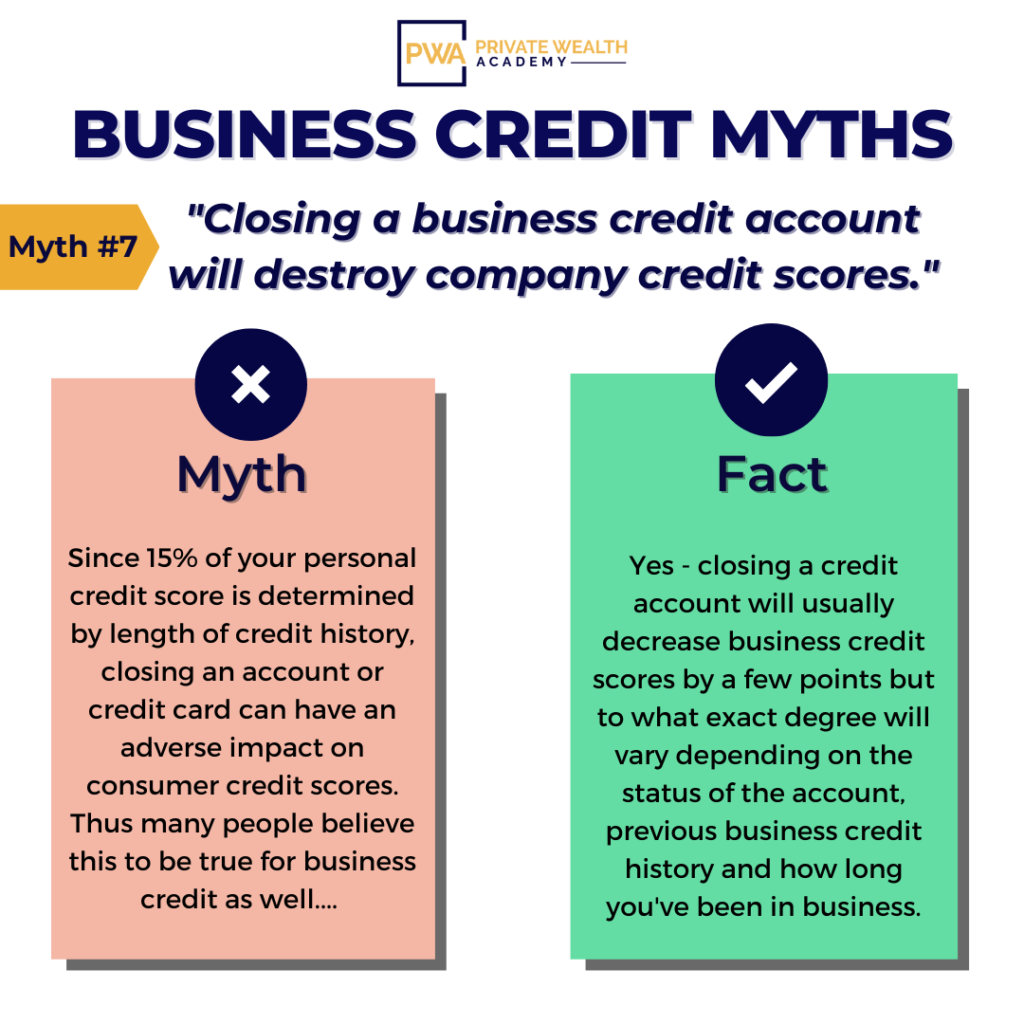

Ever wonder how closing account affects your corporate credit scores?

That’s a great question! Especially when you consider that 15% of your personal credit score is determined by your length of credit history.

So it’s easy to see why people might think that closing an account would also significantly reduce your corporate credit scores.

While corporate credit scores – it’s slightly different…

Generally speaking, length of credit history is still very important so while business credit accounts otherwise have little impact on your personal credit score, closing an account will still likely cause your scores to drop slightly.

So this myth is TRUE – it probably won’t destroy your scores but you can expect a bit of a drop in your scores overall.

The good news is, before you close any accounts – you can double check that your personal credit won’t be affected by using Credit Karma (Free).

You can double check by logging into a site like Credit Karma and clicking on “age of credit history.” It should show you a list of all the cards aging on your personal credit report.

*You can also ask the lender of the business credit account in question if they report closed accounts to the consumer credit bureaus – if they don’t, you’re good to go ahead and can close the account without consequence.

Now you’re probably wondering…

“How does closing a credit account affect your corporate credit scores?”

Well, you will probably see a bit of a decrease from the initial closure but to what degree will vary depending on the status of the account, previous business credit history and how long you’ve been in business. However, payment history is an extremely important factor for corporate credit and makes up the largest percentage of a company’s credit scores.

For example: a company that has a long-standing business credit history, excellent payment history with an account that’s fully paid up and in good standing may not experience much if any of a change to their credit scores from closing an account. On the other hand, a new company with little to no credit history that tries to close an account with unpaid debt will most likely see some kind of decrease to their business credit scores. Make sense?

BEFORE you close an account – here’s a few important things to keep in mind…

If you go close an entire account with a creditor you have multiple cards with (like a Chase account) and you want and try to apply for the same cards again in the near future – you may have trouble getting approved due to the 5/24 restrictions (meaning no more than 5 hard inquiries within 24 months.)

Fortunately, there are some proactive steps you can take to mitigate any decreases to your personal and business’s credit scores BEFORE you cancel your card or credit account.

- Open another credit card so that your company’s credit can bounce back. (Even secured credit cards can help you achieve this goal.) You don’t have to use it often, and don’t cancel your card immediately after receiving the new card. Slow down your spending first, and give it some time.

- Pay off all outstanding balances, even if it takes you several months. It’s worth it to set things right with the bank before closing the account, rather than creating a situation where the bank will want to sue your personal assets for the outstanding balance.

- It’s possible your bank won’t report on your small business card. According to the Consumer Financial Protection Bureau‘s report, banks “issuing revolving credit to consumers usually report information monthly on consumer cards. But these banks are also less likely to report on small business cards even when these are owed by, and underwritten based on, the personal credit history of the business owner.” To confirm whether this is the case with your card and bank, call and ask.

Our advice is this…

Remember it’s often better to have accounts that you don’t use at all, then to close the accounts you don’t use.

If you can keep the account open without it busting your budget – simply keep it (especially if it’s one that reports to the business credit bureaus).

Ready to stop all the guess work?

Want a proven system guaranteed to quickly increase your fundability and show how to secure $100,000 in credit in 6 months or less?

Learn More About Corporate Credit Secrets

Want to improve your credit approval rates? Tomorrow we’ll share one simple thing that many owners overlook that could be affecting your approvals (and credit limits). So watchout for our post.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.