If you’ve been keeping up with our emails by now you know how home equity works, what a HELOC is and how it’s superior to other home financing options. But you may be wondering…

How Much Money Can I Get With a HELOC?

Before we get into that, first let’s review what LTV means.

LTV means “Loan to Value ratio”, it compares the size of your loan to the value of the home. And it’s one of the main numbers a lender looks at when deciding how much money to approve you for.

LTV is the percentage of your home’s appraised value that can be borrowed, including all outstanding mortgages and home loans secured by your home.

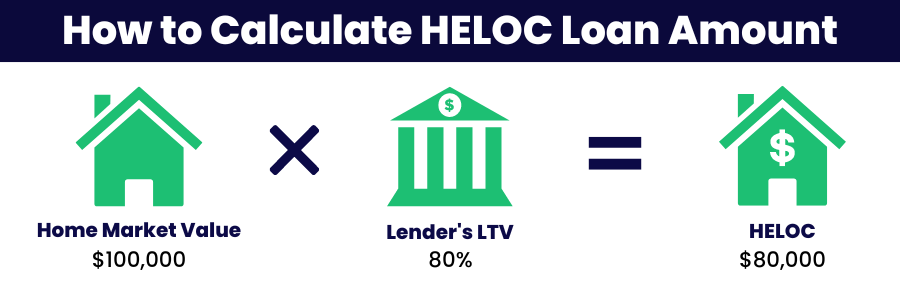

How To Calculate Your Loan-to-Value Ratio

To find your available equity, take your home’s estimated value, multiply it by the lender’s LTV %, then from that amount subtract your current mortgage balance(s). The remaining total is the maximum amount you could borrow up to. The calculations would look like this…

The “Standard” Loan-to-Value Ratio

80-90% LTV is the most common loan-to-value ratio. If you’re buying a home, by making a 10-20% down payment, you’ll be in a solid position to open a HELOC with most lenders.

Homeowners with an 80% or higher LTV typically also qualify for lower interest rates.

While some lenders will go up to 95-100% LTV – they can be very difficult to find, especially in certain states. Luckily…

we’ve done the hard work for our Half Your Mortgage students & found the best HELOC lenders in the U.S. (even ones that offer 100% LTV.)

*Just one of the many time-saving perks of the Half Your Mortgage program.

