How much home equity do you have right now?

Are you in your home because you enjoy it? Or because you enjoy your current mortgage rate?

More and more people aren’t making homeownership decisions based on where they live or even their home’s features…

A record number of homeowners are “suffering” from what the Urban Institute calls the “I hate my house, but I love my mortgage” syndrome.

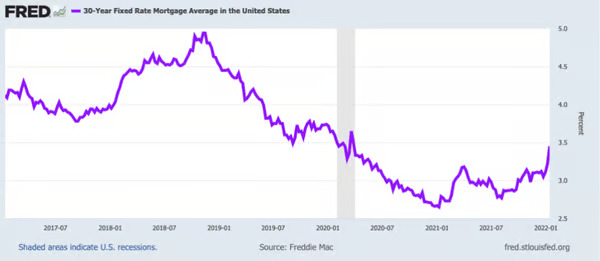

Millions of people are deciding whether or not to move or buy because they either can’t afford a higher mortgage rate or don’t want to give up their ultra-low 2-3% interest rate.

Back in the day, you might see these folks doing a cash-out refinance. But that would be nuts right now! You’d wind up paying a higher rate.

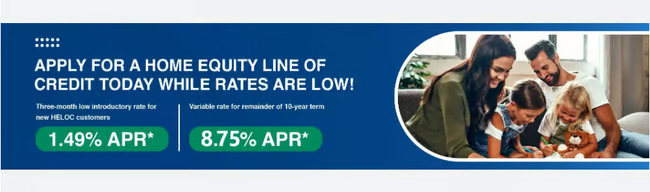

That’s why home equity lines of credit look like gold compared to traditional mortgages.

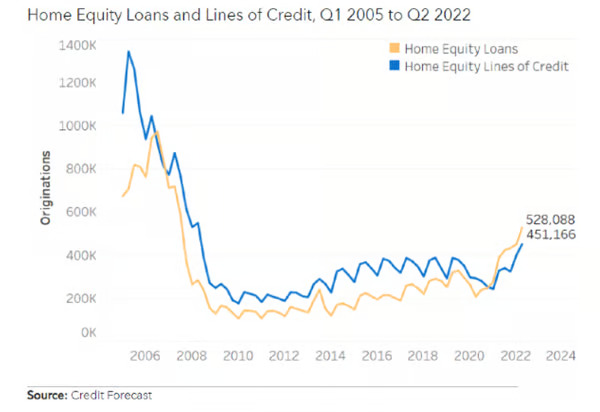

In fact, HELOC originations soared in the third quarter of last year. They let homeowners borrow a certain amount of money based on the home’s current value and your percentage of equity.

It also helps that homeowners are sitting on record levels of equity. In fact, the average homeowner has over $270,000 worth of equity in their home.

That’s A LOT of money that could be put to better use, wouldn’t you agree?

With the flexibility that a HELOC offers, you can pay it off quickly (and usually with no penalty for early payments.) This expands your wealth portfolio and boosts your cash flow significantly. Helping you meet financial goals faster and allow you to pay off your loan in 5-7 years with the right financial exit strategy in place(like the one we teach inside the HYM program.)

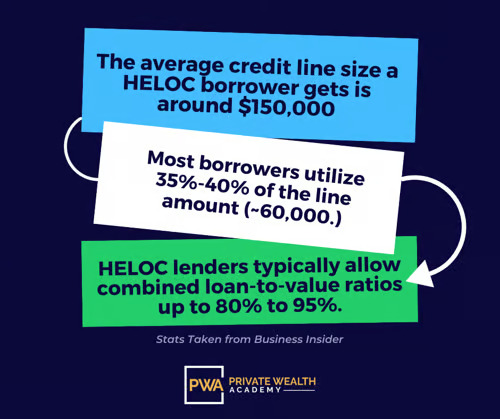

Here are some other interesting things you may not know about HELOCs. For example, did you know that…

The average credit line a HELOC borrower gets is ~$150,000. Most borrowers utilize 35%-40% of the line amount (~$52,500 to 60,000.

More good news is that if you have 10-20% equity in your home, HELOCs are pretty easy to qualify for, even if you don’t have the best credit score.

The great thing about HELOCs is that…

They have lower interest rates than most other credit or financing products.

HELOCs have…

20% lower interest rates than business loans…

25% lower interest rates than personal loans…

55% lower interest rates than credit cards!

HELOC interest rates are between 4-11% on average.

They’re one of the most affordable types of loans available and give you more flexibility as a borrower than almost any other type of loan. And do you want to know the BEST part?

Even if you end up with a variable rate loan & interest rates continue to climb, HELOCs are still going to be the more affordable borrowing option.

Due to their unbelievable flexibility, even if rates are high – HELOCs can still save you enormous amounts of money! Pretty cool, right?

Another hidden perk of variable interest rates is that…

As rates come back down, borrowers can automatically benefit from those lower rates, whereas borrowers who have a fixed rate option would have to refinance out of that in order to benefit from lower interest rates.

Ready to get the ball rolling – but not sure how to start the process?

That’s why we’ve created the Half Your Mortgage program…

We’ll dive deeper into the math, showing you exactly how much you can save when you make the switch to a HELOC. You’ll even get access to our proprietary calculators that makes the math easy-peasy.

Not only will you learn how to quickly open your own first lien HELOC, you’ll be able to save so much time and money by utilizing our tips, and resources such as our curated list of lenders with affordable rates (in your exact state.)

Ready to take advantage of the lowest interest financing available?

It’s a great time to start! Click the link below to learn everything you need to know about securing the perfect HELOC so you can get approved for the highest limits & start making your equity work for you.

Learn More About the Half Your Mortgage Program

Want to review the numbers first?

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.