Have you been wondering how does HELOC affect credit scores?

That’s a great question…

When you first apply for a HELOC the lender will check your credit score.

NOTE: This “hard pull” or “hard inquiry” has the potential to temporarily lower your score. If you haven’t applied for other credit in the past 6 months, the impact will be minimal (e.g. ~5 points average).

How Does HELOC Affect Credit Scores?

Will A HELOC Show Up On Your Credit Report?

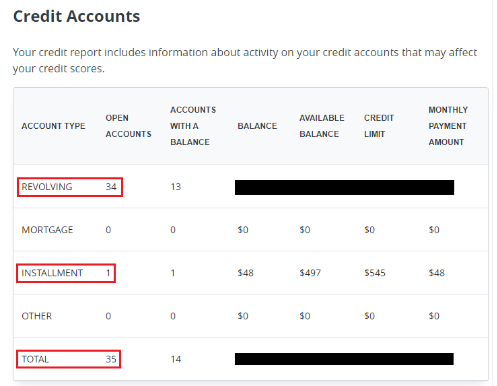

The credit report will show the HELOC balance, credit line and payment history.

Another Great Thing About HELOCs

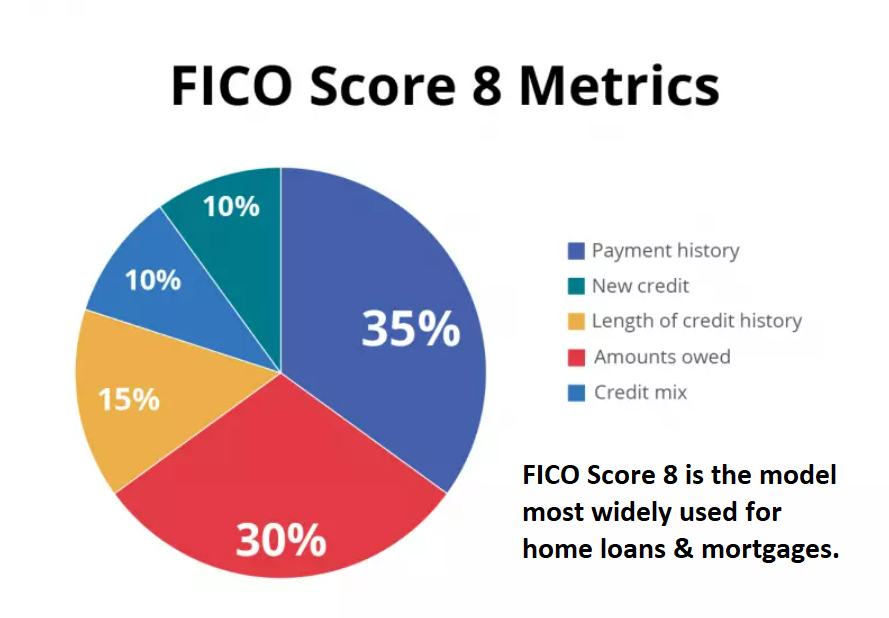

Although a HELOC is considered revolving credit, like a credit card, it won’t impact your credit utilization. Isn’t that awesome?

This is because a HELOC is a secured loan (secured by your home). As such, FICO excludes the HELOC from your credit utilization ratio and treats it like an installment loan.

This is another reason why a home equity line of credit is such a helpful & unique financial tool.

So, if you have significant debt, paying off that debt (with a HELOC) is an easy goal to accomplish. Doing this will lower your credit utilization & DTI and leave you with only one debt balance to manage – simplifying your finances.

Another Way HELOCs Improve Your Credit Score

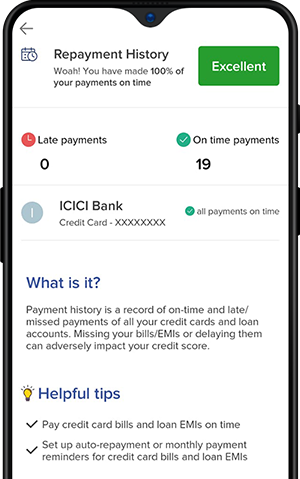

HELOCs offer flexibility of payments, but by making on-time or early payments you’ll build a positive payment history and improve your credit score over time.

A HELOC will also add diversity to your credit report. Which will help your credit over time.

HELOC Summary

When you first open the account there will be an initial decrease of a few points. Which is normal when opening a new credit account and will recover quickly). The overall impact a HELOC has on your credit score will be extremely positive. This is given that you make on-time payments.

HELOCs provide access to a large amount of cash when you need it with flexible terms. As well as, repayment options and provides lower interest rates than credit cards or unsecured loans.

The HELOC can be used as a reliable financial vehicle to invest, secure ongoing projects, remodel your home, purchase an investment property, or as an emergency fund.

Its flexibility, when combined with the right exit strategy, allows you to save THOUSANDS, better manage your debt, pay off your home(s) faster, and even increase your credit score.

Just listen to what Goldie thought about going through the Half Your Mortgage program and how much she’s been able to save.

Curious what smart investments can be made using a Home Equity Line of Credit? We’ll give you 7 good ideas in tomorrow’s email.

Until then, click the link to learn how the Half Your Mortgage program can help you find the right HELOC to pay off your home in just 5-7 years.

The Half Your Mortgage program offers our inside knowledge to help you secure the right HELOC for you. You’ll get our video training, a detailed written guide, teaching you the proven techniques for paying off the HELOC faster, along with a curated list of lenders in your State (created just for you) to help you get the best terms, one-on-one support, and much more. And as a member of Private Wealth Academy, you’ll also get access to updates and lifetime support.

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software, see how much you’ll be saving in interest & determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.