Wondering how to build business credit as a new business?

How long has your company been in business?

6 months? 12 months? 2 years? Longer?

Even if you haven’t started your company yet – you should know it can take a while until you become profitable…

Two to three years is a long time – considering…

More than 90% of businesses fail within 5-10 years…

Starting a new company can be fun and exciting but it takes creativity, innovation, a lot of hard work, and most importantly – sufficient capital.

Those first few years can be particularly tough…

Especially when you’re just starting out and don’t have much (if any) revenue.

This is where having a solid corporate credit profile comes in to save the day. It gives you access to the funding you need to ensure your business gets through the hard times.

But how can you get business credit as a new business, especially in the early stages?

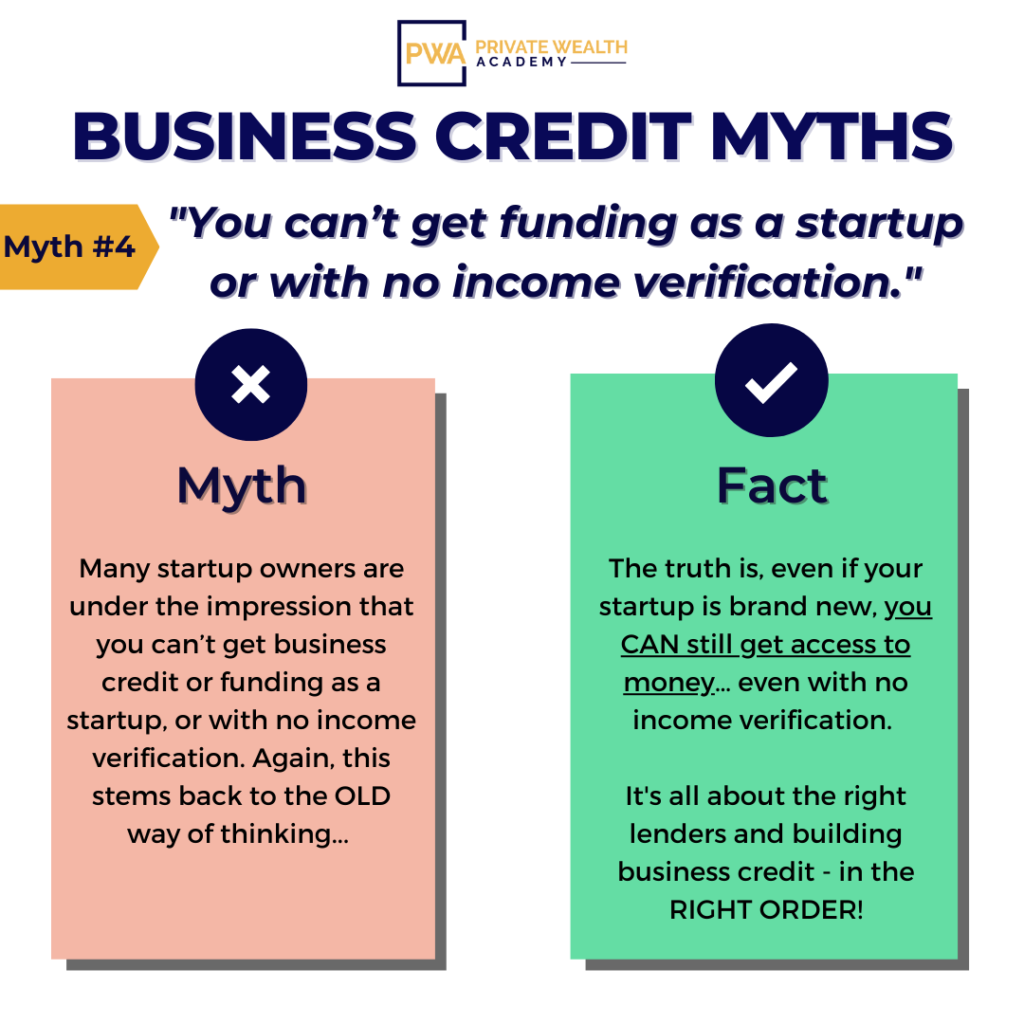

Many startup owners are under the impression that you can’t get funding as a startup, or with no income verification.

That can make the money hurdles of funding your venture feel insurmountable.

While it may feel like a mountain you can’t scale, luckily the myth that startups can’t get corporate credit or funding is completely and totally FALSE.

Even if your startup is brand new, you CAN still get access to money… even with no income verification. Isn’t that great news?

With sufficient credit & funding, you can pay for utilities, hosting, software, advertising, equipment, employees, and other necessary business expenses to keep your company running.

But what are the initial steps to take to get business credit as a new business?

How can you get a lender to trust you with their money before you can show any verified income?

The key is to establish your company’s credit – in the right order.

If you were to go into a large bank and apply for a $70,000 line of credit without an established company credit history or revenue – there’s a good chance you’d get denied.

Think of building corporate credit like building a house…

If you do it in the right order, you can do the process efficiently and end up with a safe, beautiful home.

If you do it in the wrong order, it can end up costing you extra time, money and the safety of the structure may be seriously compromised.

You should also know that not all lenders are created equal.

Certain lenders out there don’t require as much documentation or proof for income verification. And some lenders don’t require any at all.

This is the secret to getting business credit as a new business.

Many business owners struggle with this process, not because it’s hard, but because they don’t have the right information to rely on.

Contrary to what some people may tell you – you can build a solid company credit profile within a matter of months (or even weeks) – not 2 to 5 years!

You don’t have to be another statistic…

You can make your business flourish. And, we can help you do it faster with Corporate Credit Secrets.

Inside Corporate Credit Secrets we show yow how to establish credit in the right order so you can build a strong credit profile & what to do to get approved for as much money as possible.

We also show you how to choose the best lenders for your business so you can secure credit right away even without financial documentation to show.

Discover how your company can become highly fundable and get access to $50,000-100,000+ in credit in 6 months or less…

Learn More About Corporate Credit Secrets

Still Not Sure Corporate Credit Is Worth It?

Don’t take our word for it. Listen to what Dr. Juanita Woodson had to say…

Dr. Juanita Woodson – Entrepreneur, Wealth Coach

Dr. Juanita Woodson is a serial entrepreneur from Atlanta, GA. She recently spoke about building business credit the right way so that it can revolutionize life as an entrepreneur.

Here’s what she had to say…

“To understand business credit, you must understand the concept of credit itself. Credit is an overall snapshot of someone’s financial trustworthiness. Credit can be enhanced or destroyed depending upon the stewarding or squandering of spending habits. These practices can reflect positively or negatively on the credit, determining a bank’s perception of one’s financial practices. Essentially, it’s how banks determine whether to extend lines of credit.”

When asked in what ways business credit has directly benefited Woodson’s companies, she says “continual expansion is the theme. Without it I wouldn’t have been able to grow as fast.”

She has been able to finance the acquisition of several vehicles and establish her own car rental company. She has access to large pools of rewards points for travel through perks on business cards and also has no limit business credit that grows and expands with her needs.

Ready to start your corporate credit journey?

We cover everything you need to secure $50,000-100,000+ in credit for your company with time-saving tips and resources you won’t find anywhere else! *In fact we even show you a framework to help you secure over $1,000,000 in NO-DOC unsecured business credit (that allow is worth the price of the course!)

Learn More About the Corporate Credit Secrets Program

Think an EIN is enough to start applying for credit? Make sure to look out for tomorrow’s post where we’ll be revealing the truth behind getting credit for your company with an EIN.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.