Curious how HELOC vs mortgage interest rates compare?

That’s what we’ll be getting into in today’s post. But first…

Surprisingly enough around 30% of people pay for their homes in cash each year. Doing this will entirely avoid the need to pay interest on a loan.

However, if you’re like the majority of us, you’ll need to borrow money from a lender to buy that home. Which comes with a rather high mark-up once you calculate the interest costs.

It’s not just the fact that you have to pay interest…

It’s how lenders calculate mortgage interest that is the biggest problem. And that’s what we’ll be breaking down today.

Mortgage Interest vs. HELOC Interest Calculation

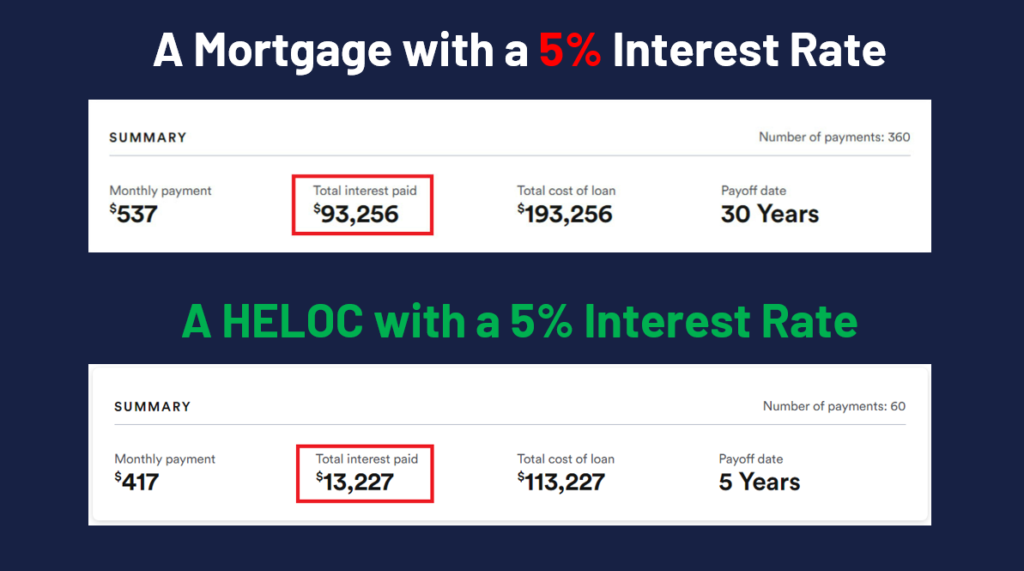

For a mortgage, after subtracting the down payment, the remainder of what’s owed will be paid over fixed monthly payments for the next 15, 30 or 40 years. For example, a 30 year loan is paid out over 360 months.

What a lot of people don’t realize is just HOW MUCH money they will pay in interest for their mortgage.

Even if you were able to lock-in a low rate (like 2-3%), the method used to calculate mortgage interest has you paying MUCH MORE than necessary over the span of the loan.

You may be shocked at just how much…

In fact, the typical mortgage loan has you paying nearly the same amount of interest as the original loan amount.

The good news is – you have other options! And one of these options (a HELOC) can save you literally tens of thousands ($xx,xxx) to hundreds of thousands of dollars ($xxx,xxx ) in interest alone!

Interestingly enough, the amount you end up paying in interest has more to do with how you make payments than the interest rate itself.

Sounds weird, but we’ll explain…

A mortgage calculates interest using compound interest. When you first take out a mortgage, the entire amount owed is calculated, split up into monthly payments – then divided between principal and interest.

For the first part of your loan (about the first 10 years), most of your monthly payment will go to interest (not the principal.)

That’s because you’re forced to pay down the interest FIRST & the interest recalculates monthly, with the rest going toward the principal.

That’s how the banks get you to pay more – by forcing you to pay off the interest FIRST.

Let’s say you buy a home that costs $100,000 at 5% interest for 30 years. Your first year, you’ll pay $4,555.45 in interest vs $968.70 in principal. With a monthly payment of $492.09.

As you can see, you’ll pay far more in interest each month than in principal.

Only after 17 years will your payments primarily go towards paying off the principal.

