Have you been paying your “fair share” of taxes?

Looking for a way to get out of paying taxes legally?

Ready or not, the government will be coming for MORE of your hard-earned money this year…

There has been a lot of talk in recent months about proposed tax hikes. Considering the IRS has already warned that returns will be significantly smaller or worse – you may actually OWE money this year…

The insanely high national debt, coupled with MASSIVE inflation, has led to “credits” and tax hikes that may cut into your wealth at a significant rate.

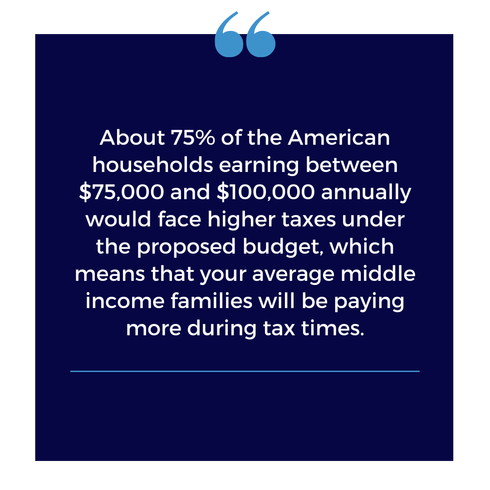

So if you’re in one of the top income brackets (even if you’re in a lower-income bracket), you want to consider what these tax hikes mean for your money.

With that being said from now on we can pretty much count on taxes increasing year after year.

Since the $1.85 trillion Build Back Better Act passed – this legislative text includes income tax surcharges on the rich as well as an $80,000 cap—up from $10,000—for state and local tax deductions. Plus many more “hidden” tax regulations and hikes.

American Pay an Average of $10,000-$20,000 in taxes a year!

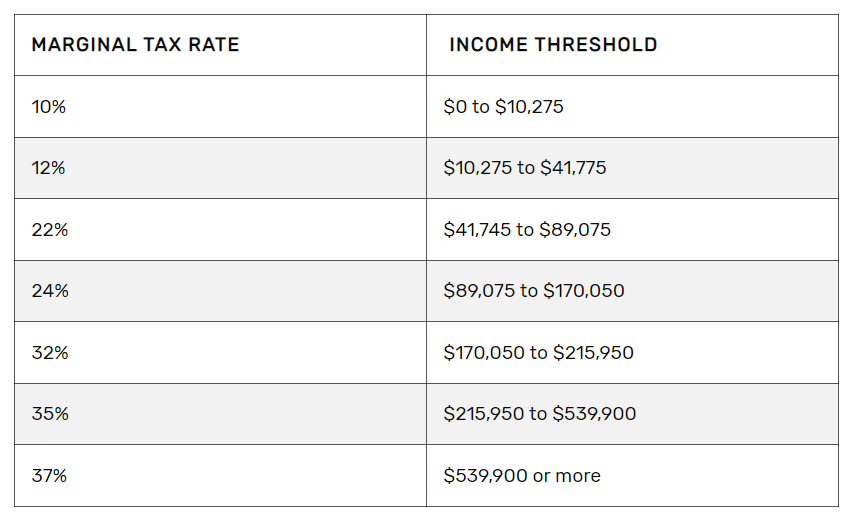

For the most recent tax brackets and visit: IRS.gov or this Forbes article that contains numbers for both 2022 & 2023.

Additionally, Large corporations and small businesses alike will also see significant tax hikes.

Accordingly, a heavy weight on your average Americans could also push the economy to the brink of collapse. Jobs will be lost, the stock market will suffer, and other investments could tank. If that happens, a ton of wealth will be lost.

Here’s what the U.S. Chamber of Commerce says about the potential damage from a tax hike:

It’s obvious – there’s a war on individuals, families and small businesses right now…

Their Goal: control the people by making everything too expensive to afford. So every person is dependent on the government as much as humanly possible, in order to successfully transform our democracy into a socialist communist nation.

Did you know there are numerous ways to avoid (not evade) income taxes LEGALLY?

Inside the Bulletproof Trust program we show you the simplest, easiest, FASTEST way to reduce your income tax liability down to ZERO.

It’s MUCH SIMPLER than you think and may even remove your need to even file taxes!

With the new tax regulations being implemented this year there’s never been a better time to get the Bulletproof Trust Secrets program.

After all, the last thing you’d want is to end up paying $5,000, $10,000, or even $15,000 or more in taxes when it turns out you could reduce your tax liability down to 0! When you know the secrets the elite do – there’s no reason to dread tax season.

Learn More About the Bulletproof Trust

Don’t let the government bleed you dry! There’s a better way!

- The process is FREE & legal to do

- It’s easy to learn

- It’s FAST to do

- The ability to remove up to 100% of your income tax liability!

So what are you waiting for?

If you’re serious about avoiding the pitfalls of growing taxes – protect yourself by learning how to legally reduce your tax liability forever with the Bulletproof Trust Secrets Program.

There’s ONE thing this method won’t help you do – get rid of back-taxed owed. This works as a prevention-method, instead of defense.

If you’ve already filed your taxes for this year – now is the BEST TIME to get a jump-start on the simple redemption method we share inside Bulletproof Trust Secrets. It has the power to reduce your taxes down to ZERO this coming year.

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.