Do you or a loved one have medical bills you can’t pay?

Looking for a way to get rid of medical debt?

Medical debt is a growing problem, causing many Americans financial instability and even bankruptcy…

According to CNBC (as of 2022), 55% of American adults have medical debt. And nearly half of people with medical debt (~25%) say it’s prevented them from buying a house or saving for retirement.

And a quarter of Americans owe $10,000 or more in medical debt, even though half of them have health insurance, which is quite shocking.

The survey also found that carrying health insurance doesn’t seem to make much difference in whether you have to take on medical debt — it merely caps how much debt you’ll owe.

They found: 69% of respondents who pay for their own health insurance reported medical debt, as did 61% of respondents with policies through their employer and 59% of respondents with no health insurance at all.

Did you catch that? – people with NO INSURANCE have LESS medical debt…

One reason people with health insurance seem to be more likely to have debt than those without coverage: deductibles.

Meaning: “You’ll have to pay out of pocket for X amount of dollars before the insurance will pay any benefits.”

So while choosing a higher deductible can lower your monthly payments, it doesn’t necessary save money in the long run.

The American Journal of Medicine reports that nearly half of people who experienced medical bankruptcy named hospital bills as their biggest expense.

The breakdown was: 46% of respondents with medical debt selected emergency room visits as the biggest reason for their debt. Just over 30% of respondents also selected Covid-19 treatment, and 23% selected mental health treatment.

But we have good news…

No matter what your medical bills are…

Regardless of how much you owe…

You can Get Rid of Medical Debts

You Can Get Rid of Medical Debt Without Paying a Dime

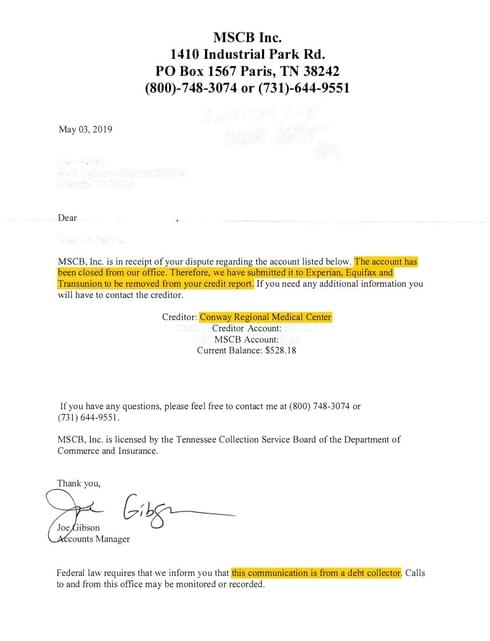

Unlike those debt consolidation companies you hear on TV, we can help completely ERASE THE DEBT and…

…force the lender to remove the negative account from your credit reports.

Oh, and best of all, you can still go back and use the lender or company again in the future – how’s that for a Win-Win?!

Inside Debt Removal Secrets we’ll teach you how to remove the debt for good so you can get back to living your life.

Aren’t you sick and tired of being forced to put your life’s goals on HOLD while you pay off inflated medical bills?

Or worse, being forced into destroying your personal credit with bankruptcy…

There’s a better way – let us show you.

It’s time to take back your financial freedom once and for all!

Learn More About Debt Removal Secrets

Curious if this method works on student loans? (IT DOES!) But there are a few extra things to know so keep an eye out for tomorrow’s post!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.