Have you been wanting an inside look into our business credit builder program?

If you’ve been able to stick with us over the last week, give yourself a pat on the back! You’ve learned a lot about corporate credit and why it’s worth the time to establish a separate credit profile for your business.

We’ve gotten a number of emails recently asking us questions about our business credit builder program Corporate Credit Secrets.

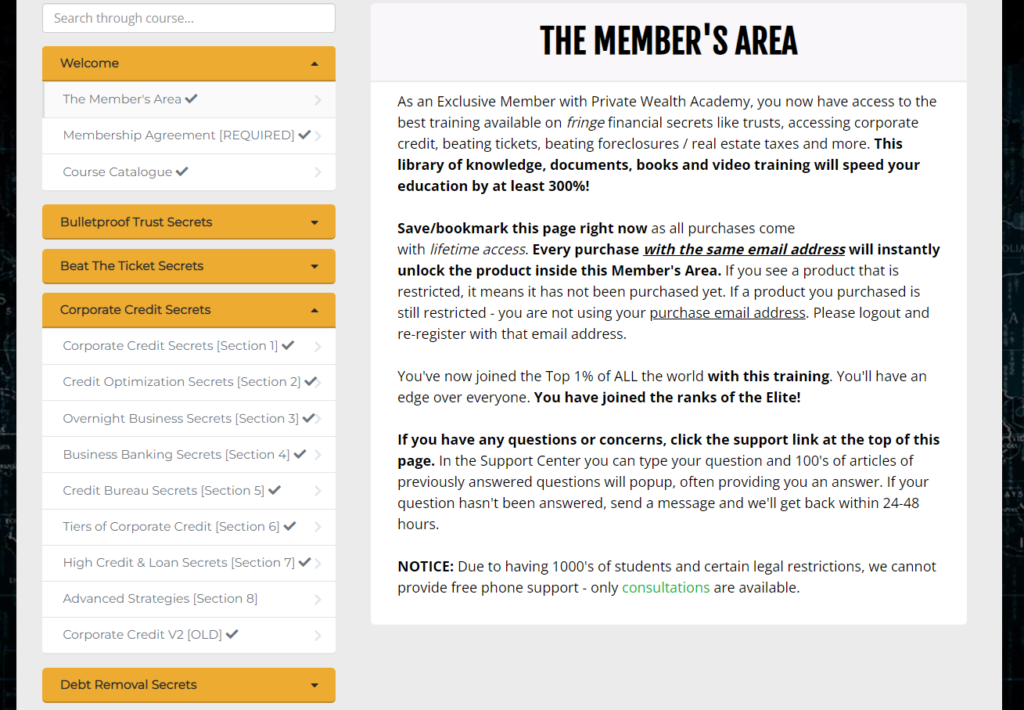

Here’s a sneak peek into our business credit builder program…

The 8 Sections of Corporate Credit Secrets

1) Business Credit Basics

This section will set the foundation and cover the most important aspects of business credit. We’ll give you an overview of the process and show you how to build your profile efficiently. We also cover the differences between various types of business financing and the resources you’ll need to begin the process.

2) Company Structure

The first step in the credit building process is to properly separate your personal finances from your business ones. So in this section we’ll review the various types of company structures. We’ll also provide a list of the most affordable states to incorporate in.

3) Company Compliance & Presence

Whether you’re building business credit for the purpose of growing your business, establishing strong credit, to get your new business started on the right foot. In this section we’ll cover the compliance requirements of credit bureaus & lenders.

For example:

While having employees aren’t a requirement, there are some mandatory elements (like being listed in the National Database). We’ll also go over company presence requirements and how to establish a professional presence quickly and affordably. *We even provide a few tools to help shortcut the process.

4) Business Banking

In this section we take a critical step in establishing separate business finances – by opening a business bank account. We’ll start by reviewing the 3 major banking components that will help you jump-start your business credit profile. We’ll also help you narrow down which bank is best for you based on the state you’re incorporated in.

5) Business Credit Bureaus

In this section you’ll take a major step in forming your company’s credit profile by registering your company with the top business credit bureaus. These are the organizations that will be establishing your credit scores. We’ll cover the differences of each organization, how they report, what’s included in each report and how they calculate their credit scores.

While this step isn’t hard, there are a number of things you’ll need to know before dealing with certain bureaus

6) Starter Credit

In this section we’ll introduce you to our list of vendors many of which don’t require a personal guarantee. Working with these vendors will set the foundation for your business credit profile. They are vital in the beginning stages of establishing a score with the bureaus.

