Don’t you ever wonder how the rich avoid taxes?

Taxes can be such a pain…

Especially when also dealing with estate & probate taxes. Handling the death of a loved one is hard enough, without the IRS also trying to take “their cut”…

But nevertheless, when someone passes away – the vultures will always gather.

How Probate Taxes Work

The Internal Revenue Service taxes a decedent’s right to pass their property to their beneficiaries when they die, subject to certain thresholds based on the value of their estate. Their estate pays these taxes, not the beneficiaries. Federal law doesn’t provide for inheritance taxes – payable by beneficiaries – but tax law is full of catches. Depending on what’s included in the probate inheritance and also what you do with it, the IRS might be entitled to a portion.

And not just a small sliver – but a BIG chunk…

After going through the entire estate/probate process, the IRS can wind up taking up to 60% of a beneficiary’s inheritance – isn’t that awful?

We it is! But the good news is – you can actually avoid all that mess…

If you’ve ever wondered how the rich avoid taxes just know…

There’s a way to protect your estate(s) and assets – even after you’re gone.

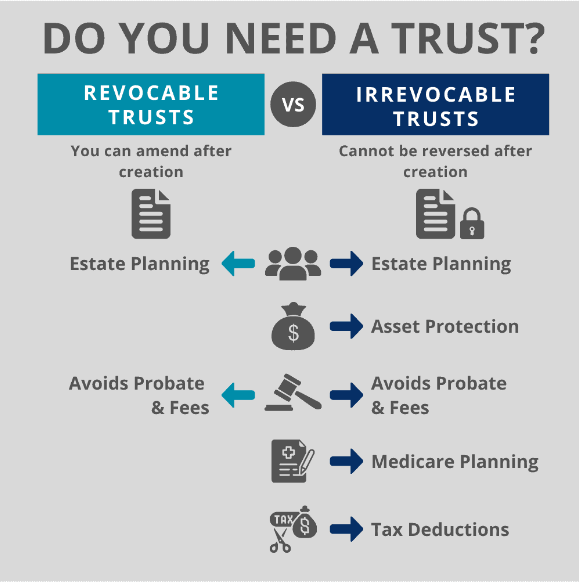

You simply need a private irrevocable Bulletproof Trust!

The benefit of this type of trust is that it removes all incidents of ownership, effectively removing the trust’s assets from the grantor’s taxable estate.

To put it another way: As a grantor, an irrevocable trust requires you to give up all ownership rights to the assets in the Trust, as well as your right to change the terms and conditions of the trust.

Because the assets in the Trust legally no longer belong to you, you cannot count them among your estate, and therefore you don’t have to pay estate taxes on them. Isn’t that amazing?

Just like Nelson Rockefeller used to say: “Own nothing & control everything.”

That’s how the rich avoid taxes and the trustee motto!

That’s the BIG financial secret of the elite…

A trust is much better (more private & secure) than a last will and testament for example a Bulletproof Trust can:

- Eliminate estate tax

- Avoid the cost and delays of probate

- Offer the utmost privacy

- Protect your assets from creditors

- Help you prepare for long-term care and planning

Sure, by establishing a Bulletproof Trust as a grantor, you are giving up ownership of your estate to the care of a trustee (someone YOU appoint) to control the estate and other assets inside the trust.

However, a will does not offer any of the benefits and protections of a Bulletproof Trust and the executor designated in your will controls your estate after your death in much the same manner as a trustee giving rise to the same potential concerns.

The bottom line is, you’ll have to give up control sometime – why not do it on YOUR TERMS with the most protection & flexibility you could ask for?

At Private Wealth Academy it’s our mission to give you the tools you need to protect your wealth.

Inside Bulletproof Trust Secrets we’ll dive deeper into how the rich avoid taxes and provide everything you’ll need to establish your own irrevocable trust, be a grantor or a trustee teaching you everything you’ll need to run the trust effectively.

Learn More About the Bulletproof Trust

Need a little something extra to sweeten the deal?

Best of all, Bulletproof Trust Secrets is tax-deductible. So, you can simply write-off the cost of this life-changing program! Knowledge is power but you have to put that knowledge to work to reap the benefits.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.