“Is it really necessary to open Net vendor credit accounts before you apply for other types of business credit?”

“Or can I completely skip the ‘tradeline building’ process?”

We get it… You want unsecured ‘cash’ credit and you want it NOW…

We know – we know. BUT not every business has the creditworthiness to receive $50,000, $100,000+ in unsecured business credit right off the bat…

Before we go too far, let’s get clear on what tradelines are.

Tradelines are credit lines (or accounts) you establish with creditors that report to the business credit bureaus (1 trade line per account).

*These aren’t necessarily JUST vendor credit, however vendor credit accounts will approve almost all businesses.

The more tradelines on your credit profile (and longer the payment history) – the stronger your credit will be.

While most owners want to immediately apply for a high limit credit card or loan – there are two problems you’ll run into…

#1 – You’ll almost always have to supply a personal guarantee

#2 – If you have no income to show, you can kiss your approval goodbye.

But there’s a way around this – using vendor credit accounts to build a corporate credit profile…

In order to even get your company a credit score with the bureaus – you’ll need at least 5 accounts reporting.

Establishing your first initial tradelines (when you have little to no business credit history) can be easily accomplished with net vendor credit accounts. For example: Net 30 accounts *The number denotes when the account needs to be paid in full – 30 days is the most popular.

What Are Net Vendor Credit Accounts?

Net vendors are merchants that allow you to buy products and services with their company now and pay later via business tradelines.

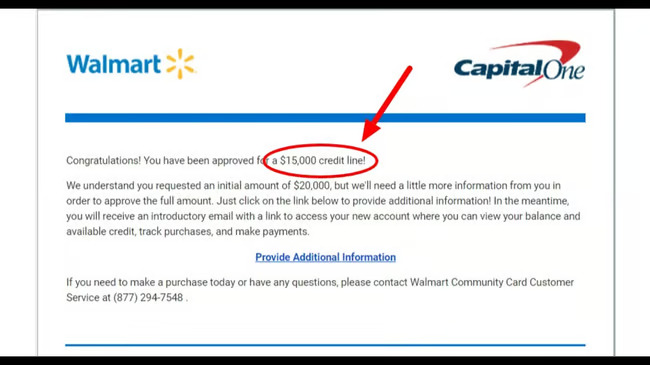

Retailers like office supply stores, Lowes, Home Depot, Walmart, Amazon and many others offer net term accounts with the ability to pay later.

Why Do People Still Use Net Vendor Credit Accounts?

We’ll be going into more detail about this in another post but net vendors have the least amount of qualifying requirements compared to banks and credit unions. So they’re seen as an excellent ‘foot-in-the-door’ when it comes to quickly establishing business tradelines and payment history.

Net vendors credit accounts are also the most common lenders to report to the business credit bureaus. And since only accounts that report will help build your score – they’re a great way to ensure you’re actually boosting your scores.; which will improve your chances of getting approved.

Want access to over 200+ vendors that actually report to the business credit bureaus? Join Corporate Credit Secrets for access to our ever-growing list.

Aren’t Net Vendor Credit Accounts Basically Store Credit?

Yes, net vendor accounts are a form of retail credit. But think outside the box. There are lots of things you can still do with retail credit. If nothing else, you can purchase items to sell OR buy gift cards to sell – either way, you can walk away with cash in hand.

So to answer the question above…

Yes.

You could skip this process…

But we do not recommend it. Especially if you’re a new business or have little to no established credit (with the business credit bureaus).

If you want to secure business credit without a personal guarantee…

And want to be able to secure higher limits & better terms as fast as possible

Take the time to establish these tradelines the way we show…

That way, you can build up your business credit profile and make it much easier to get approved for the high-limit unsecured credit you seek.

You have to look at the big picture as a business owner…

Sure, you might have to put in some time and effort to get them established.

And you might have to pay a couple hundred bucks in the process…

But if you were able to get approved for $50k… or even $100k+ in business credit… It’d definitely be worth it, right?

So all in all – we don’t recommend you skip opening those first initial tradelines even if some of them happen to be net vendors – it’s worth it.

“Are there people who skip it and still get approvals?”

Sure – but from our experience…

Companies that establish 5-10 tradelines get way more approvals than the companies with no business credit tradelines.

So if you haven’t done this, join the program and follow our instructions.

Why not learn the process for yourself and choose the right offers for you.

Learn More About the Corporate Credit Secrets Program

Wondering what could be so great about vendor credit? We’ll share the top benefits of this commonly overlooked credit sector in tomorrow’s post.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.