Want more clarity on the difference between a HELOC vs home equity loan?

If you’re confused, that’s okay – they are very similar but we’ll clarify the differences for you today.

What is a home equity loan?

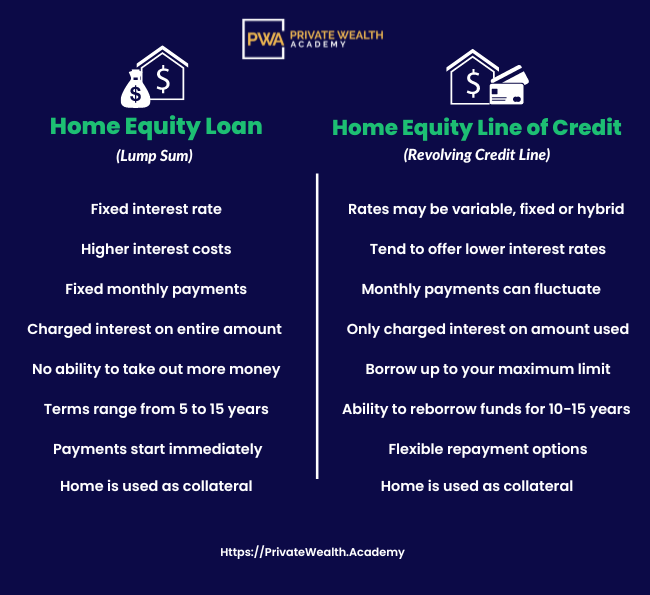

A home equity loan is a secured loan. It gives the borrower a lump sum against the equity in their home with a fixed repayment schedule. This is over the life of the loan at a fixed interest rate. Not much wiggle room there.

Home Equity Loan Terms

Home equity loans generally come with slightly shorter repayment terms than HELOCs, but some go up to 30 years. The exact terms and the interest rate depend on your credit score, payment history, income and the loan amount.

Home Equity Loan Amounts

Typically you can borrow up to 85% with a home equity loan. You’ll also need to know exactly how much you want to borrow. If you don’t, you might end up with more or less than you need. Which means you’ll either be stuck repaying the portion you didn’t use plus interest, or need to borrow more money.

Home Equity Loan Requirements

HELOC and home equity loan requirements are about the same but HELOCs usually allow you to borrow a bit more (85-90% equity. In some cases up to 100%.)

- Lenders often require you to own at least 15 to 20% of your home

- You’ll need a solid credit score — 680+

- The lower your debt-to-income (DTI) ratio, the better: 43% max

- Lenders will also want to see a steady income, even with a lot of equity

- Despite a decent credit score, a history of late payments can make you look risky

How Can You Use The Funds From A Home Equity Loan?

Neither the HELOC nor the home equity loan require a borrower to seek approval from the lender in how they spend the funds (although the lender may still ask.)

Some use it for major repairs or renovations, like finishing a basement, remodeling a kitchen or updating a bathroom. Some take out a home equity loan to pay off high-interest debt or to invest in real estate.

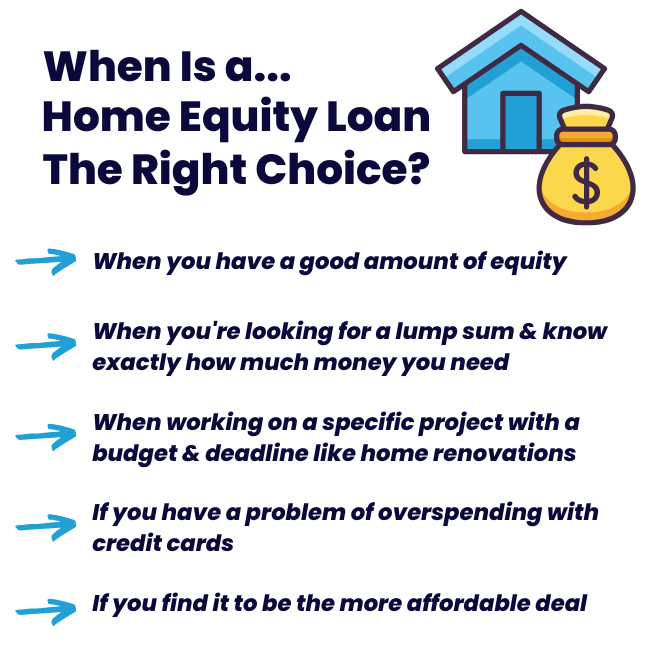

When a Home Equity Loan Makes Sense

A home equity loan could be a good fit if you know exactly what you’ll use the funds for and how much you’ll need. A home equity loan could also be ideal if you find a lower interest rate than a HELOC.

The Biggest Downsides to Home Equity Loans

- You’ll need at least 15% equity in the home

- Home Equity Loans are given as a lump sum so you’ll pay interest on the entire amount which may add THOUSANDS to the amount you owe.

- Not a good option for long, on-going projects

- Funds don’t replenish – even if you pay off the loan amount.

- If property values decline, your combined first mortgage and home equity loan might put you “underwater” meaning you owe more than your home is worth.

HELOC vs Home Equity Loan

How Is a First Lien HELOC Different?

A home equity line of credit (HELOC), offers a revolving credit line tied to the level of equity in your home. You can use the funds, repay, then borrow them again, like a credit card. You can withdraw funds for the length of the draw period (usually 10-15 years).

In a HELOC the amount borrowed changes, and subsequently so does the minimum payment, depending on the credit line’s usage. This allows you to spend as much as you’d like within your credit limit and also make a payment toward principal if you wish without penalty.

When the draw period ends, you’ll have the repayment period to repay what you borrowed plus any interest, usually up to 20 years.

Inside the Half Your Mortgage program we’ll show you how to pay off the loan BEFORE the repayment period even begins so you can save the MAXIMUM AMOUNT of interest possible.

Unlike a home equity loan…

A HELOC can come with either variable or fixed rates depending on the lender. Even variable-rate HELOCs usually come with a conversion option that allows you to set a fixed rate on some or all of your balance. Which will help shield your budget from variable-rate increases.

We know we mention this a lot but you only pay interest on the amount you use instead of the entire loan amount. Considering that fact that you can access A LOT of money through this type of credit line – we think that’s really cool.

When Is a HELOC the Better Choice?

If you’re looking for a financing option that offers the most flexibility, it’s not clear how much money you will need, want to replace your mortgage or you want the fastest way to pay off the loan – a first lien HELOC is your answer.

Especially, if you want a revolving line of credit, a rainy-day fund for emergencies or your expenses will extend over a long period of time (like paying a home contractor in installments, or paying for tuition).

Before you go off and start applying – there’s still a few more important things you need to know. So be sure to keep an eye out for our emails over the next few days.

If you’re ready to start your HELOC journey TODAY – Join the Half Your Mortgage program. We’ll show you how to lock-in the right HELOC for you.

We’ll make sure you know the right criteria your line of credit needs to have, how to prepare your finances, help you calculate the interest (so you know how much you’ll be able to save), how to get the best rates.

Click the link below for details on how you can HALF your mortgage and get on the fast track to paying off your home in 5-7 years:

Learn More About the Half Your Mortgage Program

Still confused as to which loan is right for you? We can help!

Book a FREE Discovery Call with Our Team we’ll run through the numbers with you using our proprietary software to see how much you’ll save in interest and determine YOUR PAYOFF DATE! In the rare event, a HELOC won’t work for you, we’ll help you secure the next best thing – a home equity loan. Schedule a call today to discuss your options.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.