Wish There Was a Legal Way for YOU to Pay ZERO Taxes?

How do people like Bezos and Musk end up paying $0 in taxes when their fortunes grow by BILLIONS?

Today we’re busting the case WIDE OPEN!

Details claiming to reveal how little income tax US billionaires pay have been leaked to news website – ProPublica. ProPublica is a nonprofit news site that investigates abuses of power.

The independent news site obtained a vast trove of Internal Revenue Service data. The data provides an unprecedented look inside the financial lives of America’s titans. Including: Jeff Bezos, Elon Musk, Michael Bloomberg, George Soros, Carl Icahn, Warren Buffett, Bill Gates, Rupert Murdoch and Mark Zuckerberg.

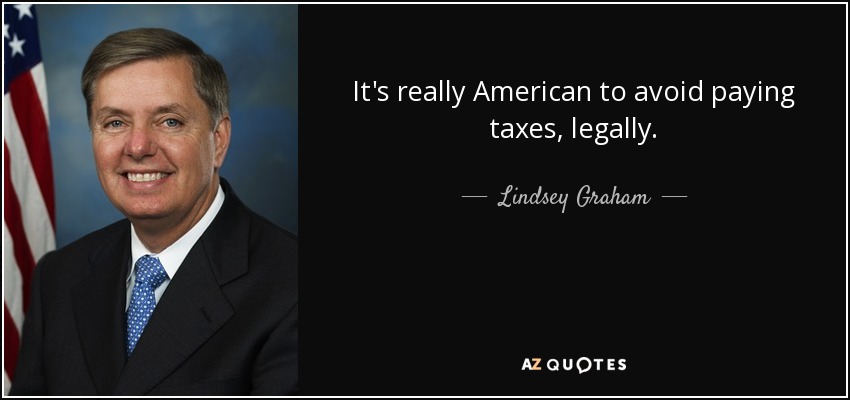

The IRS records show that the wealthy elite can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.

ProPublica said the richest 25 Americans pay less in tax – an average of 15.8% of adjusted gross income – than most mainstream US workers.

Jesse Eisinger, senior reporter & editor at ProPublica, told the Today Program:

“We were pretty astonished that you could get taxes down to zero if you were a multi-billionaire. Actually paying zero in tax really floored us. Ultra-wealthy people can sidestep the system in an entirely legal way.”

So how do they do it?

“They have an enormous ability to find deductions, credits and exploit loopholes in the system,” he said.

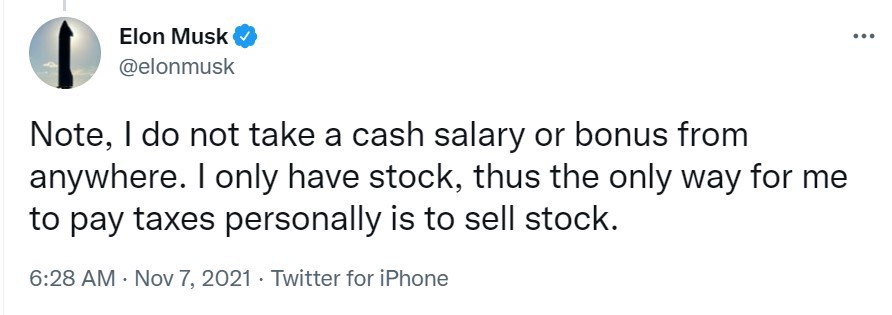

America’s billionaires avail themselves of many tax-avoidance strategies that are beyond the reach of most ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.

He said US billionaires buy an asset, build one or inherit a fortune, and then borrow against their wealth. Because they don’t realize any gains or sell any stock, they’re not taking in any income, which could be taxed.

“They then borrow from a bank at a relatively low interest rate, live off that and can use the interest expenses as deductions on their income,” he said.

ProPublica admitted that “using perfectly legal tax strategies, many of the uber-rich are able to shrink their federal tax bills to nothing or close to it” even as their wealth soared over the past few years.

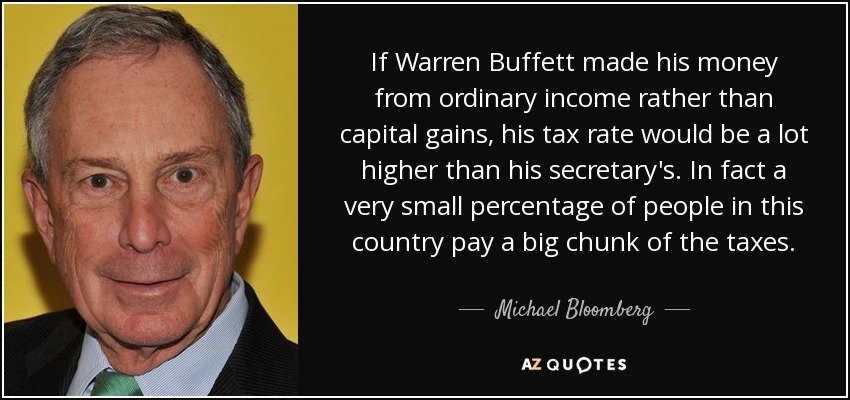

The wealthy, as with many ordinary citizens, are able to reduce their income tax bills via such things as charitable donations and drawing money from investment income rather than wage income.

The Real Tax Rate Mega Corporations Pay

According to Forbes, the top 25 richest people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.

Would raising corporate taxes help?

President Joe Biden has vowed to increase tax on the richest Americans as part of a mission to improve equality and raise money for his massive infrastructure investment program. He wants to raise the top rate of tax, double the tax on what high earners make from investments, and change inheritance tax.

