Have you been wondering how to cut your mortgage in half?

Does this situation sound familiar…

We recently had the pleasure of working with Daniela & Jose. They didn’t know how they were going to reduce their mortgage costs and avoid going into foreclosure. This is their story…

I didn’t know how to tell her…

I had just gotten laid off. The company I worked for was downsizing.

And if that weren’t bad enough, my wife and I were already in a tight spot with our finances. Let’s rewind a year (to late 2022)…

We were paying $2,600 a month on rent so we figured it was time to start putting that money towards our own property.

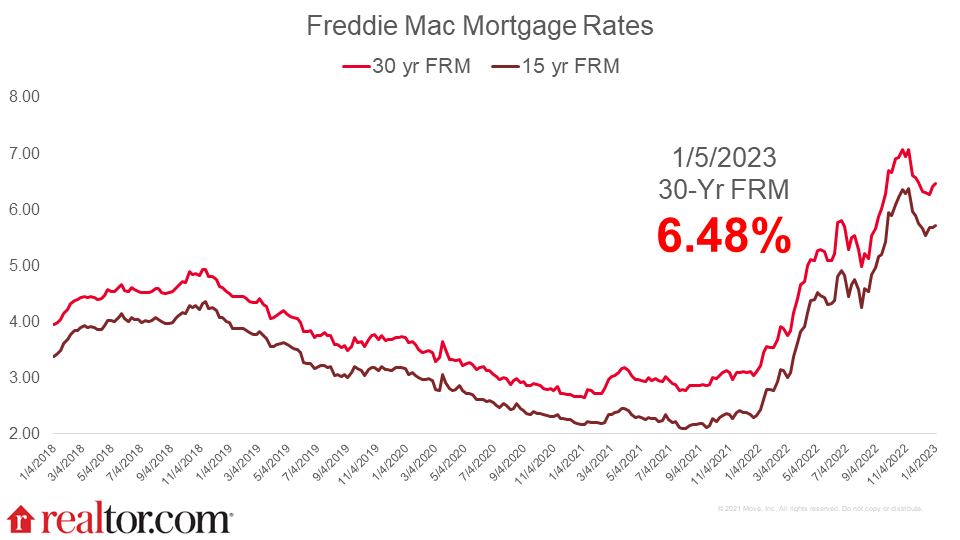

“We need to qualify for an interest rate of 4% or less in order for this to work with our budget…” Daniela said as we pulled up to the bank.

I’ll admit I was a bit nervous as the bank representative went over the numbers with us. After a few moments of putting our information into the computer, the banker gave us the news…

“With your current credit scores & debt to income ratio – unfortunately you’ve been labeled ‘high risk borrowers’ with an elevated potential for delinquency or defaulting on the loan.”

That’s when we knew we weren’t going to get the ultra-low interest rates we had hoped for…

I could see how disappointed Daniela was. But at the end of the day – putting our money towards buying our own house seemed to make more sense than continuing to pay sky-high rent.

So we bit the bullet and got a mortgage anyway.

With so-so credit scores and not much cash to put down on our home, we ended up with a mortgage interest rate high enough to make a strong man squeal. (Nearly DOUBLE the rate we had hoped we’d be getting…)

This in turn left Daniela and I on a VERY STRICT budget each month.

We learned the hard way-through our Loan Estimate that the banks raised their borrowing standards for mortgages and we needed a credit score of at least 700 and a 20 percent down payment to receive the best rates.

Our less than desirable credit scores and lack of cash for a down payment really hit us hard.

The financial tension was quickly tightening its grip as our savings account dwindled more and more every month. We liked our home, the location is great and we really didn’t want to sell. But…

Missing one more mortgage payment is all it would take to put the foreclosure wheels in motion. We had to make a choice or face losing our home.

So we started researching our options…

We didn’t want to refinance into another mortgage…

We weren’t old enough to qualify for a reverse mortgage…

And the interest rates on a personal loan (with our scores) was out of the question.

Then we discovered…

A way to REPLACE our existing mortgage with a first lien HELOC that would allow us to have flexible payment options and the ability to pay off our home in HALF the time.

How to Cut Your Mortgage in HALF!

