks, Little Banks or Credit Unions?

All can have their advantages depending on your business. Big national banks have the advantage of a wider range of credit options (especially for SBA loans & credit cards).

If you’ve been in business for 2+ yrs and have steady income with tax returns to show, a big bank can work out for funding needs, especially if you’re looking for high-limit loans. However, local banks and also credit unions are almost always the better choice for small business to secure more funding because credit unions often serve as their own underwriters.

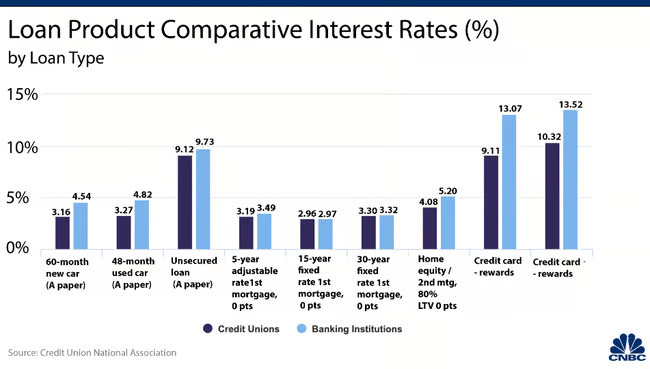

The chart below compares the average credit union interest rates with average bank interest rates (based on data from the Credit Union National Association).

Join the Corporate Credit Secrets Program and also we’ll show you exactly what to look for to find the perfect bank (or credit union) for your business and how to quickly secure high-limit credit for your company – even if you’re a startup.

Learn More About the Corporate Credit Secrets Program

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.