Curious how much business credit your company might be approved for?

Have you had trouble getting the amounts you wanted in the past?

Don’t worry. You’re not alone. It can be difficult to obtain large amounts of credit especially if you’re a new business with little or no revenue.

If you’ve been reading our emails, you might recall us mentioning that in order to secure business credit…

The first thing you have to do is prepare your company in a way where banks are willing to lend to you – or in other words increase your fundability(which we show you how to do inside our Corporate Credit Secrets program.)

Once you’re company is “credit compliant” with credit scores established…

The next thing is to set your business credit goals then…

figure out which lenders to go after.

The “perfect lender” will vary depending on your business (and your goals) and we go into it in more detail inside the program but…

99% of the time – for a small business…

You’ll want to choose local community banks and credit unions.

We’ve seen approvals as small as a $500 and as much as $250k+ (from a single inquiry).

It really just depends on your business.

Want an idea of how much business credit YOUR company can obtain?

Look at how much revenue and sales your business makes.

Typically lenders will often approve a credit limit that’s 5-20% of a company’s annual revenue per credit offer (like credit cards or lines of credit). *Loans being the exception due to higher interest rates & length of repayment terms.

If you’re just starting out with little to no income, the most cash-credit you’ll likely secure from a single lender will be $50,000-75,000 (no-doc.) Which is pretty GOOD!

In some cases, you may be able to secure up to $100,000 (no documentation)

Or if revolving business credit is more important for you then you could…

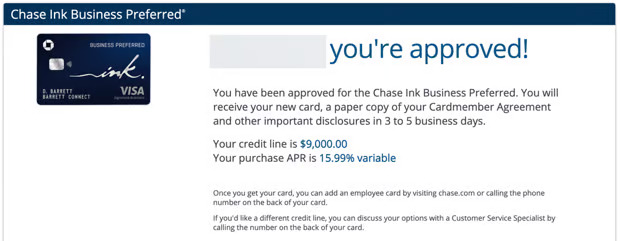

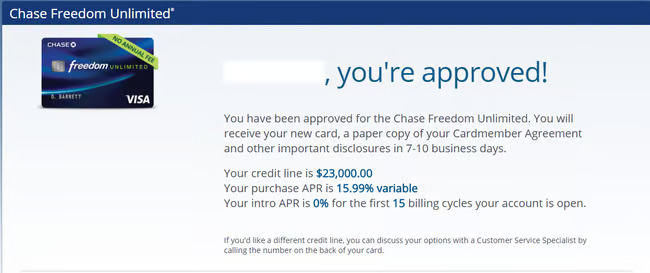

get multiple business credit cards with a lower limits.

Say around $5k to $20k each.

The good news is – that’s just the beginning…

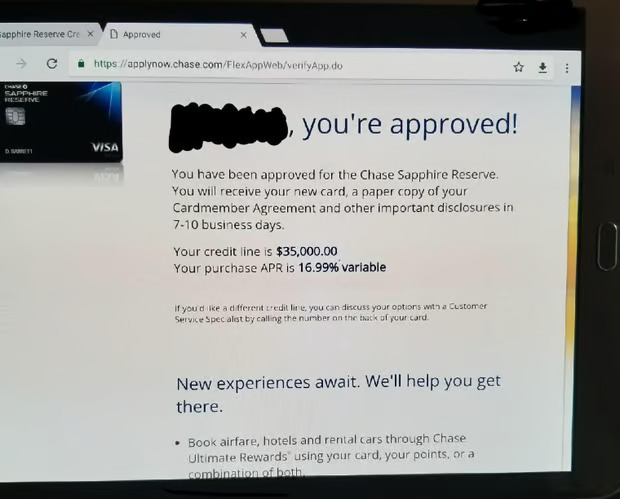

If your company has been established for a while (2+ yrs) and has consistent sales and revenue figures, then much higher amounts of credit are possible.

How much higher?

By using a variety of different credit offers and tips…

$100,000, $200,000 and even $500,000+ in business credit is realistic.

We have so much more to share with you about this process so if you’d like our help establishing business credit so you can grow your company faster…

Want to quickly become a highly fundable company and get access to $50,000-100,000 in business credit for your company in 6 months or less?…

Join Our Corporate Credit Secrets Program

Ready to get approved for higher limits in less time?

Wondering if it’s the right time to get business credit? Be on the lookout for our post tomorrow where we’ll share this year’s lending trends and what it means for you.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.