You’ll continue purchasing and building relationships with these vendors to create a strong credit history. It can be tempting to want to skip steps or go on an application spree. But, doing so could destroy all efforts you’ve done up to this point. So stick to the plan!

7) Strengthening Your Business Credit

In this section we’ll introduce you to cash-credit and how to choose the right lender for your business. We’ll also cover how to increase your bank ratings, as well as how to write a solid business plan (which will come in handy later down the road).

8) Advanced Credit Strategies

Once you make it to this section, you’ll have already established some good business credit and be ready to push it to the next level. In this section we’ll show you how to obtain business credit cards, lines of credit, vehicle leasing, corporate credit lines, cash loans, equipment leasing options, micro-loans, and more! We’ll also teach you advanced strategies for building credit along with ways to increase your business revenue and cash flow. We’ll even share some tips regarding interest rates, and getting approved for government grants, SBA loans and MORE!

Click the Image Below to Hear Scot’s Review of Corporate Credit Secrets

How Long Does It Take to Finish the Business Credit Builder

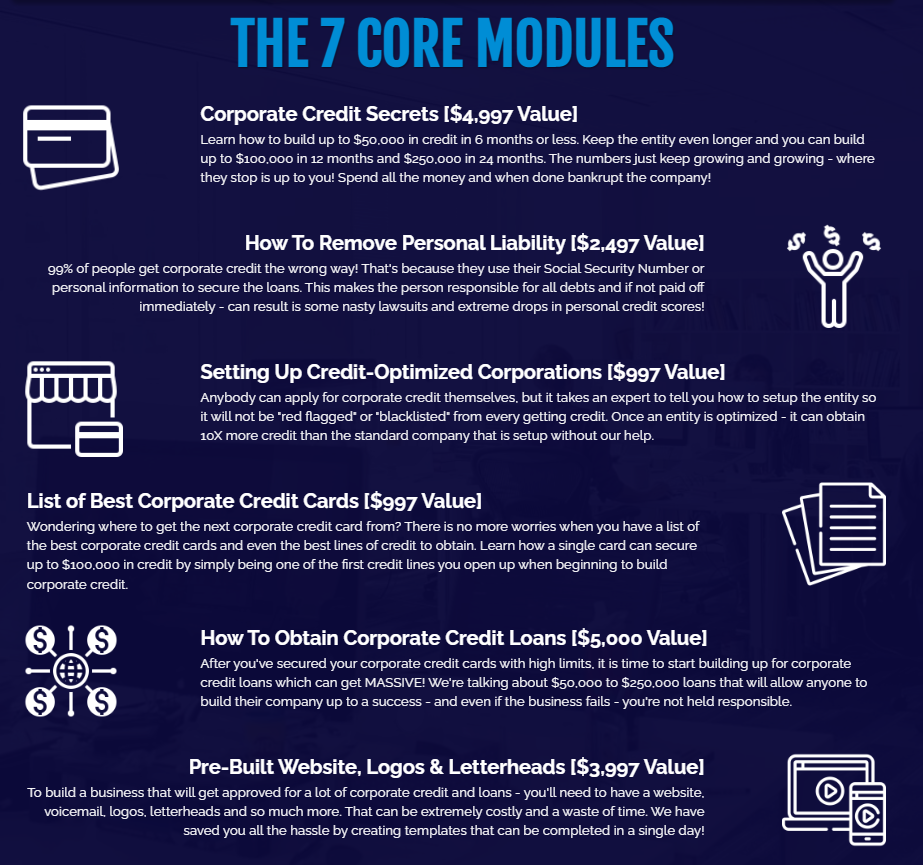

Using the techniques in our business credit builder program, one could secure millions in funding. The timeframe to do so will depend on your business & credit history.

Corporate Credit Secrets helps you establish excellent business credit in a strategic way.

For most owners that come to us for our business credit builder program, here’s how the process usually goes…

- Owner wants to build strong business credit – often they either want to reduce their liability, want to protect their great personal credit OR they’re running low on credit and need financing fast.

- They get Corporate Credit Secrets and begin the process to build their business credit profile.

- A few weeks into the program they get their first micro-loan.

- A month or two in, they begin getting approved for business credit cards.

- Three or four months in, they begin getting approved for lines of credit & higher limit cards.

- By the 5 to 6-month mark, they’ve often secured $50k-100k or more in credit and begin getting approvals for higher limit loans.

- Owners that choose to continue building their credit can often secure $250,000 or more in credit.

Are you beginning to see how this business credit builder program works?

Learn More About Corporate Credit Secrets

Wanna see REAL PROOF of what Corporate Credit Secrets can do? You gotta hear Samantha’s story in tomorrow’s post.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.