Did you know…

that after sending off your debt validation letters (to initiate the debt removal process), the creditor or debt collector has 30 days to reply back with validation?

What happens if they don’t respond back?

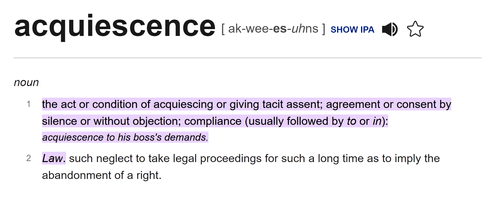

Then by ‘tacit acquiescence’ – you win by default.

Debt Validation Tips

However, it’s rare to have a creditor/collector go completely silent…

They know if they remain silent – they lose immediately.

So most will respond back.

The only question is – what will their response be…

They will either:

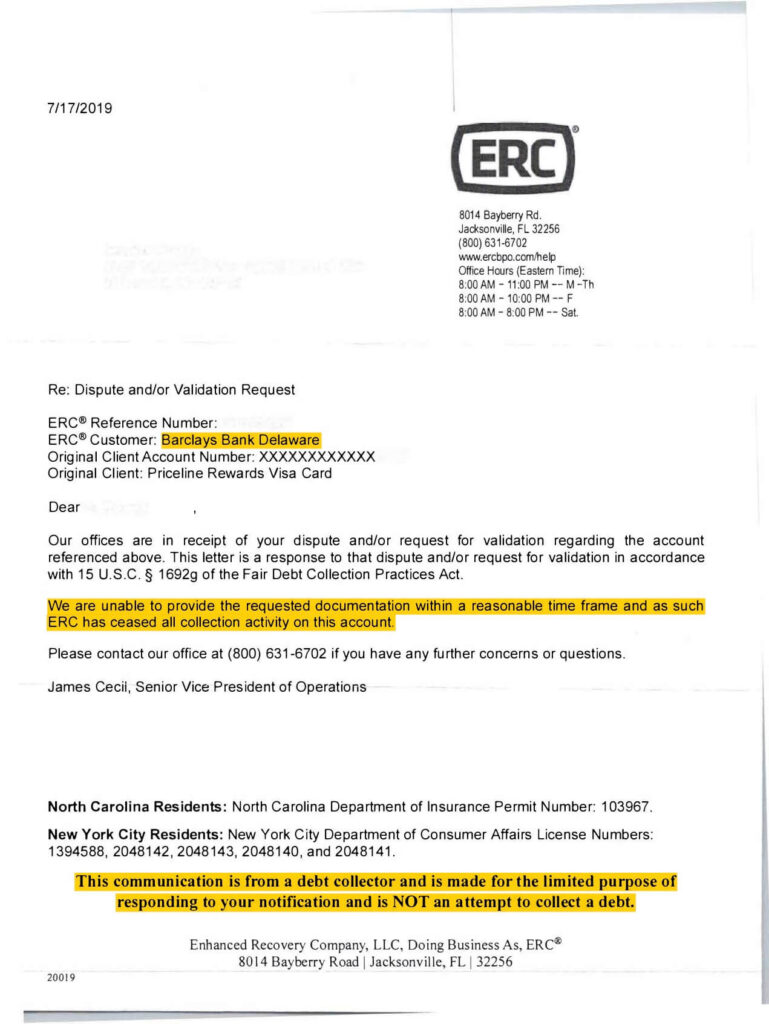

(A) Extend Their Time Another 30 Days (by replying back)

(B) Send you a copy or certified copy of the proof of debt *This again extends their time because they replied back but remember that’s verification but NOT validation of the original wet-ink signature. We need to VALIDATE the debt.

(C) Send some confirmation letter that you no longer owe the debt

Unfortunately, the student in the case above did not provide us with more details regarding the amount of debt owed – that would have given us a bit more information regarding how quickly this particular debt got removed.

We’d also guess that the amount was probably less than $3,000 – simply by the rather informal wording.

*Generally speaking, the less debt – the faster it is to get it removed.

Debt Validation Is Simply Part of the Debt Removal Process

First check into who the current creditor is. This will let you know if you have grounds to remove the debt.

*If the original creditor still owns the debt and has not sold it yet – they still have legal claim to the debt owed.

Keep in mind…

98% of the time – they’ve already sold the original wet-ink signature note meaning they CAN’T validate it and will either try to extend their time, cave or “fight it”.

If the debt’s been sold (or already gone into collections),you have grounds to remove it.

Often, debt buyers have little information about the debts they own. It’s not uncommon for them to try to collect the wrong amount or from people with similar names who don’t even owe the debt (it happens more than you’d think.)

If the debt collector can’t validate that the debt is even yours – how can they truly validate the amount you owe, or anything?

Important Tip Regarding Debt Validation:

Have you gotten the first collection notice?

If you have…

You need to HURRY if you want to erase the debt.

Because ‘tacit acquiescence’ works BOTH WAYS…

If you don’t dispute the validity of the debt or don’t request the original creditor’s name and address within 30 days of receiving the first collection letter, the agency can assume the debt is valid and continue collection efforts. Unfortunately, the debt collector has a right to use all legal collection efforts.

Isn’t it time you learn the truth & take back your freedom?

Learn how Debt Removal Secrets can set you free.

Worried you have TOO MUCH DEBT for this method to work? Don’t miss tomorrow’s post where we’ll show you how one student erased over $250,000 in debt!

Your friends in finance,

Private Wealth Academy

Leave a Reply

You must be logged in to post a comment.