But will it really change anything for the top tier elite?

ProPublica’s analysis concluded: “While some wealthy Americans, such as hedge fund managers, would pay more taxes under the Biden administration’s proposals, HOWEVER the vast majority of the top 25 would see little change” (due to the tax reduction strategies they use).

One of the billionaires mentioned, the philanthropist George Soros, is also alleged to have paid minimal tax. His office said in a statement to ProPublica that Mr. Soros did not owe tax for some years because of losses on investments (another favorite tax strategy of the elite). The statement also pointed out that he had long supported higher taxes on America’s wealthiest people.

Who’s the BIGGEST “offender” not paying their ‘fair share’?

Most people would probably say Bezos or Musk – but that’s not the case…

Out of the top 25 wealthiest individuals – no one avoided as much tax as Warren Buffett. Which may come as a surprise, given his public stance as an advocate of higher taxes for the rich.

According to Forbes, his riches rose $24.3 billion between 2014 and 2018. Over those years, the data shows, Buffett reported paying $23.7 million in taxes. That works out to a true tax rate of 0.1%, or less than 10 cents for every $100 he added to his wealth.

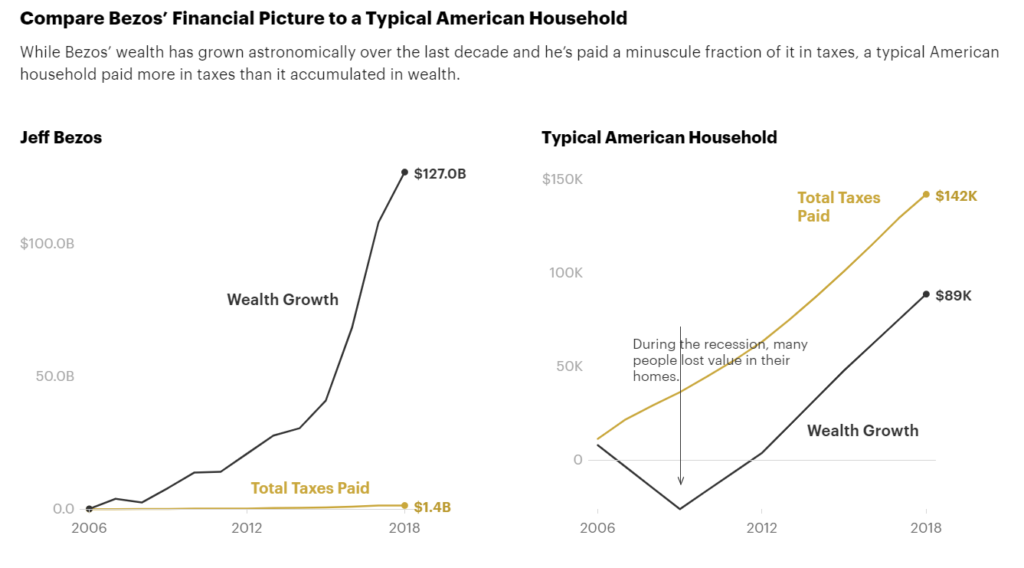

Or consider Bezos’ 2007, one of the years he paid zero in federal income taxes. Amazon’s stock more than doubled. Bezos’ fortune leapt $3.8 billion, according to Forbes, whose wealth estimates are widely cited.

How did a person enjoying that sort of wealth explosion end up paying NO income tax?

In that year, Bezos, who filed his taxes jointly with his then-wife, MacKenzie Scott, reported a paltry (for him) $46 million in income, largely from interest and dividend payments on outside investments. He was able to offset every penny he earned with losses from side investments and various deductions, like interest expenses on debts and the vague catchall category of “other expenses.”

His tax avoidance is even more striking if you examine 2006 to 2018, a period for which ProPublica has complete data. Bezos’ wealth increased by $127 billion, according to Forbes, but he reported a total of $6.5 billion in income. The $1.4 billion he paid in personal federal taxes is a massive number — yet it amounts to a 1.1% true tax rate on the rise in his fortune.

This won’t be the last you hear of increasing taxes on the rich…

President Biden isn’t the only one who’s tried to supposedly increase the tax rates of the wealthy (and he won’t be the last). In 2011, President Barack Obama proposed legislation, known as the ‘Buffett Rule’. It would have raised income tax rates on people reporting over a million dollars a year. It didn’t pass. Even if it had, the Buffett Rule wouldn’t have raised the elite’s taxes significantly. Why not?

Because if you can avoid income, you can avoid income taxes.

Buffett and his fellow billionaires have known this critical secret for a long time. As Buffett put it in 2011: “There’s been class warfare going on for the last 20 years, and my class has won.”

There’s no bringing the elite down to ‘our level’. They will ALWAYS find a way to find the loopholes & make the law work for them.

Isn’t it time you learn how to legally remove your income tax liability like they do?

Get Instant Access to Elite Tax Secrets

Inside Elite Tax Secrets we’ll teach you numerous financial practices used by the elite to eliminate taxes by avoiding income taxable events altogether.

Don’t worry though – you don’t need expensive assets, millions of dollars or complex tax shelters for this to work. The main tax method we teach is the simplest, easiest & FASTEST method to legally reduce your income tax liability. In fact, it’s as easy as writing a check!

You’ll learn how you can legally eliminate your taxation of income and better support your family by increasing your wealth, keeping every hard-earned cent. These methods will work personally, for your business, for your trust, or your faith-based organization. The only question is: what will you do with all that money you save in taxes every year?

Learn More About Elite Tax Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.