Are you wondering how to beat debt collectors?

Do you know how to spot a legit debt collector from a scammer?

From phony-phone calls to legit-looking letters – some debt collection scams nowadays can be hard to pick out.

Here’s How to Beat Debt Collectors Tricks

‘Red Flags’ to Watch Out for With ANY Debt Collector

- They contact you when they shouldn’t: Debt collectors are only allowed to contact you between the hours of 8 a.m. and 9 p.m. local time. If you’re already working with a debt collector on a payment plan, they are only allowed to contact you during the hours you specify.

- They don’t verify your identity (HUGE red flag!): This one can be tricky, because sometimes scammers actually possess information about you and can trick you into giving up more.

Legitimate debt collectors can have access to your personal information, such as your social security number, date of birth, etc. However, a legitimate debt collector isn’t going to share that info until you verify who you are first.

- They are clueless about your debt: A legitimate debt collector will have some information about the debt in collections, including who your original creditor was, what kind of debt it was (student loans, medical, etc.) how much it was for/is now, when you fell behind on payments, what the payments were/are, interest rates, etc.

If you’re asking questions and they’re not willing or can’t give you an answer, that’s a big red flag.

- They are impatient: While true debt collectors will try to get you to pay what you owe, they can work with you to make a plan. They can usually accept payment in a number of ways, possibly including debit/credit card, ACH transfers, e-checks and/or wire transfers through Western Union or MoneyGram.

They have the ability to process payments over the phone and online, and you’ll always get a receipt.

The transaction should feel professional, as it would with any kind of legitimate payment.

Scammers, on the other hand, usually demand one specific kind of payment(often credit cards or prepaid cards sent to a random P.O. box), and they will aggressively insist that you send it right away.

- They use aggressive tactics and/or language: When someone speaks aggressively and vaguely about your supposed debt but isn’t able to pin-point any details about it, it’s best to end the conversation.

“A common threat that a scammer might use is that they’re going to have you arrested if you don’t pay by today or next.”

There is no debtor’s prison. Aside from refusal to pay criminal fines, you won’t face any jail time for being in debt. The police won’t show up at your house or workplace to arrest you.

Another common threat is that they will embarrass or shame you. They might say, “I’m going to call your friends and family and your employer and tell them all about your debt and how you’re a deadbeat, etc.’” If they use language like that, hang up. Real professional debt collectors aren’t allowed to do that.

Unfortunately, letters can be much harder to decipher and may require you to call the original creditor to see if they’re working with said debt collector.

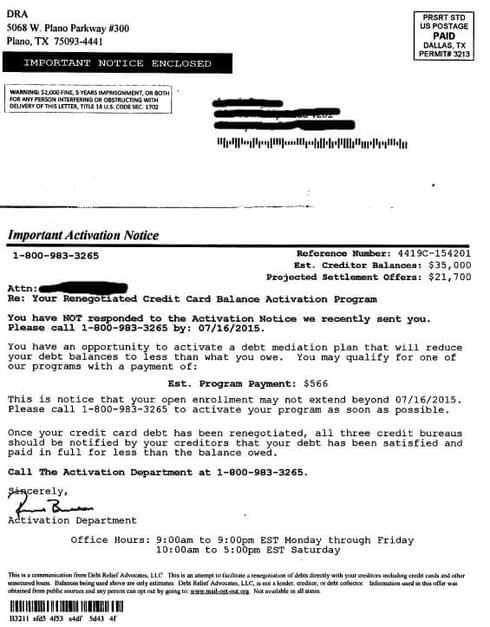

Here’s a debt collection scam letter from DRA:

The letter LOOKS LEGIT but…

DRA (Debt Relief Advocates, LLC) is an “agency” that preys on seniors suggesting that they owe debts that DRA can settle for less. In most cases – there isn’t even a debt owed at all.

An Ohio case was settled against them and they are probably sending out these letters to other states as well. The Ohio lawsuit claimed that the consumer was sent an offer to settle a debt by DRA. But what’s interesting is that the allegation made by the consumer states that they did not owe this debt DRA claimed that they did owe.

DRA violated R.C. §1345.02 and committed an unfair or deceptive act or practice in connection with a consumer transaction because DRA offered debt mediation services when DRA knew that Plaintiff did not owe an debt obligation and Plaintiff had an inability to receive a substantial benefit from DRA’s services.

Other Scams to Look Out For…

►IRS Tax Debt Scam

What it is: Someone posing as an IRS employee says you owe taxes and demands payment — usually with a credit, debit or prepaid debit card. Often, they threaten you with jail time.

How to recognize it: The IRS has clear rules on how debt collectors can approach you. Any caller that contacts you about tax debt you’re unaware of, demands immediate repayment, threatens to call law enforcement or doesn’t give you the opportunity to appeal is acting illegally.

The IRS never asks for any credit or debit card numbers over the phone.

What to do: Hang up and don’t give the caller any personal information. If you think you might have tax debt, you can check your tax account information on the IRS website, where you’ll also find payment options.

►Debt Collector Wire Transfer Scam

What it is: A debt collector calls you, says you owe money and demands repayment by wire transfer, rather than by check or online.

How to recognize it: The debt collector only allows you to make repayment through a wire transfer and also doesn’t give other options.

What to do: Hang up and don’t make the transfer. If it has, ask for the collection agency’s contact information.

►Credit Bureau Collection Scam

What it is: Someone claims they work for one of the three major credit bureaus — Equifax, TransUnion or Experian — and tells you they’re collecting debt you owe.

How to recognize it: Anyone who says you need to pay off debt through a credit bureau is scamming you. None of them collect repayments.

What to do: Get the person’s name, title and general information about the company they claim to work for before hanging up — this makes it easier to report. Don’t give out any personal information.

Still unsure your debt collector is the real deal…

How to Beat Debt Collectors Through Verification

Take These Steps to Double-Check

- Decline verifying anything until you get confirmation that the debt collector you’re speaking with is legitimate.

- Ask for a validation notice. By law, creditors are also required to send you a written notice stating how much money you owe within five days of reaching out. You can also request validation of the debt to make sure it’s legitimate and that you’re the person the collection agency is actually looking for.

A validation notice is an official letter (on agency letterhead) that details your debt(s), including the balance(s) and also info on the original creditor. When it arrives, confirm the letterhead branding, logo and address all reflect what you see on the website of the debt collection agency.

3. Check the FTC’s list of banned debt collectors. The FTC has a list of agencies that have been legally prohibited from debt collection.

4. Call your original creditor. Ask them if any of your accounts have gone into collections. If so – ask them if they work with the agency that contacted you. If they don’t, get the name and contact information of the debt collection agency they’ve hired. They can also confirm when your delinquent debt was sent off, and to whom if requested.

Ready to just erase your debt and be done with it?

Learn how Debt Removal Secrets can set you free

Still wondering if Debt Removal Secrets is right for you? Check out tomorrow’s post – we’ll breakdown which types of debts & loans this works for, plus an important note before working with a lawyer.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.