Do you know one of the very first steps you need to take before funding your business?

It’s establishing your business credit profile and scores.

Here’s an important tip before funding your business…

If you’re like many owners out there, you may have recently come to learn that businesses have separate credit scores and they do not get established automatically like personal credit scores do.

And get this…

Small business owners who know their business credit scores are 41% more likely to be approved for a bank loan.

That’s just one good reason to pay attention to your business credit…

Overall, your business credit profile acts like your financial resume.

And there are many parties who can see & use this information:

Other credit & information bureaus

Banks

Lenders

Certain employers

Auto dealers/lenders

Mortgage lenders

Business partners

When funding your business, it’s important that you know what’s being reported about your company’s financial history.

It will also allow you to understand creditworthiness and how you measure up for lenders so you can reach your business credit goals much faster.

There are 3 major business credit bureaus used for business credit profiles:

- Dun & Bradstreet (D&B)

- Equifax Business

- Experian Business

If you want more info. & how to register your company with the bureaus…

We break this down in detail in the Corporate Credit Secrets program.

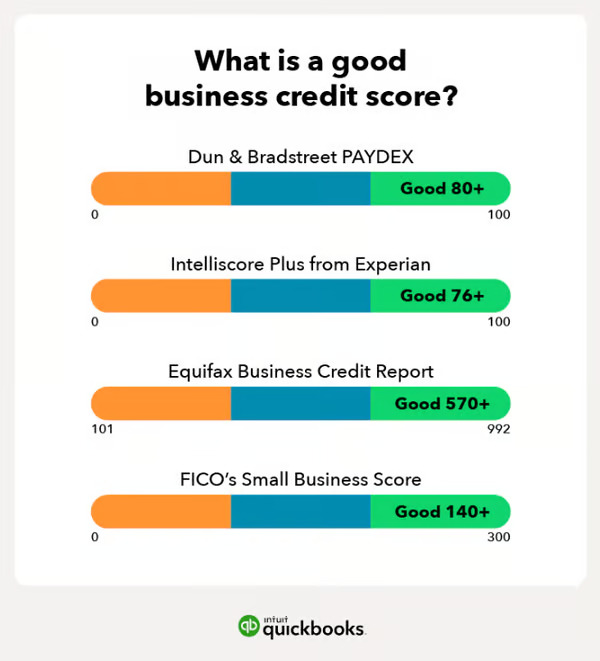

This image shared by QuickBooks sums it up perfectly!

*FICO’s Small Business Score (SBSS) isn’t as widely known.

It ranges from 0-300 and is a measure of a company’s creditworthiness and credit risk. As with personal credit, the higher your score, the better.

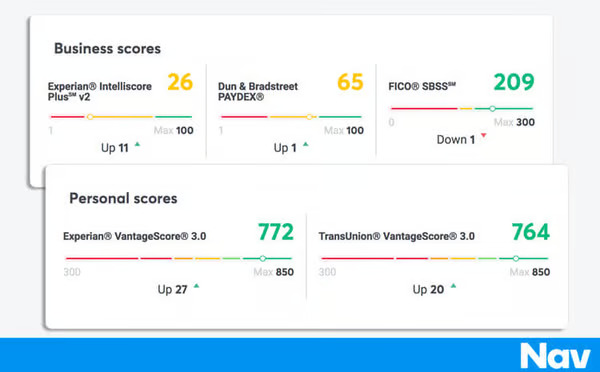

An important step to take before funding your business is having a way to monitor your business credit scores.

Want FREE Access to All 3 Big Business Credit Bureau Reports?

Nav will be your new best friend! Just follow these steps:

1. Create an account on Nav.com to get started

If you want to track your progress building business credit but don’t want to commit to a paid plan, you can always check your business credit for free on Nav.com. As long as you’ve registered your business in your state, you should be able to find it in their directory. Simply run a search and make sure the correct information is connected to your account.

2. Follow their prompts and enter your information.

Based on the information you submit, they will provide you with relevant, business credit boosting tips and funding offers from their partners.

Once you’ve registered, you will have access to all three of your free business credit scores, Business Risk Grade and alerts to changes on your business and personal credit profiles. Pretty sweet, right?

It’s the best way to monitor your company’s credit scores FOR FREE.

It will be your new best friend when funding your business & obtaining credit.

Of course, if you want to upgrade to the paid options to gain a deeper insight into your business and personal credit profiles… You can do that too.

Unlike some credit monitoring tools, we think Nav is worth it because…

You can also use Nav to build your business credit.

While Nav isn’t technically a net-30 vendor, paying your bill every 30 days for one of their paid plans (Nav Prime – $49 per month) can get payment history reported to Dun & Bradstreet, Experian Business and Equifax Business credit bureaus. You can even automate payments so you never have to keep track!

You’ve learned one of the first steps to take when funding your business – ready to learn the rest?

Want Step-by-Step Help Funding Your Business?

We’ve got MANY MORE business credit tips and tricks to share with you.

Whether you have yet to register your new company or you’re been in business for years…

If you want to learn how to become a highly fundable company and secure $100,000 in credit for your company in 6 months or less…

Click Here to Start Getting Corporate Credit Today

This program is BEGINNER FRIENDLY! Even if you haven’t gotten your company registered with the Secretary of State yet, we can help you through this step as well and all the rest that come with it!

Wondering what is considered a good business credit score? Don’t miss tomorrow’s blog post – we’ll be reviewing the 4 main credit scores.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.