Ready to get more out of your business credit cards?

They’re are one of the most popular credit tools and can be a great for bridging the gap between expenses and income.

Let’s say you own an ecommerce or retail business and need to replenish your inventory. If you don’t have terms with your vendors, paying with a credit card typically gives you an extra 20 days to make payment.

Using business credit cards can also give you more buying power.

Besides coming with 10-100X’s higher credit limits (and lower interest rates) than consumer cards – many vendors are willing to give a discount to customers who pay in a certain timeframe (often the first 10 days.) Paying with a business credit card could allow you to receive this discount and still have enough time to make repayment (plus rack up rewards in the process.)

Aside from improving your cashflow – here’s a list of ways to get more out of your business credit cards…

- Make a list of your largest business expenses. Find a card that offers a higher rewards rate for the categories you spend most heavily on — such as office supplies, Internet or travel.

You can also look for vendors in your high-spend categories that offer Net30 or 60 accounts to give you more time to pay and help build your credit.

- (Join Corporate Credit Secrets & get our ever-growing list of 200+ vendors that report to the business credit bureaus.)

- Use “card pairings” to earn more rewards. Cards that earn bonus rewards in different categories amplify your earnings.

- If you travel a lot for business, find a good hotel rewards card and a credit card that doesn’t charge foreign transaction fees.

- Go with a rewards card if you’re not planning to carry a balance.

- Earn extra rewards by shopping on your issuer’s bonus malls.

- Get a low-interest offer if you plan to carry a balance for a long time. A low ongoing APR could pay off more than a short 0% APR period.

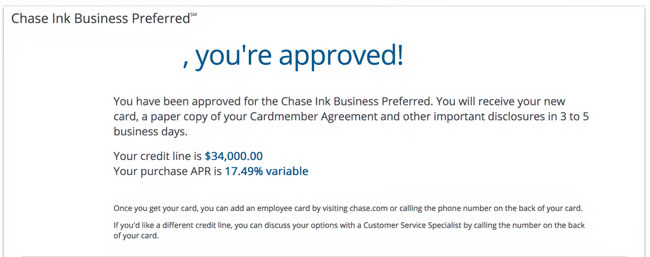

- Apply for a 0% introductory APR offer if you want to finance a major purchase. A no-interest offer can help you borrow money for free for major investments. “Many business credit cards come with a 0% APR introductory offer. If you can pay your bill in full before the introductory period ends, your business credit card essentially becomes an interest-free loan.”

Be sure to find out when your 0% introductory APR period ends and note it on your calendar.

- Make big purchases with your credit card on the day after your issuer’s closing date to maximize cash flow. If your statement closes on the 25th, and you make a big purchase on the 26th, you’ll have another full month before your statement closes.

- Simplify spending for your employees with business credit cards

Business credit cards simplify spending for your employees and allow you to have more control over how a company’s funds are spent. From an employee’s perspective, access to a company card can help them avoid a lot of hassle. From a owner’s perspective, business credit cards usually have built-in controls to ensure employees spend responsibly. You can set spending limits, set categories & alerts. Having a paper record of employee spending also makes it easier to safeguard against internal fraud.

Want more awesome corporate credit tips like these?

Get access to a proven process that will help your company get access to $100,000 in credit for your company within 6 months or less…

Join Corporate Credit Secrets Today

Curious how corporate credit can actually make you more money? We’ll be unpacking that in tomorrow’s post so keep a lookout for it.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.