The banks don’t want this to get out – but do you want to learn how to get rid of debt without paying a dime? If so, keep reading because this just may change your life FOREVER…

How much debt do you have to your name right now?

$20K?, $50K?, $100K or more? We’re not here to judge.

To most people it would seem rude to ask such a question but most people don’t know how to ERASE DEBT like we do.

We cringe when we hear stories of people declaring personal bankruptcy, especially when they have $50K or less in debt.

When you declare bankruptcy you’re DESTROYING your personal credit. And while you CAN re-build it – it takes time.

STOP THE VICISOUS CYCLE OF DEBT.

Want to Know How to Get Rid of Debt Without Paying?

Since ALL DEBT IS COLLECTED ILLEGALLY – why pay it?

But obviously you can’t just decide not to pay your bills…

Instead there must be a REMEDY.

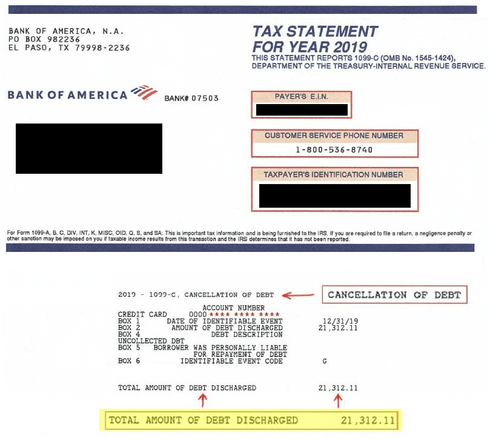

How else do you think lenders like Bank of America are “OK” letting money slip through their fingers like this…

The truth is…

They’re NOT okay with it BUT…

due to the fact that they’re guilty – their hands are tied so every lender has to let you discharge the debt.

How Does It Work?

Essentially, our remedy works by sending a special series of letters which eventually results in creating a debt cancellation contract with the lender (thus releasing one of the debt payments and getting said account removed from the reporting agencies).

A debt cancellation contract means a loan term or contractual arrangement modifying loan terms under which a lender agrees to cancel all or part of a customer’s obligation to repay an extension of credit from that bank upon the occurrence of a specified event. The agreement may be separate from or a part of other loan documents.

We have much more to share with you…

If you’re ready to escape debt slavery and discover true financial freedom – Get Debt Removal Secrets TODAY!

Got credit card debt? What if you could erase the debt AND apply for the exact same card like nothing happened? Don’t miss tomorrow’s post – you won’t believe this is even possible (not to mention legal).

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.