Want to ensure the government won’t be able to seize or infringe your organization?

When you go to an entity like the IRS, you are requesting a license for exemption.

One of the BIGGEST Tax Secrets You Need to Know…

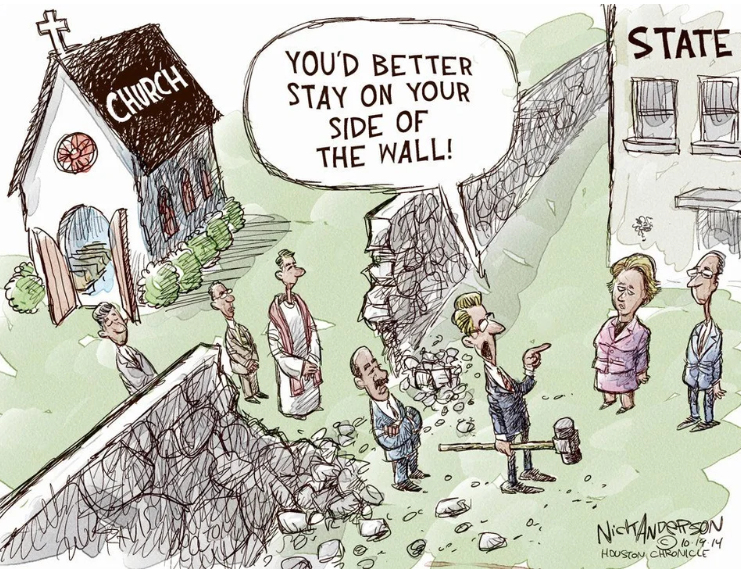

But separation from the government is only guaranteed if you don’t sign your rights away. And that’s exactly what you do whenever you create any 50X or tax exempt organization that requires the IRS approval!

Kind of a catch twenty-two…

And if you’re wondering – then how do we obtain our ‘exemptions’?

We don’t – we become an EXCEPTION.

The same way the Free Churches did between the late 1700s to 1970, before the Tax Reform Act of 1969 introducing the 501(c)3 State Church to the American public… which is to operate without oversight as a Faith-Based Organization (FBO).

It’s a theft by deception – otherwise what did the IRS do before 1969 for churches?

The answer is… NOTHING!

They stood separate from all churches, as the Constitution guarantees.

The Free Church is tax excepted and can give tax deductible receipts for donations. It enjoys freedom of speech, including, but not limited to politics, referendums, initiatives and candidates.

THE FREE CHURCH DOES NOT FILE A TAX RETURN as it is mandatorily excepted from reporting to the IRS.

In fact, the Free Church has a constitutional and legal right to form and is not required to seek approval as a tax-exempt organization.

Because it’s an exception. Elite Tax Secrets also provides you with the financial practices used by the wealthy to avoid income taxable events altogether.

Just think of the financial freedom you’ll also be able to enjoy when you can legally keep all your money by removing your tax liability forever.

Learn More About Elite Tax Secrets

*Don’t operate a church or faith-based organization?

No worries. Elite Tax Secrets will still teach you a method to reduce your personal income taxes (often down to $0). The best part is – this particular method is the absolute easiest, fastest way to legally avoid income tax liability.

Your friends in finance,

Private Wealth Academy

P.S. In tomorrow’s post we’ll explain the differences between a state citizen and a federal citizen and the 2 sets of rights that come with them.

Leave a Reply

You must be logged in to post a comment.