We’ve had some people report that they paid to get an EIN number…

DO NOT PAY TO GET AN EIN number.

You can get an EIN for free.

Go to IRS.gov

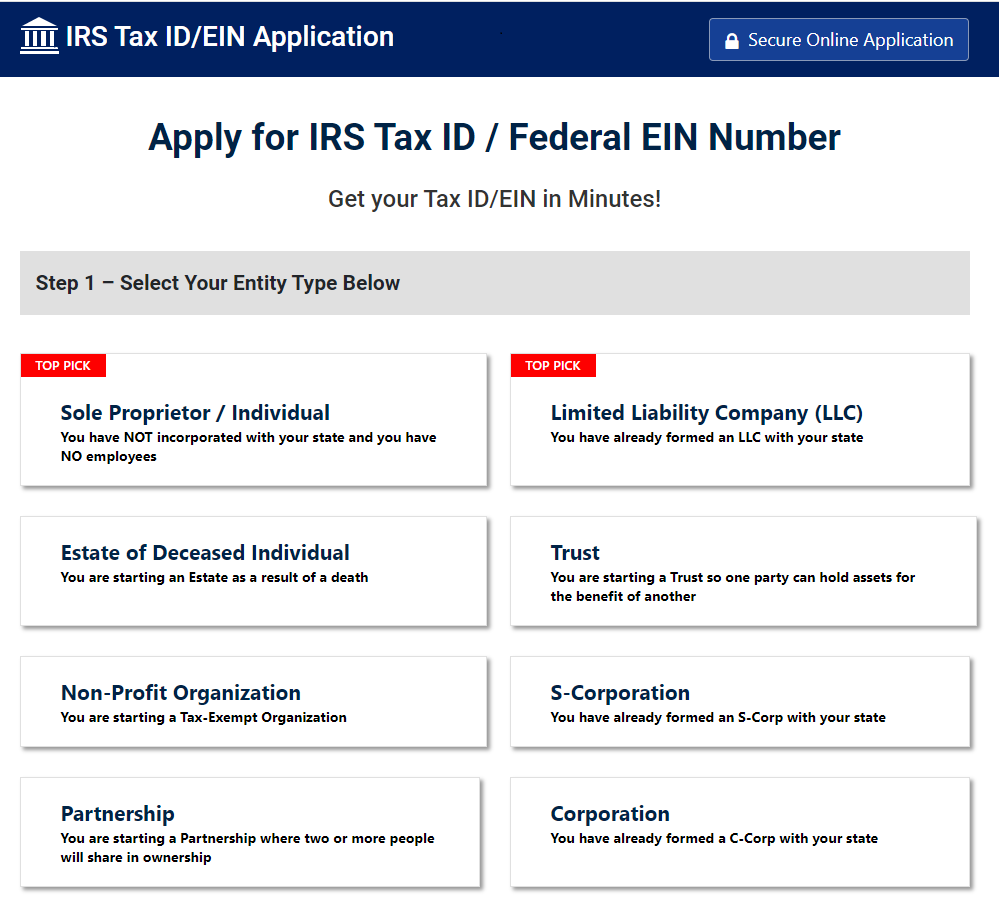

There are three options to get an EIN for a trust bank account:

1) Apply Online [15 minutes]

2) Registered Agent Apply as Foreign Entity [15 days]

3) Tacit Acquiescence from Department of The Treasury for Private EIN [30 days]

Most people choose the fastest online option however…

it requires linking a social security number which can shift your jurisdiction into the public realm – personally, we like to stay private.

However, one who banks (using the special redemption method we show in Section 4) won’t have income taxes to worry about.

Go to https://irs.gov

Search for “Online Application” and answer the questions:

TRUSTS > IRREVOCABLE TRUST > CONTINUE > GRANTOR INFORMATION > TRUSTEE FIRST & LAST NAME + I AM GRANTOR, TRUSTEE, BENEFICIARY > TRUST MAILING ADDRESS > NAME OF TRUST, COUNTY, STATE, DATE FOUNDED > NO EMPLOYEES IN NEXT 12 MONTHS > SUBMIT

As you can see, it’s easy to get an EIN from the IRS (Internal Revenue Service), online and offline. Once filled out, your number will be instantly disclosed.

Get The Bulletproof Trust Package now and discover all the tips and tricks we’ve learned over the years when dealing with the IRS.

Learn More About Bulletproof Trust Secrets

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.