Ever wonder how some people are able to afford multiple homes?

Nowadays for the average person, paying off ONE HOME is quite an amazing feat…

But what if there was a specific strategy these people use to pay off their properties quickly and increase their cash-flow so that they can easily purchase additional homes?

Using a HELOC for Real Estate Investing is a match made in Heaven

By using a Home Equity Line of Credit and utilizing the payment strategy we teach inside the Half Your Mortgage program you can pay off a home within 5-7 years and save tens of thousands in interest!

Just imagine what you’ll be able to do with all that money you’ll save…

Want To Invest Or Create New Streams Of Income?

REI might just be right for you. Investing in real estate offers several benefits for investors, depending on market conditions. Here are a few reasons why investing in real estate can be a good decision:

Hedge against inflation: It’s a popular strategy to keep up with inflation because home prices and rental income tend to rise right along with inflation.

Diversify your investment portfolio: It may help reduce portfolio volatility as home prices tend to fluctuate less than other asset classes, such as stocks & crypto-currencies.

Provide semi-stable asset appreciation: The value of real estate assets may increase over time, and while it can vary, it is often viewed as a steady long-term investment that can provide growth. However, keep in mind that past performance doesn’t guarantee future returns.

Is a tangible investment: Investing in properties and building a real estate portfolio can give you hands-on experience in property management and renovation.

Can be done on a part-time or full-time basis: Some people use rental properties as a secondary source of income, while others invest in real estate full-time by acquiring new properties or improving existing ones.

A Good Entry-Point for New Investors: While it used to be expensive, modern investment options enable people to enter the market even with limited funds. Investment options such as real estate investment trusts (REITs) allow individuals to invest in real estate through companies that own and operate properties.

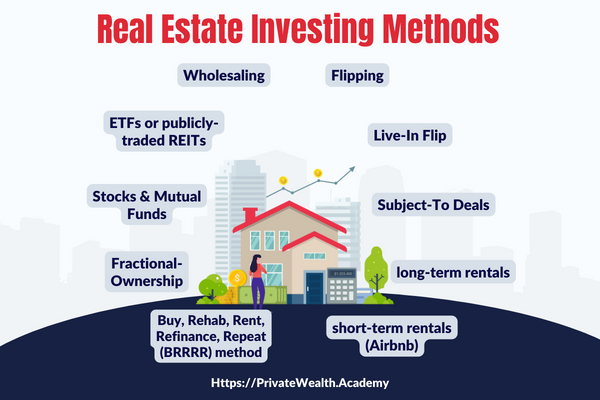

Types of Real Estate Investing

Each of these strategies comes with their own pros & cons and varies in risk level and profitability. There really is no one-size-fits all for real estate investing considering that each person’s budget, experience and risk tolerance is different.

Tips When Using a HELOC for Real Estate Investing:

NOTE: The only REI strategy that doesn’t typically work with HELOCs is buying undeveloped land.

Using a HELOC for real estate investing is usually a solid move but it still comes with risks. So you’ll want to do plenty of research before diving in and making an investment decision.

There are some challenges that may come with securing a HELOC for real estate investing, especially certain investment properties (which we’ll discuss another day).

Regardless, there’s no question about the benefits of using a HELOC for real estate investing, it’s well worth the time and effort. It’s very effective as a long-term investment strategy and is used by many successful investors today.

Just imagine being able to use the current equity in your home to open a HELOC and put a down payment on another property using the profits from the sale or rental to pay off the loan. Rinse & Repeat.

This is how a HELOC can help you build wealth & an REI portfolio faster than ever!

Even if you can’t afford to take on another property right now, a HELOC will at least help you save more money and allow you to pay off your home in 5-7 years – giving you the opportunity to invest much sooner than you’d be able to if you were stuck in a 15 or 30-year mortgage.

There’s no legal limit on the number of HELOCs you can have (even on a single property). If you meet the lender’s eligibility criteria and have sufficient equity in the home, you’re permitted to take out two or more HELOCs.

This is how smart investors get the job done.

Especially if you’re into flipping homes! The best part about a HELOC is that you have a long draw period and don’t have to sell your property to reap the savings. This allows you to have consistent income. Allowing you to expand your financial holdings and continue to grow your overall wealth.

Do you know the difference between first lien and second lien HELOCs?

We’ll be making this important distinction in tomorrow’s post. Until then…

Ready to Learn How to Use a HELOC for Real Estate Investing?

Aren’t you ready to learn the HELOC Hyperdrive Strategy that will allow you to pay off your HELOC in 5-7 years and allow you to buy a second (or third) home or investment property?

The Half Your Mortgage program gives you everything you need to quickly go from homeowner to investor by helping you secure & manage the perfect HELOC for you.

Are you a real estate investor or looking to enter the REI game?

One of our students, Jacob is a real estate investor and says this strategy has been a total game-changer for him. Here’s what he had to say…

The Half Your Mortgage program will give you access to our extensive knowledge and help you secure the right HELOC for you.

You’ll receive video training, a detailed written guide, teaching you the proven techniques for paying off the HELOC faster, along with a curated list of lenders in your State (created just for you) to help you get the best terms, one-on-one support to make sure the bank correctly sets up your HELOC, and much more. And as a member of Private Wealth Academy, you’ll also get access to updates and lifetime support.

Learn More About the Half Your Mortgage Program

Want to talk first? We’re here for you…

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.