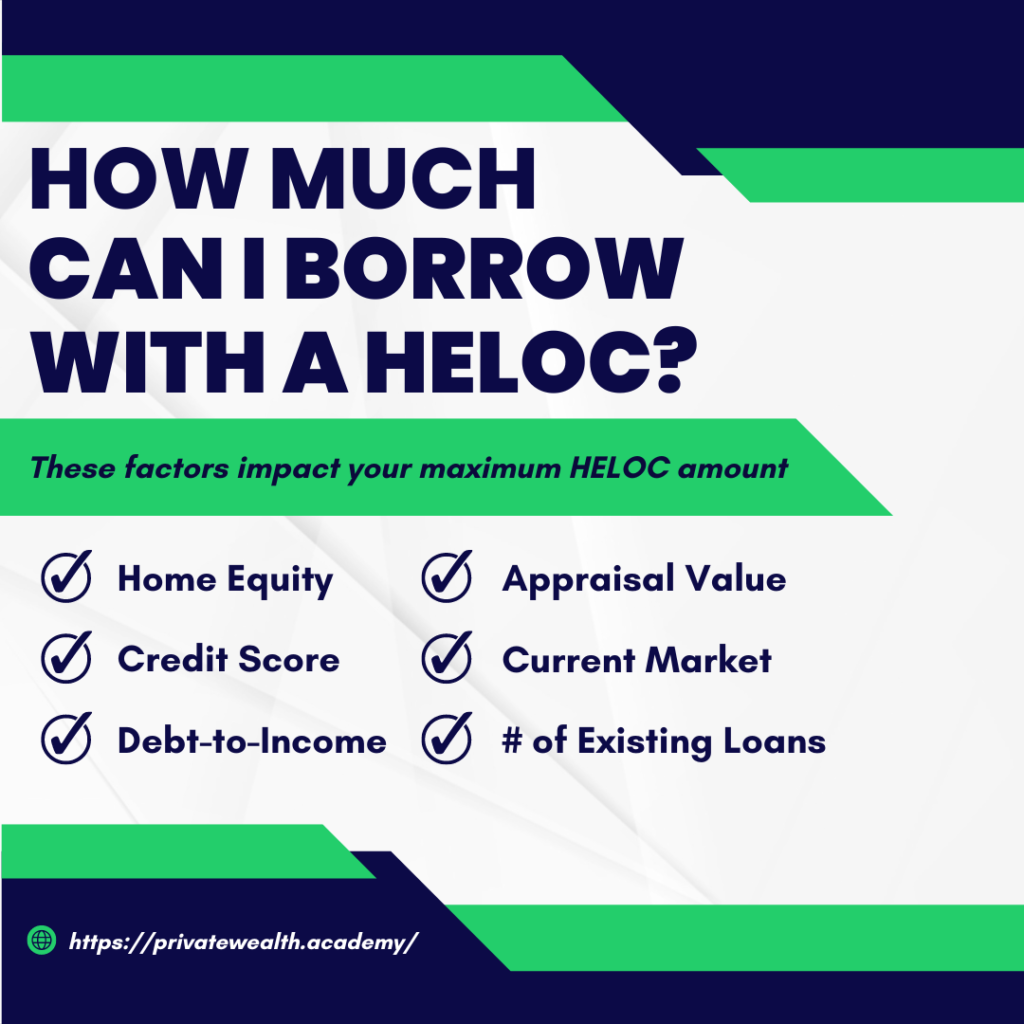

How A HELOC Amount Is Determined

The maximum amount you’ll receive for a home equity line of credit will vary by lender and also depends on:

- The amount of equity you have in your home

- Your debt-to-income ratio and credit scores

- Other lender requirements

Are There Dollar Limits on HELOC Amounts?

Lenders may also have dollar limits. This will vary; $50,000 to $100,000 are “normal” lower limits, while average limits range from $250,000 to $500,000. Higher limits go up to $2,000,000 (or more) in high-cost states like California.

Other Factors That Impact Your HELOC Amount

Besides your home’s value, equity, current mortgage balance, and lender guidelines, other factors may affect your maximum HELOC amount such as…

✅Your Credit Score

The lower your LTV and the higher your credit score, the more likely you are to qualify for a low interest rate on your HELOC. On the flip side, a poor credit score could mean a higher interest rate and a lower loan amount. If you have poor credit – no worries, the Half Your Mortgage program will also help you easily boost your credit score so you’re ready to qualify WITHIN DAYS!

✅Your Debt-To-Income ratio (DTI)

Your debt-to-income ratio (DTI) will determine just how much you can afford to borrow when qualifying for a HELOC. Debts included in your DTI include your existing mortgage payment, credit card payments, and payments on other installment loans like business, student or auto loans. Child support and alimony payments are also included.

The less money you spend on other existing debts each month, the more you can borrow on a HELOC. The lender will require proof of income in order to calculate your DTI. Typically, a HELOC requires a lower DTI than a traditional mortgage. Typically 43% DTI or less is ideal.

✅Home Appraisal

When you apply for a HELOC, your lender may require a new home appraisal. Your home’s appraised value is important because it’s used to calculate the amount of equity in your home. The higher your home’s appraised value, the easier it will be to borrow money based on your home equity.

✅The Current Market

Current market conditions may also affect how much you can borrow however the good news is – since HELOCs are based on your equity and secured by your home, you can still access the cash you need even if lenders pull back on other types of financing. The rates you’ll pay will vary depending on your credit, debt-to-income ratio, and lender requirements. We’ll talk more about HELOC interest rates another day.

As you can see, home equity lines of credit gives you the ability to use equity like cash and with flexible and affordable payments, so it just makes sense.

Inside the Half Your Mortgage program we’ll show you how to quickly boost your credit score, calculate your home equity, your DTI ratio, how to shop for the right lender and lock-in the perfect HELOC to meet your needs.

Just listen to Gary’s experience using the Half Your Mortgage program…

Wondering what you can spend HELOC funds on? The answer may surprise you, we’ll dive into that in tomorrow’s email. Until then…

Click the link to learn more and get started with Half Your Mortgage today.

By following our proven strategy you’ll be able to get funded quickly and get approved for the highest limits possible with your current amount of equity.

Learn More About the Half Your Mortgage Program

You can also Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) we’ll run through the numbers with you using our proprietary software and determine YOUR EXACT PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.