Wonder whether carrying a balance on your corporate credit accounts will help or hurt your company credit scores?

That’s an important distinction to make…

Just like a personal credit score, two of the biggest factors in determining your company credit score are your payment history and credit utilization.

Credit bureaus & lenders like to see that your credit utilization ratio is under 30%. This means that you should only be using an average of less than 30% of all of your available credit at any given time. However, the lower the credit utilization – the better (5-9% is ideal).

For example: if your total credit line is $10,000, you should only owe a maximum of $3,000 (30%). Keeping a 9% credit utilization would be a balance of $900.

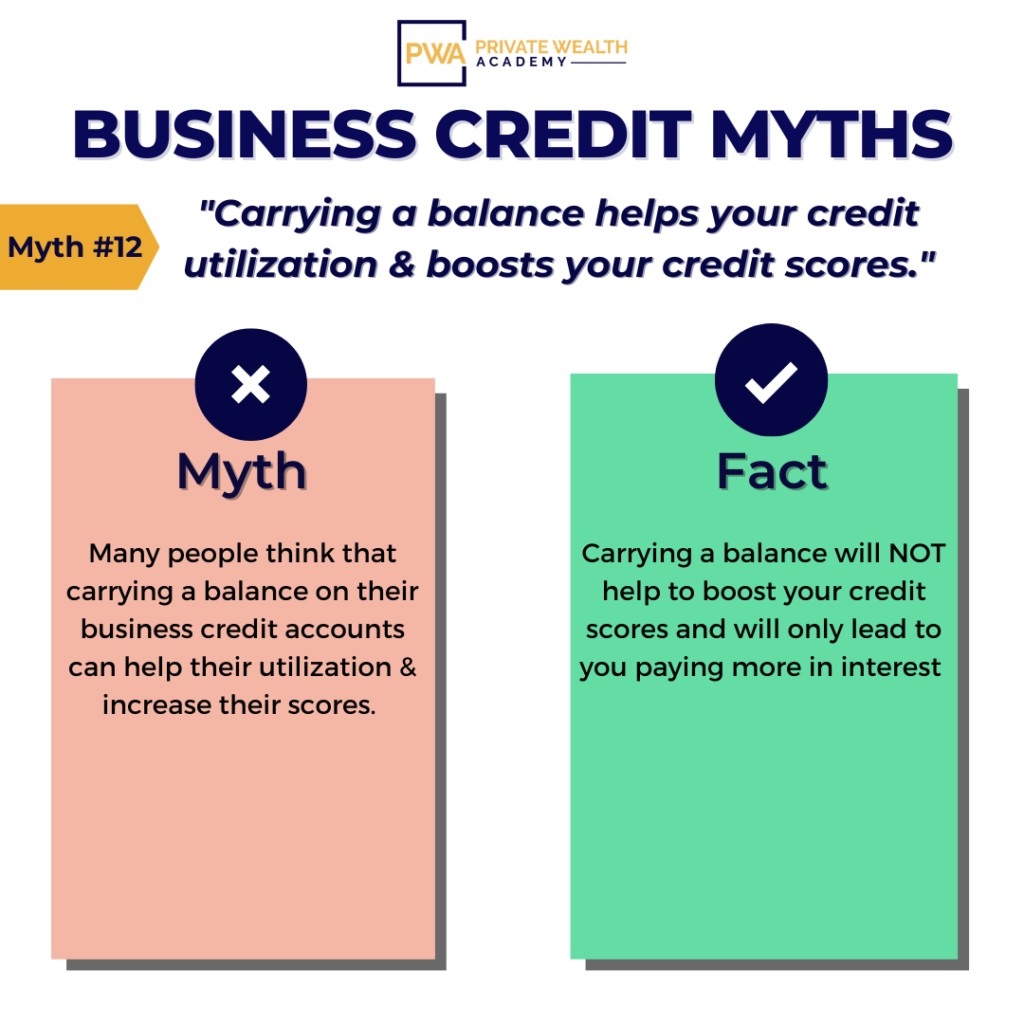

A HUGE Myth About Company Credit Scores

Because credit utilization ratio is so high on the list of important credit-scoring factors, many mistakenly believe that carrying a balance is helpful in building their credit score, as long as they make their minimum payment each month.

In fact, according to a recent Bankrate survey, 51% of consumers believe that carrying a high balance is good for credit health. However…

Carrying a balance, is NOT the same as utilizing your credit.

In fact, carrying a balance can be risky – not to mention way more expensive.

When your credit card bill is due, you’ll start owing interest on any amount you didn’t pay by the due date. The longer you wait to pay off your balance, the more interest you’ll end up adding to your bill.

Another myth a lot of people believe about carrying a balance is that it helps your credit score because you pay more in interest. If card issuers are making more money off of your interest payments, you’re sure to have a higher score, right?

WRONG. This couldn’t be further from the truth. While the percentage of credit used does impact your credit score, the amount you’ve spent or the amount credit card issuers make off of you does not make any positive difference.

Bottom line: No – carrying a balance will NOT help increase your company credit scores and doing so will accrue more interest and make your payments more expensive.

If establishing and maintaining excellent business credit is important to you – the Corporate Credit Secrets program was made for you…

If you want to learn how to establish strong business credit so you can be able to get access to $50,000-100,000 in 6 months or less…

Join the Corporate Credit Secrets Program

Curious how important your company’s credit scores are to lenders? Watch out for next blog post where reveal what lenders REALLY want to see in a borrower.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.