Wondering how can you use the equity in your home?

Feel like you need more clarity on how a HELOC works?

That’s what we’ll be diving into today.

First let’s get clear on what home equity is…

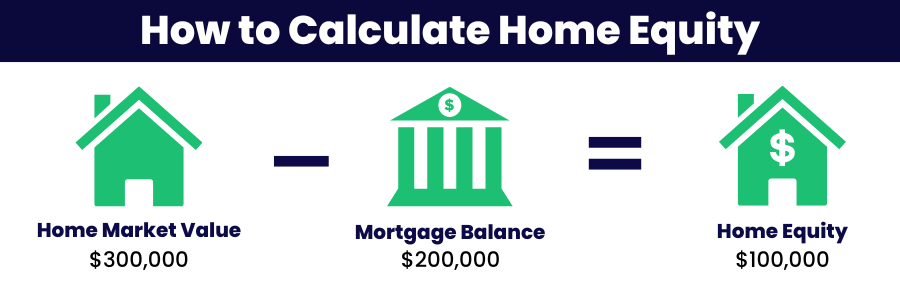

Home equity is the portion of your home you’ve paid off — in other words, it’s your stake in the property as opposed to the lender’s. You home’s equity is the appraised value minus your mortgage balance.

To determine your home’s equity, use the following simple calculation:

You naturally increase the equity, whenever you:

- Make a large down payment

- Make mortgage payments

- Make home improvements that increase the property value

- When the property value rises

Did you know you can tap into your home equity and use it like cash?

It’s true. While you can’t do that with a mortgage…

How Can You Use the Equity in Your Home

There are a few products that allow you to borrow the equity you have in your home.

- Home Equity Lines of Credit (HELOCs)

- Home Equity Loans (HELOANs)

- Cash-Out Refinancing

- Reverse Mortgages (only for people 62 and older)

Tomorrow we’ll talk more about how these options compare with each other but for now, let’s focus on the most flexible option – the HELOC…

What Exactly is a Home Equity Line of Credit?

A Home Equity Line Of Credit (HELOC) works similar to a credit card that allows you use your equity like cash.

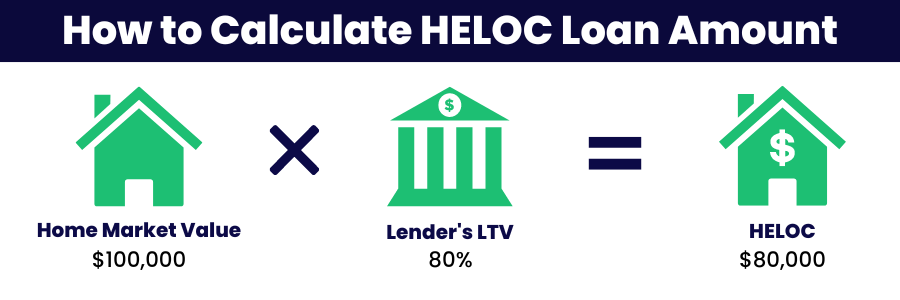

The amount of money you can get is based on the amount of equity you have in your home. Typically, you can borrow 80-85% of your home equity (although we have a few lenders that go up to 100%.)

This is why it’s vital to find the RIGHT lender…

Also, keep in mind that you can draw from a HELOC and repay the total balance or a portion each month, (the way you’d make credit card payments.) So as you pay down the amount you borrow, it becomes available again.

The best part is…

A HELOC can allow you to pay off your home in 5-7 years!

How is this possible?

While you can make interest-only payments, you’ll SAVE A TON OF MONEY over the course of the loan by also making principal payments.

So what has to change in order to get a HELOC?

We simply change where we’re making payments from. That’s it!

Your current mortgage can be refinanced into a HELOC in the first-lien position. Unlike a home equity loan (HELOAN), this is not a loan on top of the existing mortgage, it is simply replacing the current mortgage.

With a HELOC, your money is kept in the operating account so your cash can flow freely in and out just like any other checking account.

Just listen to how much Sara was able to save using the proven strategy in the Half Your Mortgage program. It’s pretty incredible…

Even better news is…

It’s easier to get approved for a HELOC than a conventional mortgage!

And you’ll lower your monthly payments as time goes on.

Tomorrow we’ll dive deeper into how HELOCs compare with other types of home equity financing – so keep an eye out for that email.

In the meantime, click the link below to learn more about how the Half Your Mortgage program can free you from your existing mortgage loan and provide you with cash from your home’s equity.

We’ll teach you how to… find out how much borrowable equity you have in your home, prepare your finances, compare interest on your mortgage versus a HELOC (so you know how much you’re saving), all the features your line of credit needs to have to save you the maximum amount of money, find the best lenders in your state, lock-in the most affordable ratesand MUCH MORE!

Learn More About the Half Your Mortgage Program

Want to speak to one of our team members? We’re here to help!

Book a FREE Discovery Call Today to discuss how a HELOC can half your mortgage (whether it’s new or existing.) We’ll run through the numbers with you using our proprietary software and see how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.