Are you getting ready to start shopping for A home equity line of credit lender?

Hopefully, you’ll take advantage of the Half Your Mortgage program.

HELOCs can be complex. When dealing with an asset as valuable as your home & equity, this isn’t something you want to learn on the fly.

A home equity line of credit can allow you to tap into your equity, invest in real estate, pay for unexpected emergencies, or anything else you need.

The BIGGEST downside to HELOCs is how much they vary in rates and terms depending on which lender you choose.

This can create a lot of frustration. We want to help you avoid all that frustration so you don’t miss out on this incredible tool.

Besides, we’ve already done the heavy lifting by creating the Half You Mortgage program. All you have to do is follow the steps we’ve outlined.

10 Things to Know Before Choosing a Home Equity Line of Credit Lender

Even if you can’t join the Half Your Mortgage program today – here are 10 important things to know.

►Compare Lenders. With a variety of options before you, it is important to consider the following in looking at the home equity line of credit (HELOC) as your source of funding: While your current lender or bank may offer you a good deal on a HELOC, don’t stop there.

Compare estimates from other lenders, including your community banks, credit unions, as well as national banks, and online lenders.

►Don’t Get Blinded by Low Introductory Rates – Lenders often advertise attractive introductory rates that can last for 6-12 months. Some of these rates are incredibly low starting at 2%.

Make sure that the interest rate after the intro period still makes sense for you.

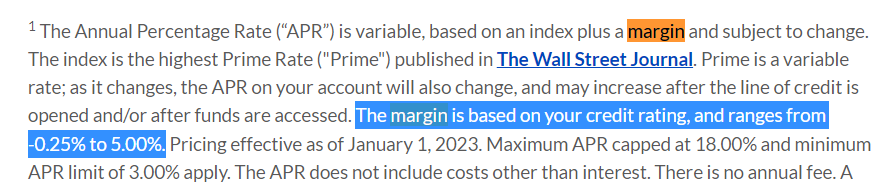

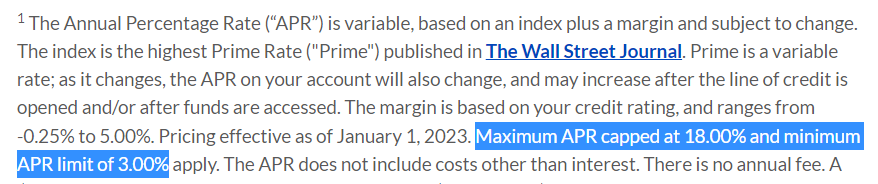

►Margin – A margin is the markup that the lender adds to the index to arrive at your interest rate. Margins can range quite a bit. The average margin added to the prime rate is about 0.25-0.75%, although they may range from -1% to 5%.

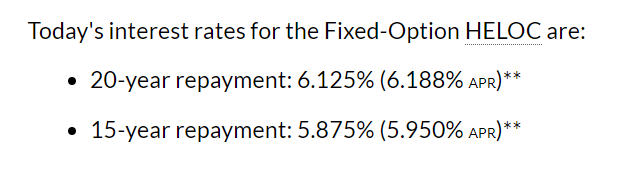

►Consider Fixed-Rates – In addition to the interest rate, it’s important to understand if the rate is variable or fixed or a mix of both. A HELOC typically comes with an adjustable rate during the initial draw period but this varies by lender..

The HELOC (even with variable rates) can allow you to save hundreds of thousands in interest versus a mortgage or home equity loan.

No matter which type of interest rate you end up with – the strategy in ‘Half Your Mortgage’ will help you pay off your home in 5-7 years.

►Look for Low Interest Rate Caps (or the Maximum Lifetime Rate) – Most HELOCs offer rate caps or maximum interest rate percentages as a safeguard against rising interest rates.

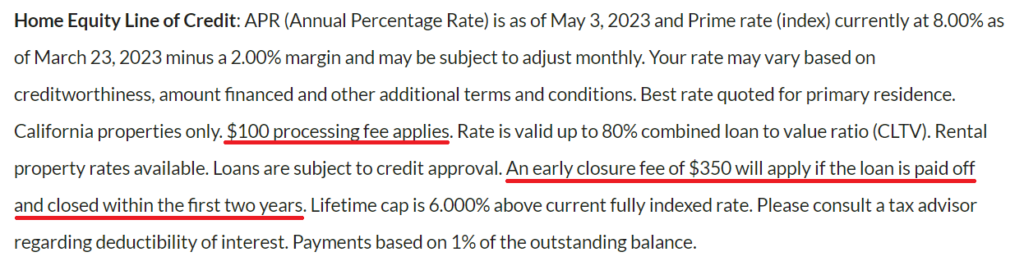

►Factor In All Fees – While obtaining a low interest rate is important, the fees associated with a HELOC also play a big factor in your final cost. Be sure you get clear on the closing costs and any other fees that may come with the loan. Some lenders charge upfront fees, third-party fees or an annual fee. They may also require you to draw a minimum amount of credit to avoid a fee or charge inactivity fees.