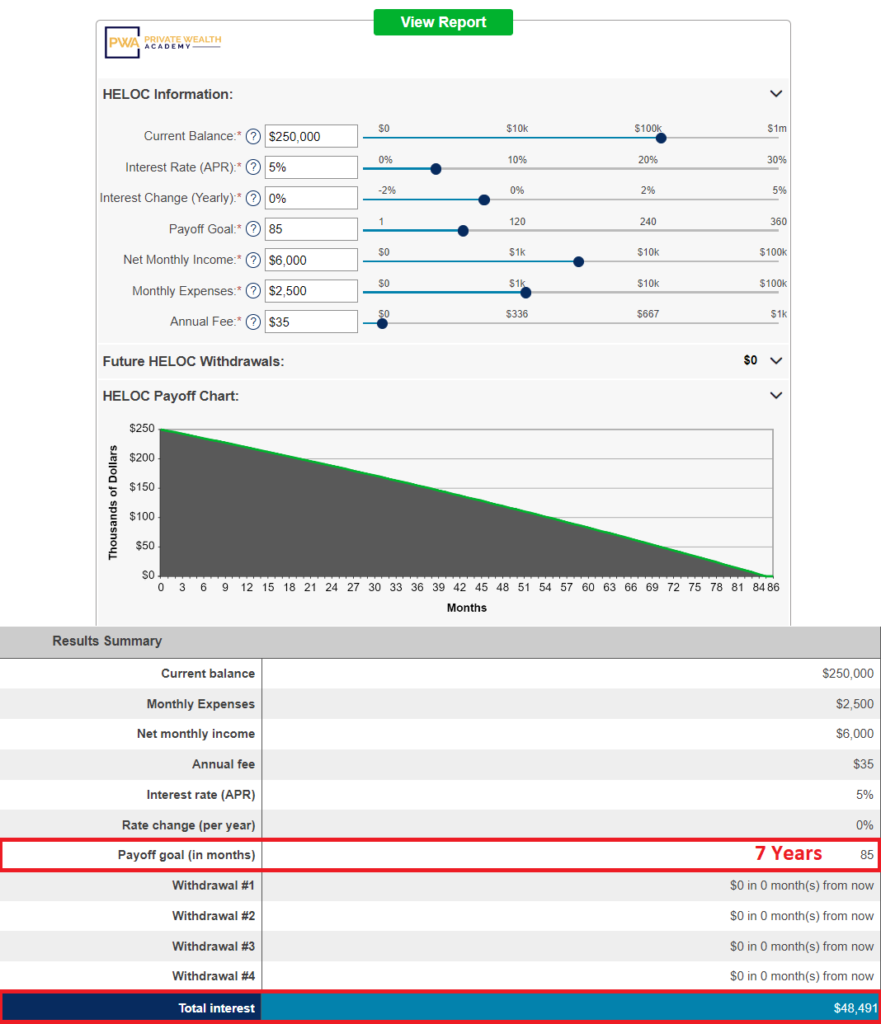

As we were researching HELOCs, we came across Private Wealth Academy and their Half Your Mortgage program. After we spoke to their team and we went over the numbers, it just made sense to make the switch!

It’s been a year since switching to a HELOC, following the HELOC Hyperdrive Strategy and we’ve already saved thousands in interest.

We’re scheduled to pay off our home in just 7 years compared to 30! And unlike a mortgage, we can withdraw funds whenever we need! We’re SO HAPPY to have discovered this option & a team to help us implement it!

If this situation sounds all too familiar and you’re looking for a method to pay off your home as fast as possible or you simply want to be able to tap into your equity – the Half Your Mortgage program will teach you how to secure the right HELOC for you.

Want to dig deeper into the math PROVING you can pay off your home in 10 years or less? That’s what we’ll be diving into in tomorrow’s email.

Until then…

We have SO MUCH MORE to teach you about finding the right HELOC. Click the link below for details on how Half Your Mortgage can shred your amortization schedule and put you on the fast track to paying off your home in just 5-7 years:

Learn More About the Half Your Mortgage Program

You can Book a FREE Discovery Call with Our Team to discuss how a HELOC can half your mortgage (whether it’s new or existing) by running the numbers through our proprietary software, seeing how much you’ll save in interest and determine YOUR PAYOFF DATE!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.