Would you like the HELOC strategy explained to you?

That’s what we’ll be diving into today.

Whatever your payment arrangements during the draw period—whether you pay some, a little, or none of the principal amount of the loan—once the draw period ends, you enter the repayment period.

During this time you must make payments on the principal + also the interest to repay the full amount over the loan term (10, 15 or 20 years.)

But like we mentioned yesterday, if you also follow our proven strategy – you should be more than able to pay off your HELOC in 10 years or less, meaning before the official repayment period even starts.

Also, more good news is that…

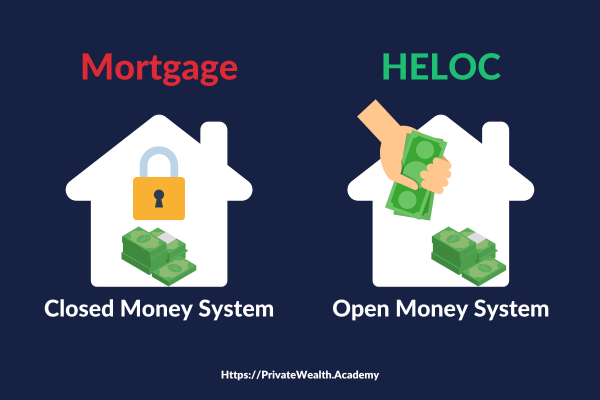

The type of HELOC we recommend inside the Half Your Mortgage program is an “open money system” which means you only pay interest on the average daily balance.

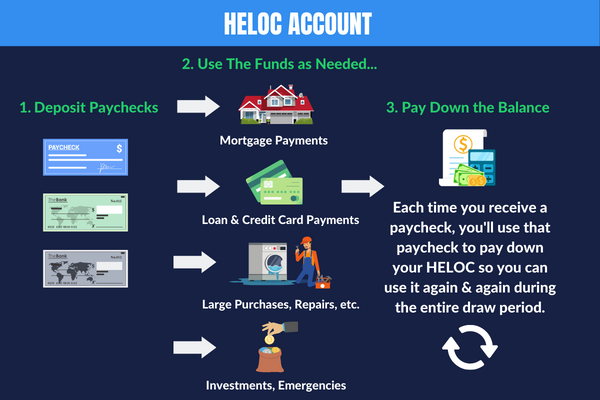

You can also put 100% of your income into a HELOC operating account and move money freely (in and out) during the “draw period”.

In fact, we suggest that all expenses that you normally pay (utilities, groceries, gas, etc.) be paid from the HELOC operating account, this will make it easier for you to manage and will help you lower the daily principal balance and interest at the same time.

Since the bank cannot control the allocation of principal versus interest on each payment – as the HELOC balance decreases, your interest and monthly payment amount decrease too!

The HELOC Strategy Explained

This is starting to all make sense now, isn’t it?

Don’t worry – if you find yourself unable to afford payments, you have refinancing options and start a new 10-year draw period.

What Happens When the Repayment Period Ends?

At the end of the repayment period, your lender might encourage you to leave the line of credit open. This way you don’t also have to go through the cost and expense of opening a new loan, if you expect to borrow again.

Excited to get started?

Implementing the HELOC Hyperdrive strategy found in Half Your Mortgage will also help you break many of the cash-flow issues you may currently be facing.

Our strategy is mathematically proven to help lower your mortgage costs and pay off your HELOC & home in just 5-7 years!

Check out how much Nicole was able to save by implementing the

Half Your Mortgage program…

We can’t wait to help you find the perfect HELOC – click to learn more about how you can get started with the Half Your Mortgage program:

We’ll teach you how to… find out how much borrowable equity you have in your home, prepare your finances, compare interest on your mortgage versus a HELOC (so you know how much you’re saving), the exact features your line of credit needs to have to save you the maximum amount of money, find the best lenders in your state, lock-in the most affordable rates and MORE!

As a student of the Half Your Mortgage program you’ll get access to our High Credit Secrets program for FREE, which will also help you boost your credit score by 100 points in just 10 days & up to 720+ in 90 days or less. PLUS…

You’ll also receive access to our proprietary calculators (that makes the math super-duper easy.) And you’ll learn our proven HELOC Hyperdrive Strategy that will show you how to pay off the loan in as little as 3 years.

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.