Do you currently have a loan?

Are you struggling to make payments? Looking for help getting out of debt?

Has the loan already gone into collections?

We can help.

Loans can be a great way to finance what you need in a pinch but when you add up interest (plus inflation) that monetary hill to give you a boost up starts to feel like a mountain you’ll never climb over.

If You Need Help Getting Out of Debt Be Aware That…

That debt could be FRAUD…

And what if you could LEGALLY ERASE THE DEBT?

No more harassing phone calls or messages.

No more struggling to make payments.

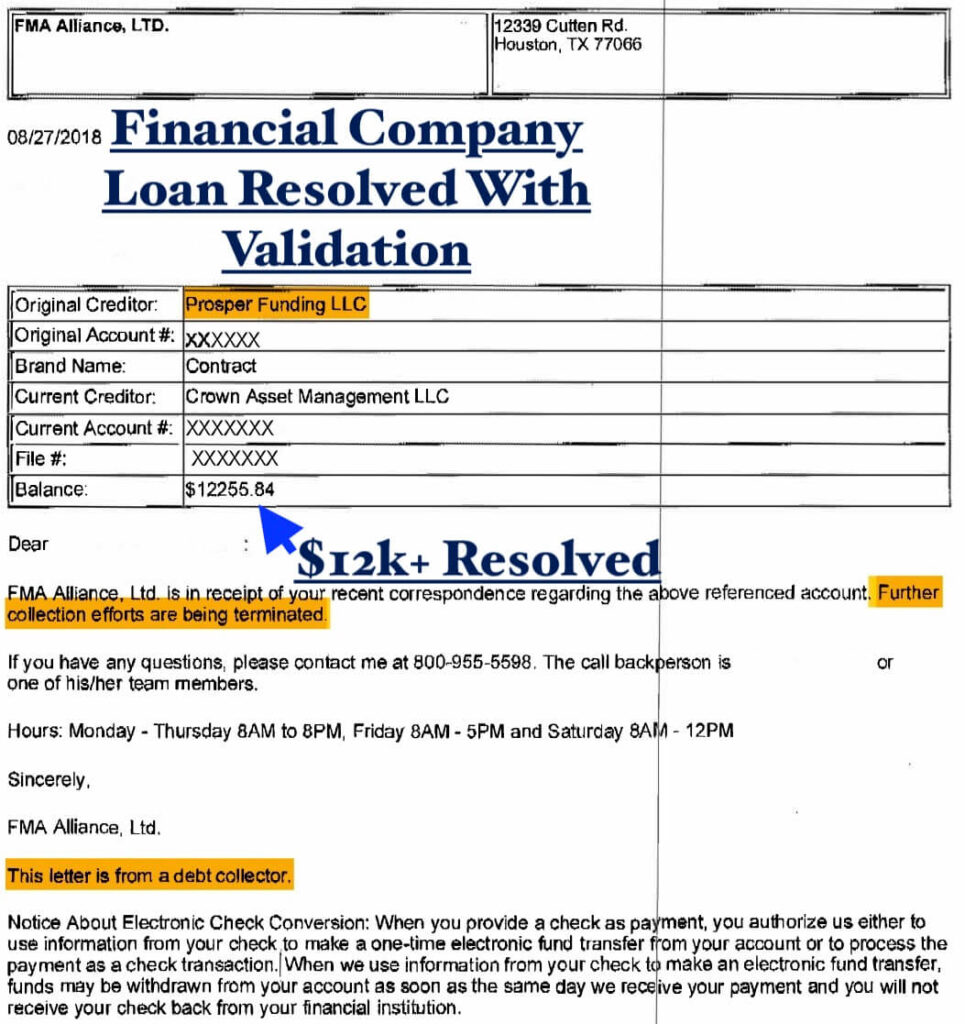

Just look at what one of of students was able to remove…

What Types of Loans Does This Work For?

Personal loans, medical loans, bank loans, car loans, and MORE.

This process works for personal, family and household debts are covered under the FDCPA. This includes money owed for medical care, charge accounts, and credit cards.

Does This Work for Federal & Private Loans?

If the loan reports to the credit bureaus, then the debt can be removed.

What If The Debt Is Private & Doesn’t Report?

The wet-ink signature argument is all that exists for private debts that do not report to credit bureaus.

If the creditor did not sell the note to the Federal Reserve, a debt collector or fund the loan with outside assets – it remains private.

NOTE: There is always the ability to reach out to the creditor and work out a payment plan for a reduced amount (usually ~50% less). Typically a private organization is willing accept the offer because something is better than nothing.

Can This Process Remove Car Loans?

Debt Removal Secrets typically will not work if one still possesses the vehicle.

WORD OF WARNING: Be cautious of anyone who says they have removed the debt from a vehicle/home/boat (while KEEPING THE ASSET), as this is quite a rare occurrence (though it does happen) but often results in one losing the physical possession.

Isn’t it time to end the vicious cycle of debt?

If you want help getting out of debt…

Learn how Debt Removal Secrets can set you free.

Curious what happens if the creditor/debt collector doesn’t reply back to you? We’ll reveal this and much more in tomorrow’s post.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.