►Avoid Prepayment Penalties – Typically most HELOCs don’t come with prepayment penalties as long as you keep the account open for at least

2-3 years. If you decide to sell your house you’ll have to pay off the HELOC, just find out if the lender charges a fee for prepayment or the cancellation of the line of credit.

►Get It in Writing – Get documentation for each quote you receive by asking for a ‘Good Faith Estimate’ or Loan Estimate that includes the interest rate and all fees so you can compare your options side by side. It’s important to evaluate the total, long-term cost of each loan offer. And when evaluating costs, remember, some loans–even with fees–may still end up having a lower overall cost.

►The Benefit of Shorter Terms – Many lenders only have one set of HELOC terms, but some lenders let you choose the length of your draw period and the repayment period. Opting for a shorter repayment term can decrease the amount of interest you pay.

You may also get a better interest rate if you select a shorter loan term.

If you want the best of both worlds: a long draw period + lower interest costs, follow our tips inside the Half Your Mortgage program.

We’ll show you how to pay off your HELOC in less than 10 years – BEFORE the draw period ends saving you $$,$$$ to $$$,$$$ in interest.

►Take Advantage of Discounts – Most lenders offer discounts for bank customers or members (especially when you set up automatic payments or direct-deposits) which works perfectly with the HELOC Hyperdrive Strategy. Credit unions require becoming a member to gain access to their products and services so just be prepared to open a new account when you find the right lender for you.

We know there’s a lot to know and you’re probably feeling a bit overwhelmed…

BREATHE. It’s okay – You don’t have to try to do this all on your own…

We’re here to help you and make it as simple and easy as possible.

If you’re looking for a reliable way to pay off your home faster, need to cover large or unexpected expenses or find a more affordable form of credit than loans or credit cards… A first lien HELOC is an ideal solution!

The Half Your Mortgage program is exactly what you’re looking for!

We’ll show you how to prepare your finances, boost your credit score,

calculate your debt-to-income ratio, the criteria your HELOC needs,

how to compare lenders, the questions to ask to ensure you’re getting the

best rates, what to do if your application gets denied and much more!

You’ll also get access to our proprietary calculators to make the math super-duper easy. A list of state-specific lenders that will save you hours of research time.

Learn More About the Half Your Mortgage Program

Does this all sound like too much to take on yourself?

That’s why you’re here!

Our Half Your Mortgage Coaching program will pair you with one of our knowledgeable coaches to help you get the right HELOC for you.

Plus, we’ll show you how to perfect your own land patent to avoid foreclosure & remove yourself from property taxes FOREVER. AND, we’ll even teach you how to get a 12% ROI every year with the one incredible banking secret! You’re basically getting 3 courses-in-one with a coach to guide you every step of the way. That’s a pretty sweet deal, isn’t it?

Just listen to what one of our most recent coaching students had to say…

By joining the Half Your Mortgage Coaching Program our team will walk you through the entire process of finding the perfect HELOC for you.

Not only that – we’ll also help you…

Improve your personal credit.

Lower your debt-to-income ratio.

Check if your financials will qualify.

and MORE!

PLUS – you’re going to have one of our knowledgeable coaches there to help you everything step of the way.

You’ll always have your coach there to help you.

But don’t wait around too long…

Our coaching program is limited to 100 people every 12 weeks. Spots are filling up fast but there are still a few openings left…

So be sure to book a call TODAY!

We don’t want you to have to wait – because with a HELOC every 6 months the average student saves $14,000!Our coaching program will more than pay for itself in that time!

Don’t worry you don’t have to pull out your credit card just yet…

Book a FREE Discovery Call with Our Team to see if you qualify for the Half Your Mortgage Coaching program and discuss how a HELOC can half your mortgage (whether it’s new or existing.) We’ll run the numbers with you and see how much you’ll save in interest and determine YOUR PAYOFF DATE! Click the link to schedule a call for a time that works best for you.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.