What’s the ONE commodity that can’t be bought, borrowed, and doesn’t replenish?

Need a fun little hint?…

What flies but has no wings?

TIME.

It seems everyday it’s getting harder for people to find common ground, but one thing that almost everyone can agree on is that time is our most precious commodity.

But, NONE of us can add more hours to the day.

It is the coveted resource we all seek, whether we’re looking back at our past or forward to our future. However, we continuously strive to maximize our time.

Money is also time, because it takes time to make money.

You know the old saying: “Time is money.”

How to Cut Your 30 Year Mortgage in HALF…

Considering that the average mortgage takes ~30 years to pay off…

How much would it be worth to you to cut that down to 7 years or less?

Just imagine – that could mean 23 more years of…

No more mortgage payments…

Saving $2,000+ a month (thanks to no mortgage payments)…

Increasing your cash-flow and investment portfolio…

That’s almost like adding 23 years to your life (financially speaking).

That’s a lot of time AND money on the table, isn’t it?

The ideal goal is to retire with a million dollars (or more) but it seems like that would take a miracle for most people right now.

So what is the best option that will allow you to significantly increase your cash flow and pay off your home faster?

Well, let’s also look at what your most expensive monthly costs are…

For most people housing is the biggest monthly expense.

In fact, the average American spends 37% of their budget on housing.

Housing costs have a trickle-down effect into other parts of our budget, that’s why having the right exit strategy in place to pay off your home is a matter of survival in today’s economy.

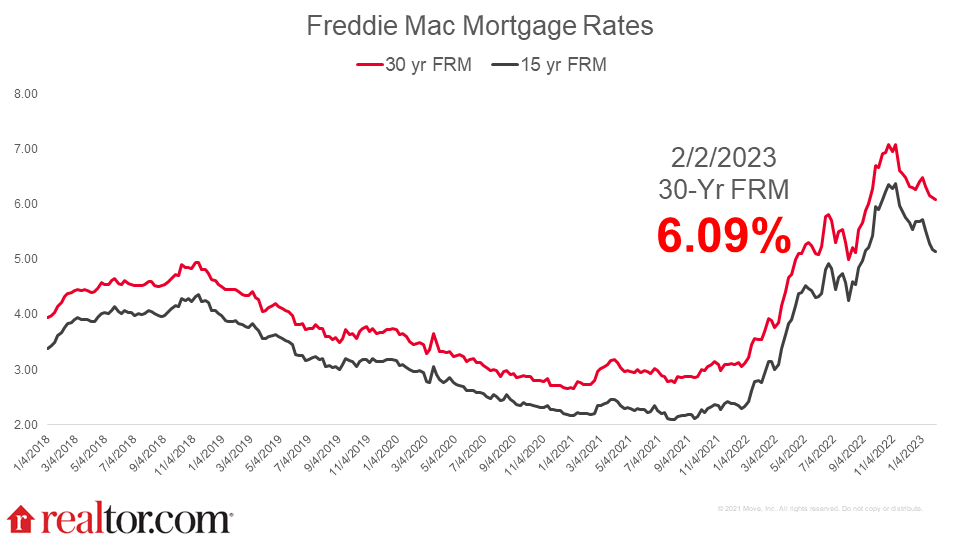

According to data from the National Association of Realtors, the average monthly mortgage payment last year was $2,047.

But, that’s a lot of money! Especially when you consider the fact that just a few years ago the average monthly mortgage payment was ~$1,427.

Plus, the mortgage isn’t the only thing you’re paying for each month…

Other monthly costs also include mortgage insurance, homeowners insurance, property taxes, and other fees (where applicable).

If that weren’t bad enough, the costs continue to rise each year…

So where can homeowners find relief & maximize their cash flow?

Well, what if you could reduce your mortgage costs by 50%? (without increasing your income or paying more.)

And better yet…

What if you could do that while paying off your home in 5-7 years?

That would help you improve your financial situation, wouldn’t it?

Sounds too good to be true, right?

We know. We talk with a lot of homeowners and real estate investors, and we hear the same questions a lot like…

“How can I possibly pay less in interest with a higher rate?”, “Why does interest calculation type matter?” and, “Why haven’t I heard of this before?”

These are all great questions to ask.

If you’ve been wondering how to cut costs, increase your cash-flow and pay off your home faster than ever – the HELOC has come to the rescue!

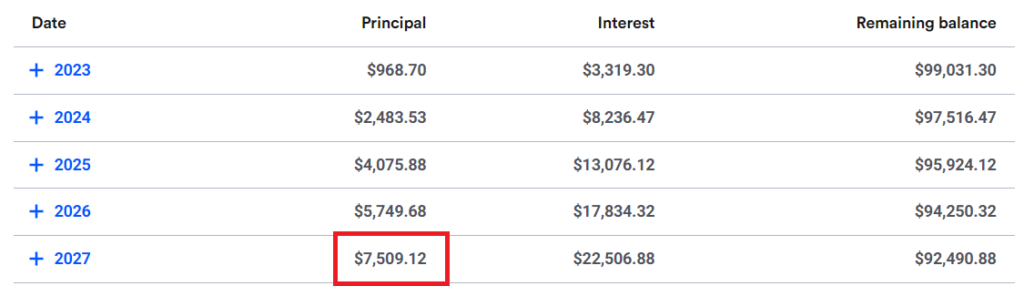

The truth is with a conventional mortgage, the first 5-10 years of mortgage payments will barely scratch the surface of the principal owed.

On a $100k mortgage, after 5 years you’ll only pay $7,509.12 off the principal!

This is due to the fact that you’re paying off the interest FIRST as per the lending agreement you signed at closing.

This guarantees the lender makes DOUBLE the money. BUT not anymore!

You no longer have to be tied to the shackles of a 15 or 30-year mortgage that’s only in the best interest of the banks.

You can break free with the flexibility of a HELOC and realistically pay off your home in less than 10 years! (Most student do so in 5-7 years.)

HELOCs can be an excellent tool for investors as well because of the leverage created by saving 80%+ on interest payments, having lower interest rates, and so much more.

However, the best part is that nothing has to change in your life!

Not your income, not your lifestyle…nothing has to change except where you make payments from.

Half Your Mortgage shows our mathematically proven strategy to paying off your home in 5-7 years using only your current income!

Curious what all comes with the HYM program?

When You Join the Half Your Mortgage Program You’ll Get…

Our extensive financial knowledge, video training, a detailed written guide, advanced techniques for paying off the HELOC faster, a curated list of state-specific lenders (created just for you) to help you get the best HELOC terms, one-on-one support to make sure the bank correctly sets up your HELOC, and much more. And of course, as a member of Private Wealth Academy, you’ll get access to updates and also support for life.

We constantly pour our hard-earned cash into our homes year after year. So isn’t it time that the home that you’ve painstakingly paid for finally gives you something in return?

As well as, we can reduce your mortgage by 50% guaranteed!

Just click the link below for more details to learn how you can also save years of time and hundreds of thousands with Half Your Mortgage!

Learn More About the Half Your Mortgage Program

Just listen to Maria’s experience with the Half Your Mortgage program…

Want to speak with someone first?

Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing.) We’ll run over the numbers with you using our proprietary software and see how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.