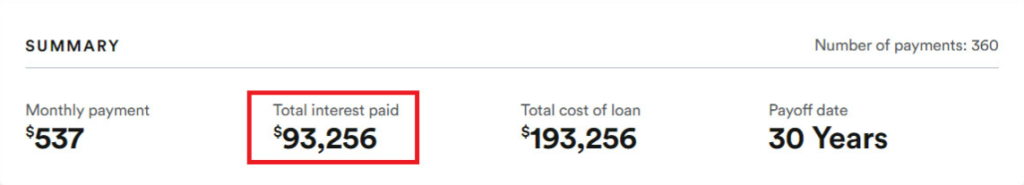

After 30 years, you will have paid a total of $193,256 for a $100,000 mortgage loan – paying $93,256 in interest alone! You could buy another home for that much!

Are you beginning to see the “scam” going on here?

But your monthly costs don’t end there…

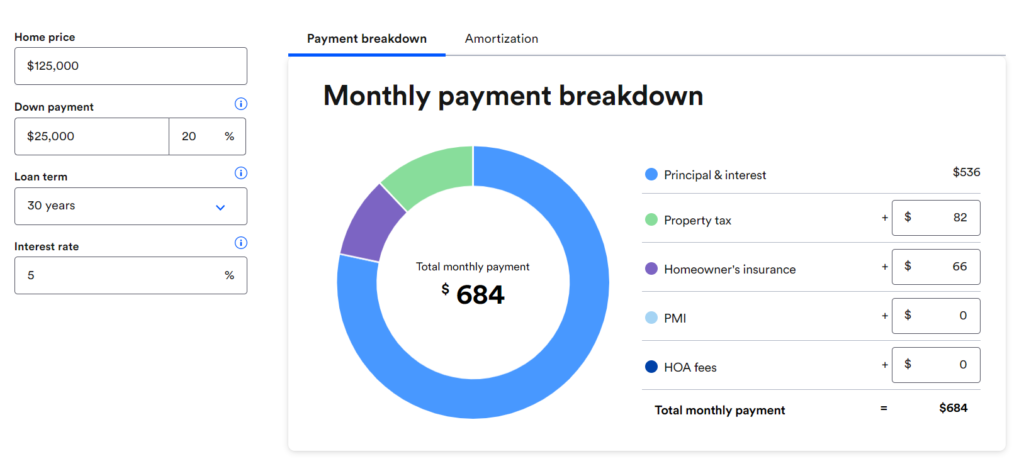

After all we can’t forget the fees… Conventional mortgages have so many fees: insurance, origination fees, high closing costs and more!

The APY adds these fees so it gives you a better idea of your true “effective” interest rate over the life of your loan once you factor everything together.

For example, property taxes and homeowner’s insurance typically adds an extra $148 to a $100K loan, bringing your total monthly mortgage payment to $684.09 but only $80.73 of that goes towards the principal!

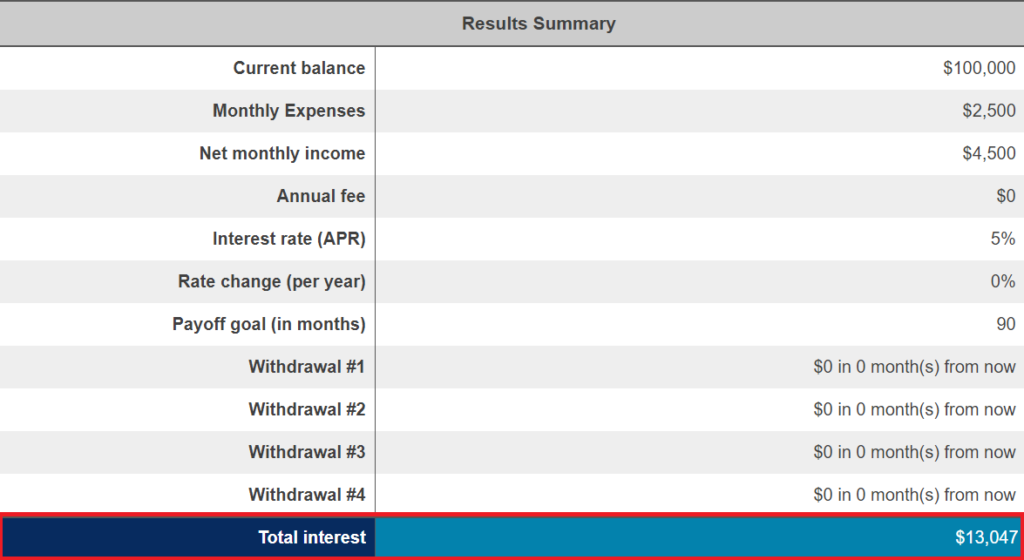

For a HELOC, the interest is calculated on the average daily balance.

