We often get questions like: “how can I lower my income taxes?”

We also got another great question recently about putting your IRA funds into the trust and if you owe taxes…

In short, the answer is yes, you can put your IRA funds into your Bulletproof Trust.

However, be aware – that even if the IRA is within the trust’s name it will still incur early withdrawal fees.

If one still desires to place the IRA in the trust’s name, just ask the IRA management to change the name on the account to that of the trust’s – (however doing so may trigger a taxable event even though the trust itself may be tax non-obligatory.)

The taxes would occur before the assets are put into the trust.

ALSO NOTE: Transfers may not be possible with certain things, such as: life insurance (except as a beneficiary), IRA (can but not suggested), SSI (can receive payments as representative payee but has no benefit compared to the special tax redemption method), retirement benefits (varies based on company and terms) and others.

A better alternative is to…

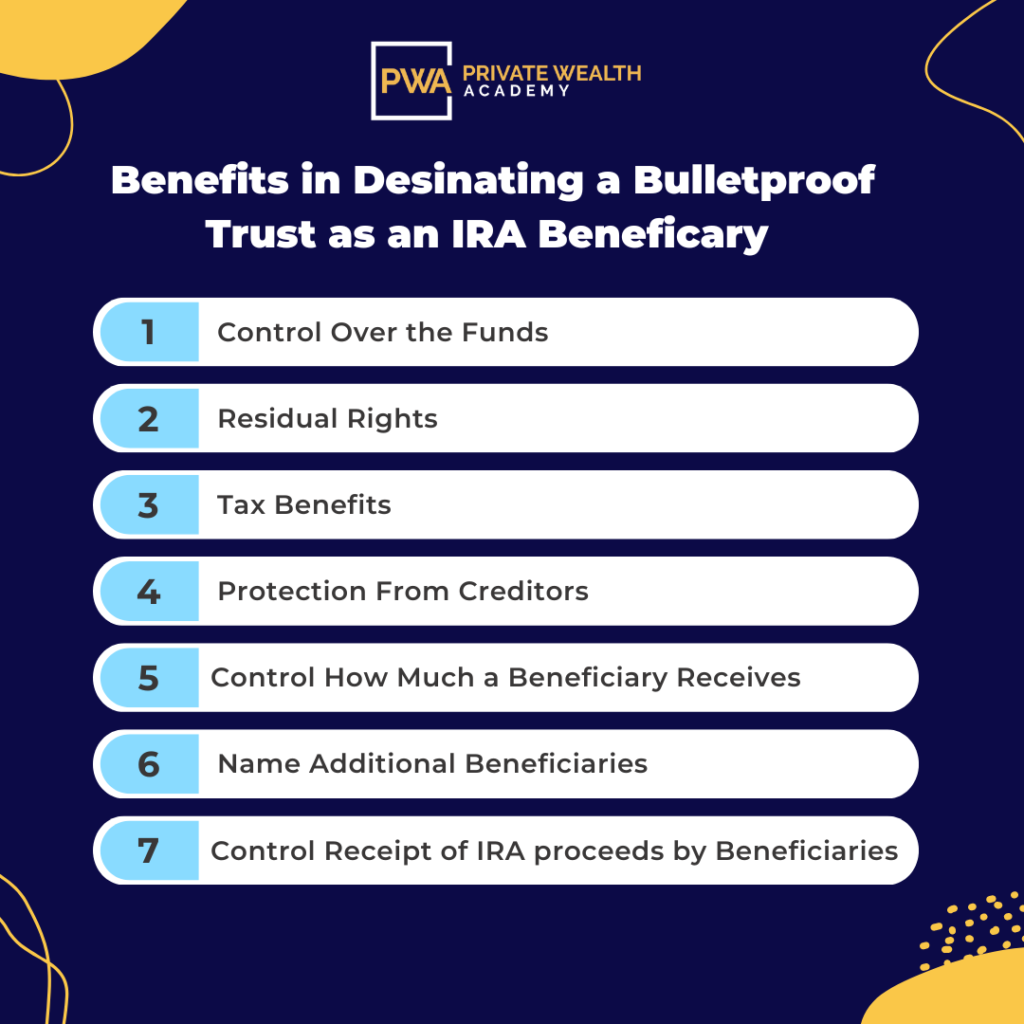

Name a trust as the beneficiary of your IRA or other policy and dictate how the assets are to be handled after your death. This applies to all types of IRAs, including traditional, Roth, SEP, and SIMPLE IRAs.

Still wondering “how can I lower my income taxes?”

With regards to taxes, while we don’t offer tax advice, if you’d like to learn a remedy to reduce your tax liability, we suggest discovering the special redemption method (shown in Section 4 of The Bulletproof Trust program).

By the way – the method is so simple you’ll want to slap yourself for not knowing how to use it sooner!

As simple as writing a check… yes – really!

Learn More About Bulletproof Trust Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.