Have you ever been denied funding because your company credit score wasn’t high enough?

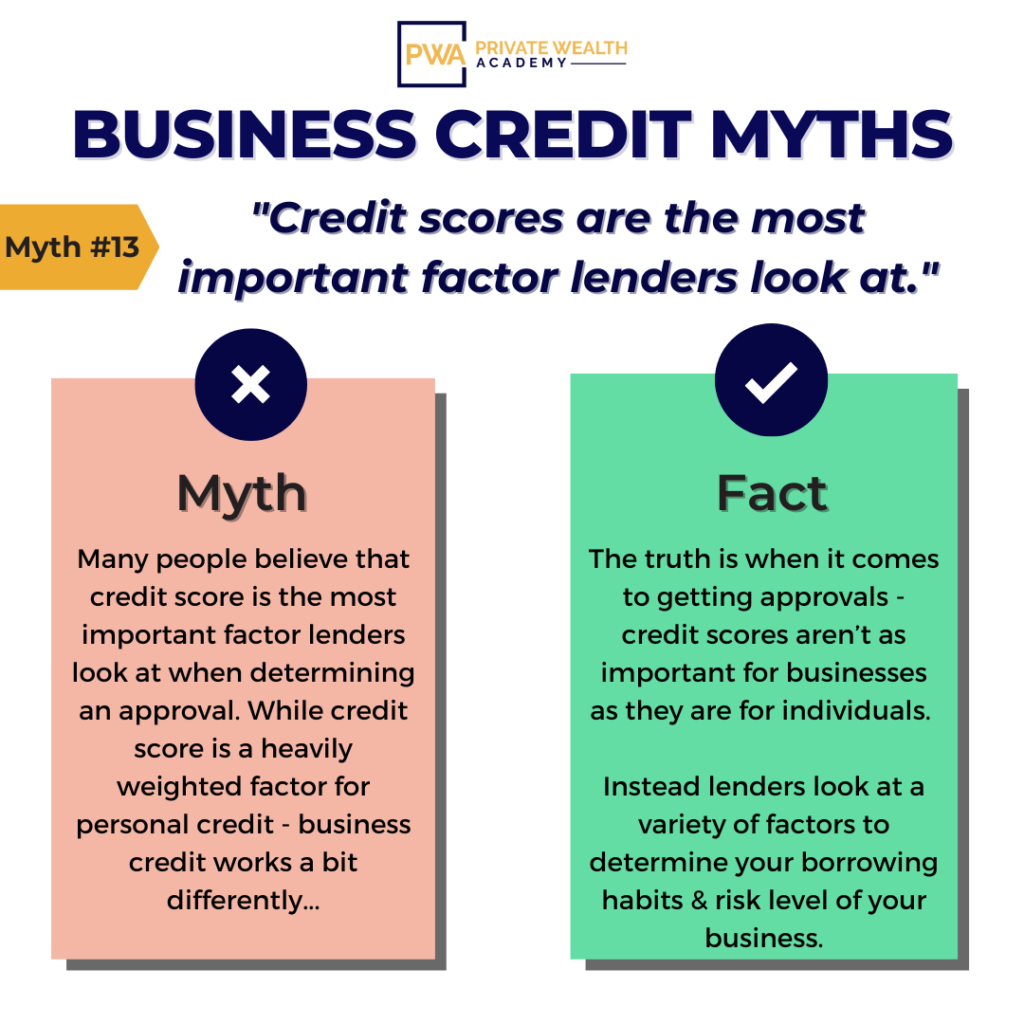

As you probably know, when it comes to applying for a personal or consumer credit offer – your credit score is a heavily weighed factor when it comes to a lender deciding how much credit to extend to you.

But things are a little different with business credit…

By now, you know business credit profiles are maintained by different credit bureaus and scores are calculated differently than personal FICO scores.

One thing that might surprise you, is that credit scores aren’t as important for businesses as they are for individuals.

With business credit, your company credit score(s) matter, but your entire financial profile and history is equally important.

What lenders really look at…

You may have sky-high company credit scores, but there are plenty of retailers, vendors, and lenders who won’t approve you based on business credit scores alone.

Other requirements come into play, too.

For example: some lenders have time-in-business requirements. Others may have revenue requirements that they take into account when approving or denying you.

While some factors vary from lender to lender, there are four common factors that all lenders weigh heavily when lending out business credit.

These include:

>How your business pays its bills

>The possibility of your business failing or filing for bankruptcy

>Your business credit score(s) *primarily based on payment history

>Cash-flow (deposits, annual revenue, total income)

The Truth About Company Credit Scores

Think of business credit as a holistic picture. Without having every piece of the puzzle in place, your risk of a denial increases significantly.

If you want to be treated as a highly fundable business by creditors and vendors, you need to…

Establish a business credit profile that can stand on its own.

The majority of your company credit scores are calculated based on how you pay your bills and the length of your payment history.

90% of the process of business credit is proving that you pay your bills on time. (And you get extra ‘points’ for paying early).

It’s that SIMPLE!

There are a few key elements to help make the entire process faster but we’ll talk about that later on.

The whole point of business credit is to reduce risk (for you personally and for lenders).

If you can prove that you’re less of a risk to lenders, then they’ll be much more likely to give you money.

Otherwise, if they see you have little to no business credit – they can interpret that lack of credit as a sign that your business is in trouble or on the verge of bankruptcy, which they’ll see as a huge red flag.

The good news is – we’ve found the best way to maximize your company’s fundability…

Want Help Improving Your Company Credit Scores for More Approvals?

If you want to learn how to become highly fundable and start getting approved quickly… Join The Corporate Credit Secrets Program

We’ll show you how you can build a strong corporate credit and become a highly fundable company (that lenders will throw money at) within a matter of months (or even weeks) AND boost your personal credit at the same time!

How does getting $100,000+ in credit for your company sound?

Learn More About Corporate Credit Secrets

Curious if better company credit scores really lead to better financing terms? So be on the lookout for our new post – we’ll reveal this and more.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.