The average daily balance is calculated as the total balance for each day in the billing cycle, divided by the number of days. So, you’re only paying interest on the current balance – just like a credit card!

Let’s keep go through an example, say that your average daily balance, for the last month, was as follows:

Days 1-15 – $1,000 balance

Day 16 – 30: $0 balance ($1000 payment applied)

Your average daily balance would look like this:

[$1,000 x 15 days] + [$0 x 15 days] = $15,000 –>

$15,000 / 30 days in cycle = $500 average daily balance

With an interest rate of 5% the amount owed for the month would be:

$500 x .05 x 30 / 365 = $3.26

The big difference is…

with a HELOC, each day your payment will be recalculated!

So unlike a mortgage any additional payments you make will reduce your average daily balance (and interest) for that billing cycle.

You’ll also pay less fees with a HELOC. You may pay some fees when opening the account or a small annual fee per year (like $50), but nothing compared to the private insurance and fees on a conventional mortgage.

Because of the difference between compound interest and average daily balance, with a HELOC you’ll end up saving THOUSANDS of dollars!

How many thousands?

For example: with a $100K HELOC (at 5%), you’ll pay $13,227 in interest while a 30-year mortgage will have you paying $93,256 for that same $100K.

Isn’t that crazy? Just take in how much money that is…

Outside of charging you almost DOUBLE in interest – there are two things that mortgages will never allow you to do…

#1: Make Additional Principal Payments

Let’s say you have some extra cash, and you want to apply it to your housing payment. With a mortgage, you can make a principal reduction payment and direct your bank to apply the entire amount to the principal. However, this will NOT change your monthly payment.

When your interest recalculates the following month, you will have less principal owed. The amount of interest owed would change compared to not making the payment, but the monthly payment is virtually the same. You wouldn’t see the impact until the end of the loan.

With a HELOC, making a large payment has an immediate impact. Your average daily balance decreases that day and every day going forward, reducing the amount of interest owed.

#2: Use Your Equity Like Cash

Imagine you have equity in your home after making payments for several years and you want to use $25,000 to make home improvements.

In order to do this with a mortgage, you would need to refinance (or sell) your house to get the cash. You would also need to pay origination fees, as well as other closing costs. Worst of all, the term of the loan would “start over,” & the interest would calculate monthly on the new, higher loan amount.

With a HELOC, you have access to the equity within days of opening the account. You can draw on the line of credit when you need it – only paying interest on the amount you use.

PLUS, you have the flexibility to make additional or larger payments at any time and pay it off sooner without being penalized for it.

Ways a HELOC Can Help You Save Versus a Mortgage

A first lien HELOC allows you to…

- Easily tap into your equity to use like cash whenever you want

- Interest is calculated daily – based on current balance (not loan sum)

- Make additional principal payments (immediately lowers the balance)

- Pay off home FAST (in as little as 3 years) without penalties

- Help you save $100K+ in interest alone (average $230K mortgage).

- Can come with fixed-rate options (more about this in tomorrow’s email)

This was a long email but hopefully it helped you understand how much interest calculation impacts the amount you pay and how much you can save by making the switch to a HELOC.

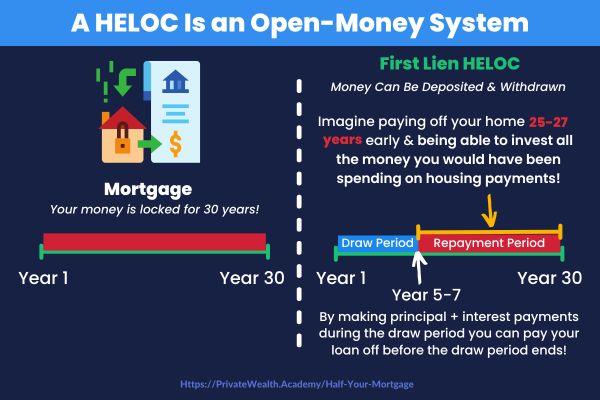

The Half Your Mortgage program will show you how to get the best first lien HELOC in your state. We’ll teach you everything you need to know, show you how to prepare your finances, compare lenders, and most importantly – teach you the strategy to use to be able to save MASSIVE AMOUNTS in interest and pay off the loan in just 5 to 7 years.

We’re ready when you are! Simply click the link below to get started on the Half Your Mortgage program:

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.