Wondering how to compare HELOCs and lock-in the most affordable rates?

Learning how to utilize your equity when you need it, can help you get ahead financially.

If you have a good chunk of equity in your home, a home equity line of credit (HELOC) can be a great tool to leverage. Understanding this type of funding and also how to shop for the best HELOC for your situation is key.

Tips to Compare HELOCs:

HELOC rates vary greatly based on a variety of factors.

Here Are the Main Factors Lenders Look At To Determine Your Rates:

📌Property Location – A nicer location means higher property value. The higher the property value – the more money your HELOC loan can be approved for. Which leads us to…

📌Property Value – The more your property is appraised for, the more your HELOC loan will be approved for. If you can make small (affordable) updates to your home that will increase the property value BEFORE the appraisal – the more money you can get approved for and use.

📌Equity – The amount of equity you have in the home is a major factor for the lender in determining how much to lend you and setting your interest rate. 10% equity is the bare minimum for some lenders but most lenders want to see at least 15-20%. If you’re worried your current equity is too low, if you’re able – make some additional payments to boost that percentage.

📌Credit Score – Your credit history also plays a large role in determining the rates on a HELOC. If you have a great credit history, lenders are likely to give you better rates and a higher loan-to-value (LTV). Lenders are generally looking for credit scores of 620+ (680+ is more realistic in slower economic times.) Also you should also be aware of how many hard credit inquiries you currently have. Ideally it should be less than 5-6 within a 24 month period.

If you struggle with poor credit, you’re in luck because the Half Your Mortgage program includes access to High Credit Secrets for FREE. We’ll help you boost your personal credit score by at least 100 points in the next 10 days and go from 0 to 720+ in 90 days!

📌Income – Your income matters because lenders want to ensure that you can make the payments. The lower your debt-to-income ratio (DTI) is, the more likely the lender will give you better terms and rates for your HELOC. 43% is usually the max DTI percentage for most lenders. If your DTI ratio is over 43%, do what you can to either increase your income or also reduce your expenses.

📌Property Type – Most people are typically looking to take out a HELOC on their primary residence (a single-family home). But if you have a condominium or townhome you want to take a HELOC out on, there may be varied factors involved regarding LTV and rates. Some lenders also offer HELOCs for second homes or investment properties. *Undeveloped land and pre-fab/mobile homes typically aren’t eligible for home equity financing.

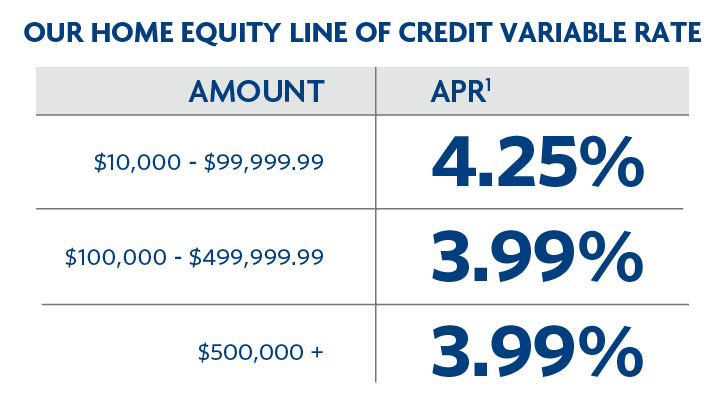

📌How Much You Ask to Borrow – Rates will also differ depending on how much you are looking to borrow with your HELOC. Typically, the higher loan-to-value (LTV) or amount that you borrow, the more you will be charged on your annual percentage rate.

Expect to provide the following documentation:

- Your name, Your name, date of birth, and Social Security number.

- Your current address (and previous address, depending on how long you’ve been in your current home).

- Your employer’s name and address. *If self-employed, write the company name.

- A copy of a government-issued photo ID, such as a driver’s license or state identification card.

- If applying at a credit union, you’ll need to become a member first.

- Income documentation

- Proof of property ownership documentation

- Most of the time, you’ll also need an appraisal to apply for a HELOC. Once you submit your application, the lender will schedule the appraisal to determine the home’s value

To get the best rates for your HELOC, you’ll need to shop around. This is where we can help!

We’ve done literally 95% of the hard work for you. We’ve…

Also simplified the process…

Perfected the formula to pay off a 30-yr mortgage in 5-7 years…

Increased the amount one can save in interest by 80% on average…

We’ve also done the deep-dive for you and cut out most of your research by finding the top lenders across the country that offer the right type of HELOC with affordable rates.

By joining the Half Your Mortgage program, you’ll also receive a list of the best lenders in YOUR STATE saving you hours of time. All you have to do is pick the right one for you!

The Half Your Mortgage program will walk you through the steps of opening your own Home Equity Line of Credit from start to finish.

As a student of the Half Your Mortgage program you’ll get access to our High Credit Secrets program for FREE, which will help you boost your credit.

PLUS…

You’ll also receive access to our proprietary calculators (that makes the math super-duper easy.) And you’ll learn our proven HELOC Hyperdrive Strategy that will show you how to pay off the loan in as little as 3 years.

Learn More About the Half Your Mortgage Program

Why wait any longer? Book a call with one of our team members. We’ll review your numbers together and see if a HELOC will make sense for you.

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software we’ll see how much you’ll save in interest and determine YOUR PAYOFF DATE! Schedule a call TODAY!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.