Wondering what you should be investing HELOC funds into?

Yesterday we talked about how to use a HELOC for debt consolidation. While that can help you save a lot in interest, it’s not able to earn you more money.

If you’re not using your home equity to pay off your home faster or reducing high interest debt – we highly recommend you spend it on something that will increase in value.

Here a few wise ways for investing HELOC funds:

►Real Estate Investing – The HELOC is an excellent financial tool that many people use as an entry point to invest in real estate. Because of its repayment flexibility, it allows investors an efficient mechanism to buy and sell properties regularly without having too much equity “tied up”. There are many REI methods. One is to use a HELOC to fund a quick “fix and flip” that will only take a few months to complete and won’t break the bank trying to carry the property until it’s sold. It also makes a better tool than home equity loans since you don’t have to know the exact amount you’ll need and can use the same line to withdraw and pay down repeatedly.

►Home Renovations – Using HELOC funds to make repairs or renovations is an excellent way to invest the funds. This is a win-win as it will increase the value of your property and help build even more equity into the property. Plus, the interest can also be tax deductible per IRS regulations if it is spent on the primary or second home residence.

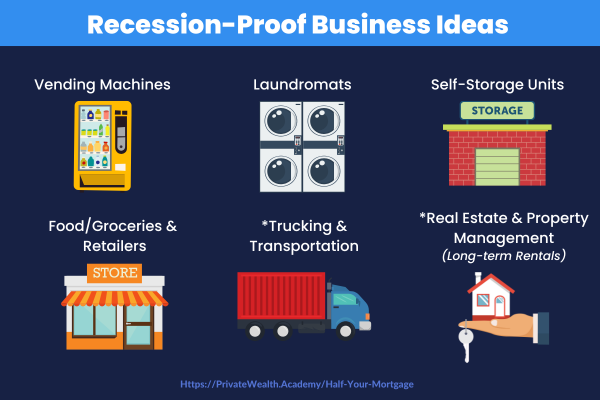

►Business Opportunities – Is a business loan bleeding you dry? Would you like a lower interest rate when paying for business expenses? Or need working capital for a great new opportunity? Applying for business loans can be a long and difficult process that can take 45-60 days. Lower interest SBA loans may take up to 3 months to secure. Tapping into your home equity may prove the smarter decision in the long run for a few reasons: 1. You will typically pay lower interest rates. 2. You have flexible repayment options. 3. You can close on the loan & begin withdrawing funds in about 33-45 days.

►Investing in Gold & Silver – In a volatile market, there’s one place you can park your money that won’t lose value – gold and silver (especially gold.)

Here’s why…

- Inflation-Proof – Whether the nations’ currency’s value decreases or increases, gold and silver are not liable to that uncertainty. According to historical analysis, precious metals are renowned because they perform well, even during economic devastation and depression.

- Universal Value – Gold and silver will always be in high demand & do not lose their intrinsic value. In fact, wherever you are in the world, precious metals remain precious commodities!

- High Liquidity Rate – Gold and silver have very high liquidity compared to most of the other investments. Since they are highly valued, this makes converting them to cash very easy anywhere in the world.

- Gives You Privacy – Most investments in this modern-day need the expertise of a third-party financial consultant or financial institution. This means that you need to contact a third party before you can access your investments. You can avoid this to a large extent by investing in gold and silver bullion. With these, your investments remain — private.

- Topnotch Generational Investment – If you have been thinking of assets you can leave behind for your future generations, gold and silver might be the answer. You can consider preserving gold and silver and leaving it behind for your great-grand-children and their children. They would be glad you did! Because the value of the gold and silver appreciate over time.

►Market Investing – If you have a good history with trading and you know what you’re doing – proceed with caution. However, if you’re just getting into the stock market game – DO YOUR RESEARCH and talk to a few financial advisors before putting your valuable equity into the market.

For now we highly recommend sticking to precious metal markets like gold and silver to significantly reduce market volatility & risk. After all, this is your home equity you’re investing with. Playing the stock market is always a risk and performance is never guaranteed.

►Higher Education – Many people use the funds from their HELOC to pay for college tuition. It can also be used for continuing education or to add any certifications to your profession. However, you should consider the rate you could get on a traditional federal student loan before deciding to use your home’s equity for this purpose.

There are so many advantages to using a HELOC for investment purposes. Just imagine being able to lock-in a HELOC with rates a quarter of what they are for your credit cards & being able to spend up to your limit, pay it down and re-spend for 10-15 years! Pretty sweet, right?

However, it is important to put consideration into your personal circumstances and investments make the most sense for you right now.

The most important thing to keep in mind when it comes to investing HELOC funds is…

How soon can you expect to make your money back (i.e. reach the break-even point)?

If the answer is more than 1-2 years – proceed with caution.*The one exception to this is higher education expenses, as long as you make principal + interest payments during the entire loan term.

We’re ultra-conservative investors here but…

By ensuring you can make your money back within a short time frame will allow you to pay off the HELOC fast and give you the best opportunity to increase your cash-flow without worrying about how to pay off the loan before the draw period ends (even in the event that something goes wrong, like contractors don’t finish on time or a buyer backs out of the deal.)

A HELOC can be an excellent investment tool for extra leverage – especially when you have a clearly defined exit strategy in place.

Don’t you think you could DOUBLE, or even TRIPLE your wealth with an extra $25,000, $50,000, $100,000+ in cash to invest with?

That is what’s possible with a HELOC…

Wondering what other ways a HELOC can benefit you as an investor? We’ll be covering that in tomorrow’s email. So keep an eye out for it.

No matter what you choose to invest in, the Half Your Mortgage program will teach you how to keep your costs LOW and pay it off the balance in the FASTEST time possible (without changing your current income!)

Using HELOCs for investments allows you to take advantage of…

- Lower interest rates

- Only getting charged interest based on the amount you use

- The ability to withdraw funds for 10-15 years (making it perfect for renovations, unexpected expenses or on-going costs.)

The current equity & easily increase the property value

The ability to save 80% or more in interest when paying off a home - The current equity & easily increase the property value

- The ability to save 80% or more in interest when paying off a home

We’ll show you how to find the right first lien HELOC, teach you the exact criteria to look for, how to prepare your finances, how to calculate the interest (so you know how much you’ll be able to save), how to find the best HELOC lenders, how to lock-in the best rates and so MUCH MORE!

And if that weren’t enough…

The average student saves $14.5K every 6 months using our program!

Ready to step up your investment game?

Click the link below to learn everything you need to know about using HELOCs for investments.We’ll even teach you a few of our favorite real estate investment tips and our long-time banking secret so you can earn a 12% ROI annually.

Learn More About the Half Your Mortgage Program

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Schedule a call with us TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.